Domestic revenue of Grupa Żywiec decreased year by year from PLN 3.75 to PLN 3.47 billion, and from abroad – from PLN 73.9 to PLN 70.1 million.

– Last year, we increased revenue per hectoliter of beer, thanks to the increase in sales of premium beer and very good innovation results. Żywiec Jasne Lekkie is the channel’s best-selling novelty, both traditional and modern. However, increases in the premium segment did not offset the decline in beer sales, especially in the economy segment, Simon Amor, CEO of Grupa Żywiec, commented in a statement.

Grupa Żywiec’s revenue from related entities by capital (the company belongs to Heineken) decreased from PLN 363.7 to PLN 340.8 million.

Beer is less popular lager

Grupa Żywiec produces, among others Żywiec, Desperados, Heineken, Warka, EB, Namysłów, Tatra, Królewskie, Leżajsk and Brackie.

The president of the company confirms this Low-alcohol beer, which is often flavored, is becoming more and more popularWhile still representing a smaller share of the market.

– The dominant beer to date is significantly losing its popularity, especially among younger consumers. In addition, sales of beer in the traditional channel fell last year. All these factors translated into a decrease in revenue – explains Omar.

Grupa CEO Żywiec talks about ‘sharp cost increases’

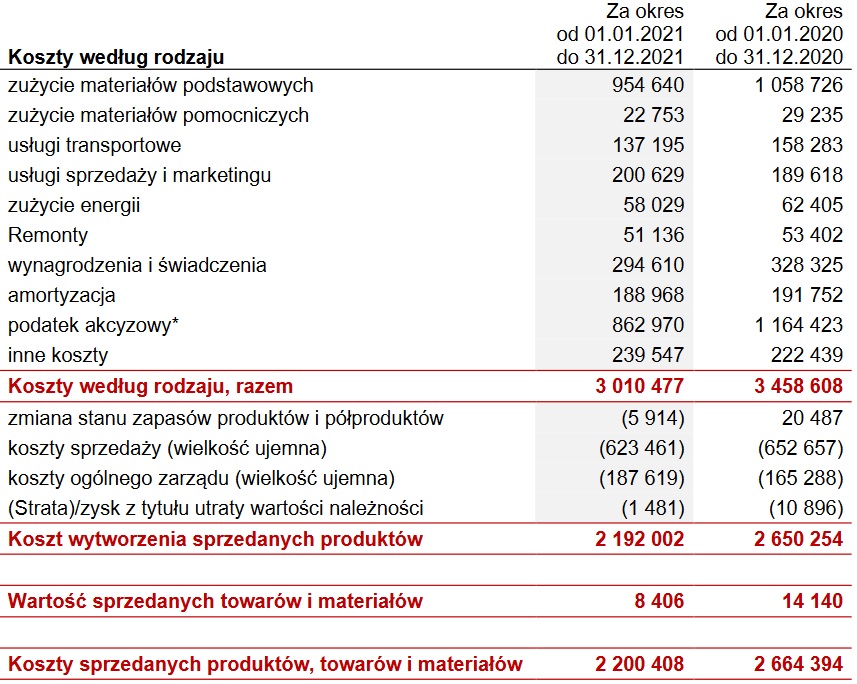

Costs by type of Grupa Żywiec decreased by 13%. – From 3.46 billion PLN to 3.01 billion PLN. Excise tax expenditures decreased from PLN 1.16 billion to PLN 863 million, incl. In connection with last year’s receipt of 237.7 million PLN from excess taxes in 2007-2018.

Expenditures on consumption of basic materials decreased from PLN 1.06 billion to PLN 954.6 million, and on salaries and other employee benefits – from PLN 328.3 million to PLN 294.6 million.

On the other hand, selling and marketing costs increased by 5.8%. – From 189.6 million PLN to 200.6 million PLN. On the other hand, expenses identified as other increased from PLN 222.4 million to PLN 239.5 million.

– We are working in unprecedented conditions of a significant increase in costs, the effect of which is on the result in a shorter period of time, we are trying to reduce through various savings initiatives. With the simultaneous decline in the market and the increase in costs and tax burdens related to the increase in selective taxation, this presents a major challenge for the further development of the industry and for the maintenance of investment and profitability – Simon Amour comments.

More than 400 million PLN of Grupa Żywiec . net profit

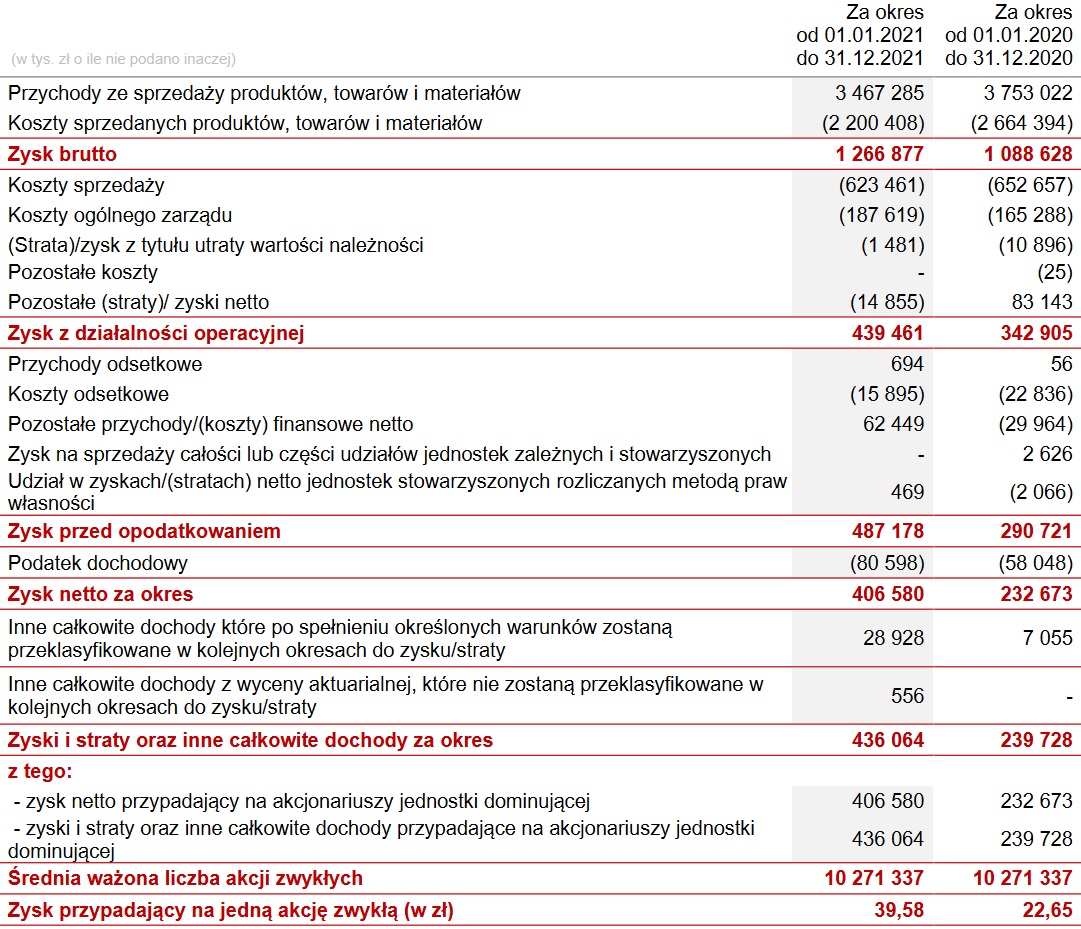

The operating profit of Grupa Żywiec increased from PLN 342.9 million to PLN 439.5 million, gross profit – from PLN 290.7 million to PLN 487.2 million, and net profit – from PLN 232.7 million to PLN 406.6 million. Last year the company paid PLN 80.6 million in income tax, compared to PLN 58 million in the previous year.

In the second half of December last year, Grupa Żywiec paid a dividend of PLN 205.4 million, PLN 20 per share. On Wednesday morning, the company’s share price was PLN 495, which gives a capitalization of PLN 5.08 billion.

Heineken owns 65.16 percent. Grupa Żywiec stock.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.