2022-02-17 22:36

publishing

2022-02-17 22:36

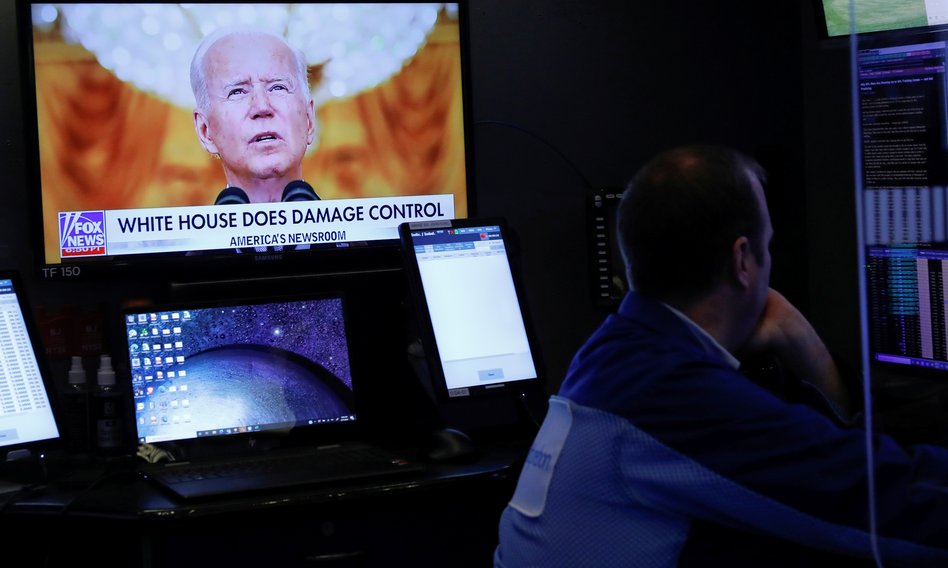

Thursday’s session brought back declines in the New York stock exchanges. Investors returned to concern about the situation in Ukraine and the US administration’s statements. The comments of a prominent representative of the Federal Reserve also did not help.

Russia plans to invade Ukraine In the next few days and Looking for an excuse to justify it The President of the United States, Joe Biden, said. The Kremlin denied this and said it had no plans to attack Ukraine. Very serious accusations are being made and the situation is again tense, which worries investors. In addition, the media reported about the shootout in Donbass.

– Our information clearly shows that Russian forces are preparing to attack Ukraine in the coming days – US Secretary of State Anthony Blinken added during the UN Security Council meeting. He added that Russia had already taken steps toward war, trying to create a pretext for an invasion.

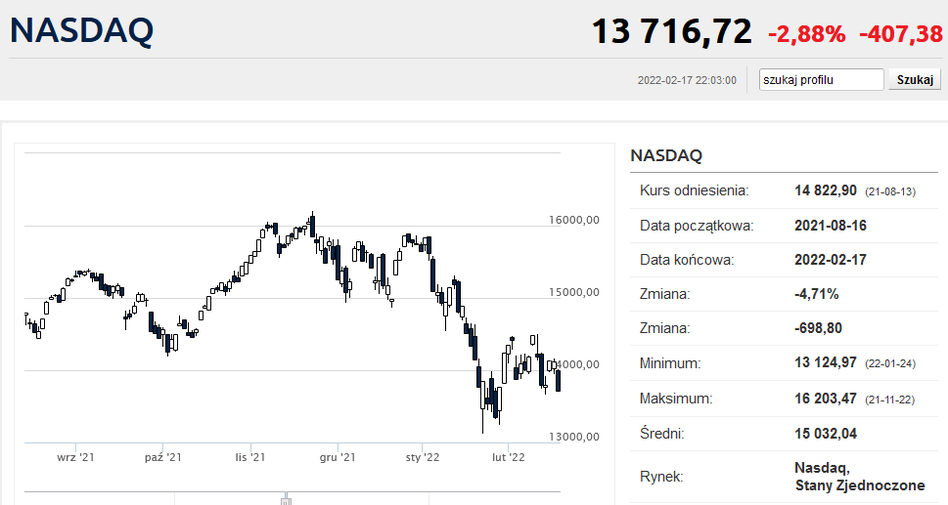

Amidst the rising wave of geopolitical risks in the second part of Thursday’s session, New York indices deepened their initial declines. The Dow Jones Industrial Average fell 1.78% to 34,312.03 points. The S&P500 fell by 2.12% at the close of the session, reaching a value of 4380.26 points. The Nasdaq fell a whopping 2.88%, ending with a score of 13,716.72 points.

In addition, the mood on Wall Street was exacerbated by “hawkish” comments made by James Pollard. Federal Reserve Chairman St. Lewis said core PCE inflation (the Fed’s preferred measure of inflation) “is not known to decline on its own.” It was a clear suggestion that the Fed should raise interest rates quickly and clearly to contain the highest inflation in 40 years in the USA.

In addition, Bullard said he would like to begin shrinking the Fed’s balance sheet in the second quarter. The futures market is priced in by the US central bank making six increases in the federal funds rate (25 basis points each) by the end of the year.

Tech companies are under pressure as interest rates may rise. Nvidia shares were discounted 7.6%, despite the company’s higher expectations for the current quarter. Palantir shares fell about 16 percent after the company was disappointed with its quarterly results.

K

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.