The government tackled the savings problem, which inflation is eroding more and more. The first target was for borrowers (although real interest rates are still negative), and the second for the savings of ordinary savers. It started with the prime minister’s appeal to the banks to raise interest rates on deposits dramatically. But in order not to be unfounded, the government had to improve the terms of the treasury savings bonds offered, because the interest rates on these bonds, especially the short-term, are very low.

From June, the Ministry of Finance’s offer of new bonds will be extended, and the interest rate will be based on the NBP reference rate, with monthly interest payments. You will be able to buy one-year bonds at an interest rate equal to the rate of NBP, which is currently 5.25 percent. and two-year-olds with an interest equal to the reference rate NBP plus 0.25 percentage point. Margin percentage, which will now give 5.50 percent.

The new bonds offer better conditions than the previous “two-year” fixed-rate bond, which was 3 percent in the May offer. Annually (two-year-olds will disappear at a fixed rate).

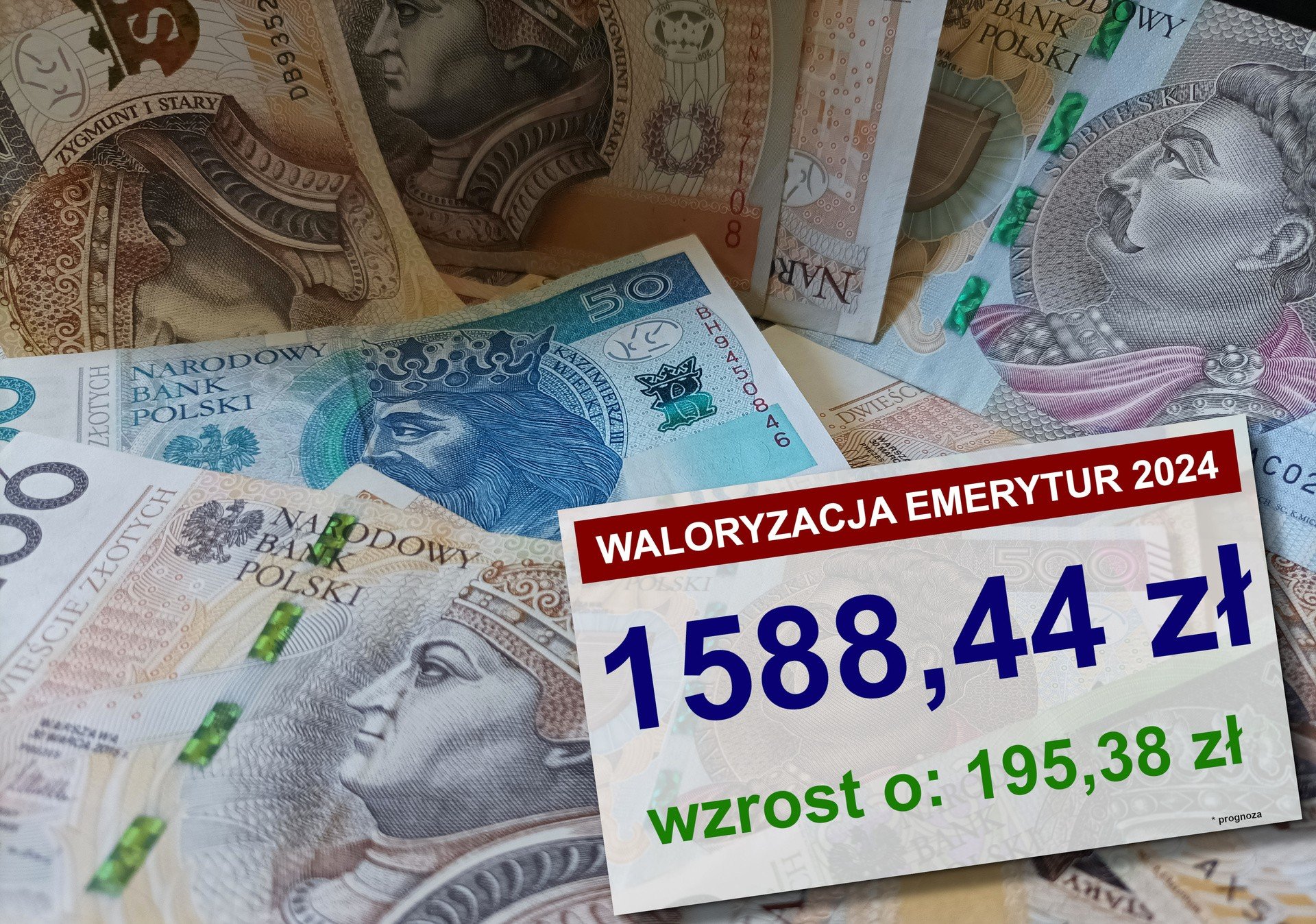

At the same time, after the previous cosmetic changes, the interest rate on savings bonds with maturities ranging from 3 months to 12 years will be raised from June onwards. The new interest rate on 3-month fixed rate bonds will be 3 percent. (Currently 1.5 percent). Other bonds in the first interest period also improved even more, respectively: 5.50 percent. For 3-year-olds 5.50 percent for 4-year-olds and 5.75 percent. For children 10 years old. On the other hand, family bonds for 6 and 12 years intended for beneficiaries of the “Rodzina 500 plus” program, carry an interest of 5.70 percent, respectively. and 6.00 percent in the first year of saving. In subsequent interest periods, the interest on these securities is indexed.

The interest rate on 3-year bonds is calculated every six months based on the value of the six-month interest rate WIBOR6M. In the case of 4-year bonds, the interest rate is changed every year and is calculated based on the sum of the inflation rate from the last 12 months and a 1% margin. The same interest rate mechanism also applies to 10-year bonds, but in this case the margin is 1.25%.

The interest rate on family bonds changes every year and is calculated based on the sum of the inflation rate for the last 12 months and a preferential margin of 1.50%. For 6-year bonds, 1.75 percent. For children 12 years old.

Previously, the government raised the interest rate on bonds symbolically (in February and April it was raised by 0.5 percentage points, and in May by 1 percentage point, but not for all types of securities).

BUSINESS INTERIA is on Facebook and you are up to date with the latest happenings

However, the effective interest rate on bonds is lower, because the so-called BELKA tax. However, despite the fact that it additionally devours the real value of the savings, the government does not plan to suspend or limit it.

New bonds – one- and two-year bonds – have attractive interest rates, but are unlikely to provide complete protection against inflation. Their interest is based on the NBP reference rate, which has been well below inflation in recent years. Unfortunately, it may be the same in the coming years. Treasuries, the interest rate of which depends on inflation, i.e. 4-year and 10-year bonds, and family bonds, i.e. 6-year and 12-year bonds, provide a much greater chance of achieving this goal. The interest rate from the second year onwards is the sum of the previous year’s inflation plus an additional margin. For example, the interest rate for 4-year-olds sold in June 2021 will soon increase to 13.15%. (12.4% inflation + 0.75% margin). However, these bonds also have some drawbacks. In the first year, the interest rate was fixed and very low compared to inflation. For example, for 4-year-olds sold as of June this year, it would be 5.5 percent. (In the May view it is only 3.3 percent – editor) – says Jaroslav Sadovsky, senior analyst for Expander.

He adds that another drawback that will prevent overcoming inflation until next year is the tax. – Holders of the above-mentioned four-year bonds will get an interest rate of 13.15 percent, which is compensation for inflation of 12.4 percent. Between April 2021 and April 2022. Theoretically, the interest rate is higher than inflation, but when we take the tax into account, it turns out that the amount of interest actually paid is only 10.65%, which is less than inflation. This problem will be solved by increasing the margin. If it is not 0.75 percent, but 2.91 percent, then the after-tax interest will be exactly the same as inflation, i.e. 12.4 percent. – Jaroslaw Sadovsky Lists.

The tax can be avoided by purchasing bonds through IKE, but only with the condition that the funds are paid only after the age of 60.

When asked by Interia whether in a situation of such high inflation it does not plan to abolish or adjust the Belka tax, for example with regard to savings on treasury bonds, the Ministry of Finance replied that it is not working in this direction. When asked about her Prime Minister Morawiecki argued in the newspaper Interia that “the government wants to tax capital, not labour.” He noted the reduction in income tax as a result of the introduction of the Polish system, which is to leave 33 billion zlotys in the pockets of the Poles, and the abolition of the Belka tax would give investors only 3 billion zlotys.

Monica Krzyniak Sajevic

Check also:

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.