- On July 29, the Credit Leave Act officially entered into force

- Submitting the application should not be difficult, as it will be supervised by, among other things, Yukic. The effects of office control are already visible

- The easiest way to take advantage of credit leave is to complete the procedures online

- In the case of the PKO BP bank, it takes literally a few minutes. You just need to pay attention to choosing the appropriate credit holidays and the period of suspension of installments

- In the case of other banks, according to their representatives, it should be similar

- In addition, a helpline will be launched at the Office of the Financial Ombudsman, through which anyone interested will be able to ask an expert or report a problem.

- More such information can be found on the home page of Onet.pl

Like millions of Poles, I am a “lucky” owner of a mortgage. In my case, it was granted by the largest bank in Poland, i.e. PKO BP. Since I pay in installments at the beginning of the month, I don’t have much time to place an order. So I decided to do it as soon as I had the opportunity to test the system on the occasion of my professional duty.

Why take a credit break at all? For people who, due to high interest rates and high inflation, can barely make ends meet, this is an opportunity for a moment to breathe. For those who do not have significant repayment problems, it is possible to overpay the capital and thus reduce the premiums.

Let me keep my motives to myself, but whatever they may be, Credit holidays are essentially a free loan, which – according to the Ministry of Finance estimates – can be used by up to 2 million people and That is why the banks scared him so much. Borrowers should not lose it in any way, and To see it, among others Yukik. The only remaining fee to pay while enjoying your vacation is insurance. However, it is usually only a few tens of zlotys.

See also: credit holidays. It is more profitable to suspend installments in these months

Application for holiday credit in PKO BP

So let’s get down to business, PKO BP promised that official online procedures will take no more than 3 minutes. Before filling out the application, I studied the bank’s July 25 announcement. It’s bold out there, which you should watch out for.

First of all, you can put your loan repayment on hold:

- for two months from August 1 to September 30, 2022;

- for a period of two months from October 1 to December 31, 2022;

- One month after each quarter of 2023

Interestingly, on July 28, PKO BP made a slight change to the advertising content. Originally, you could have read: Remember that you must submit a separate application for each period. You may submit another application after the previous suspension period has expired. ” In the end, that part disappeared It can be guessed that this is a result of the intervention of the Office of Competition and Consumer Protection.

– We do not accept the practice that already appears in some banks, concerns, for example, the requirement to submit a separate application to suspend the payment of installments in each quarter of the loan holidays, or even a separate application for the payment of a particular loan installment. This makes it difficult to take advantage of the credit holidays offered to facilitate consumers, said UOKiK President Tomasz Chróstny.

Taking advantage of credit holidays, contrary to previous concerns, will not have consequences in the PKO BP in the event of applying for further loans. “We will provide information about the suspension of payment to BIK. This information contained in PKO Bank Polski is not treated as being in arrears and does not affect the assessment of creditworthiness.“- We read.

This thread, however, will return later in the text.

In the middle of the night, he couldn’t

Unfortunately, I miscalculated, hoping that the applications would start in the middle of the night. I spent the first 28 minutes updating the IPKO platform and waiting for the credit holidays to appear in the Instructions and Certificates tab. It turned out to be very easy to apply – it took 2 minutes. I used the IPKO service according to the instructions below.

|

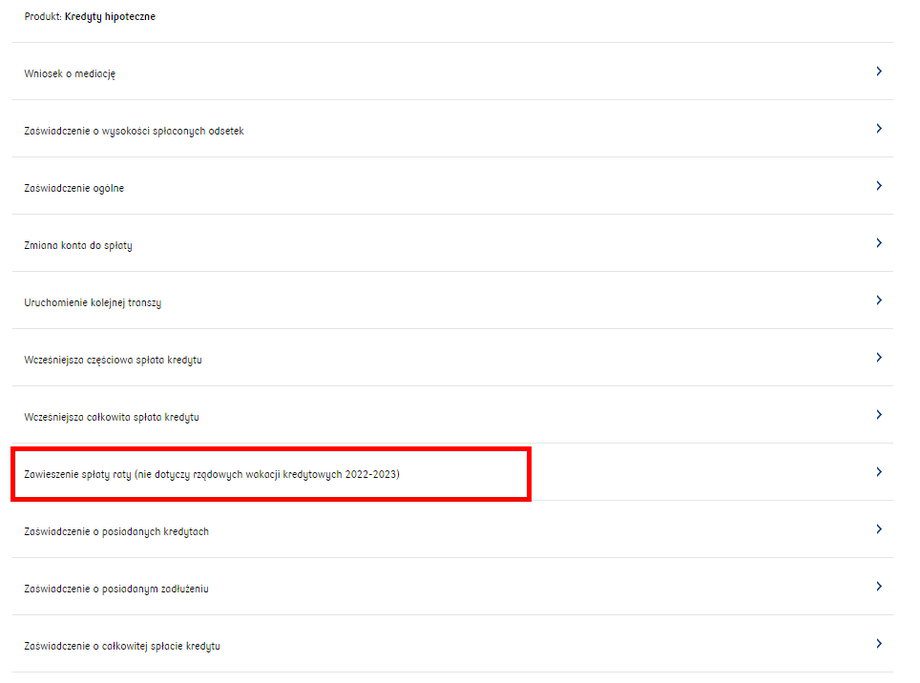

PKO BP

In the case of PKO BP, when the borrower has the option to take credit leave independent of government support in the contract, it is important to determine the appropriate application. However, they are clearly marked on the site. In the case of holidays arising from the contract with the bank, they are marked before midnight.

When applying, be careful about choosing the right credit holidays

|

PKO BP

Most importantly, the bank also confirms that if you have already applied for a suspension of the next loan installment as part of the contractual loan holidays, it will be canceled so that you can use it when the statutory suspension period expires.

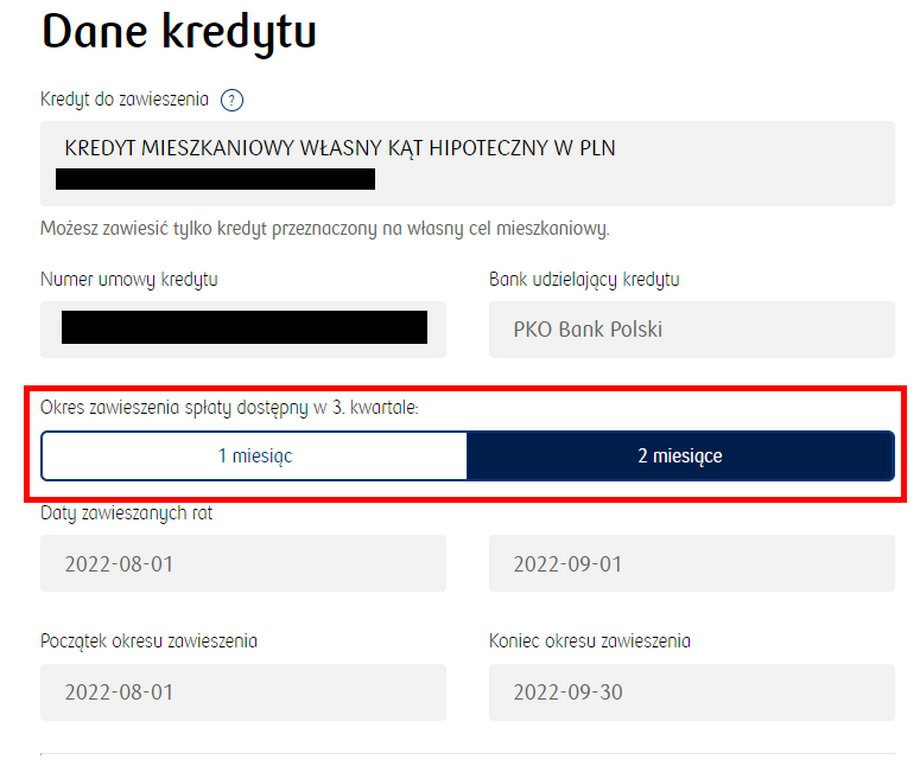

In the next step, select the appropriate loan and the data will be collected automatically. However, attention should be paid to the period of suspension of payment. One month is set for automation. It can be changed for two months with one click.

Pay attention to the installment suspension period

|

PKO BP

Here we return to the topic of submitting applications for later periods. I was not immediately able to suspend the premiums in the last quarter of this year or in the specific four months of 2023.

The next stage is to confirm that the suspension of installment payments relates to a loan aimed at meeting private housing needs. We do this under the threat of criminal liability.

|

PKO BP

After that, all you have to do is validate the data, authorize the app and it’s ready.

|

PKO BP

In sum, placing the instructions is simple and intuitive. I can only complain that I waited almost 30 minutes for the service to start, but I realized that the systems also needed some time to configure, and besides, maybe a few people started doing this shortly after midnight. The second issue is the fact that so far I can only suspend installments for two months out of the eight that are due.

How to apply for credit leave in other banks?

I am aware that PKO BP is only one of the banks in which the Poles receive loans, so my experience will not be 100%. Useful for everyone. However, at Business Insider Polska, we’ve collected the most important information from the most reputable banks.

Credit Leaves – How to Apply? We explain. Check your bank

The Ministry of Finance has also prepared its guide. She emphasized that credit leave is a “leave” from foreclosure, that is, the possibility of suspending its payment for a period of up to eight months. Requests to suspend installment payments can be submitted from July 29 this year, Credit holidays apply from August of this year.

It was noted that the borrower individually decides the number of outstanding installments. Credit leave can be used under the following conditions: Up to two installments from 1 August to 30 September 2022; up to two installments for the period October 1 – December 31, 2022; A maximum of 4 installments in 2023One installment per quarter.

In the manual, the Ministry of Finance mentioned that a mortgage borrower who has a loan in PLN can take advantage of loan holidays. However, people who pay off mortgage loans in other currencies do not have such a possibility. As we explained on Business Insider Polska, On the other hand, banks do not see any contraindications to granting holidays to properties that are still under construction. It must be remembered that the choice of an apartment that meets housing needs is subject to criminal liability. There is a risk of imprisonment for making false statements.

Credit leave applications can be submitted in writing or electronically, on a form or without – depending on the functions that the bank will provide. The ministry confirmed that it had not issued a regulation regarding the application form.

The bank will confirm acceptance of the application within 21 days of receiving it. It will also indicate the period during which loan repayment has been suspended, as well as the amount of fees that must be paid for securing the loan. The ministry stressed that the lack of confirmation does not affect the start of the suspension period. He added that money “saved” during the credit sabbatical could be used to pay off the mortgage more than necessary.

The Ministry of Finance announced that a hotline will be launched at the Office of the Financial Ombudsman, through which anyone interested will be able to ask an expert or report a problem.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.