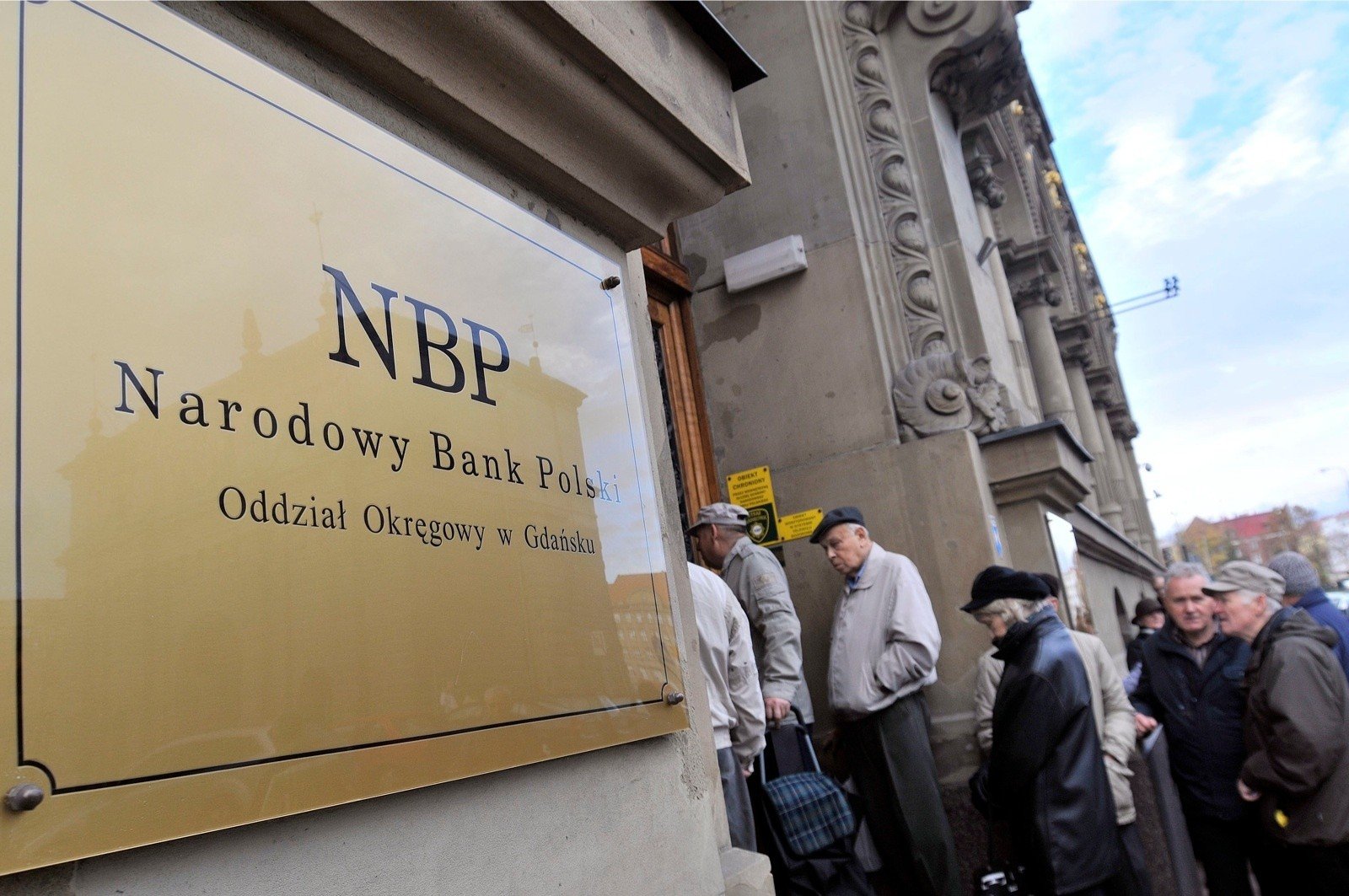

Given the practice, the title question remains unanswered. Although more and more, in most cases – we know very little about investing, and even if we have some knowledge, we are afraid to take risks. As a result, the financial surpluses of three out of four poles … are transferred to a bank account! Only if the banks faced the threat of negative interest could something change in attitudes.

More than four out of ten Polish adults have no savings. Among those who have it, only 16 percent. Actively investing in it – the results of the “ASSAY INDEX” study, which was conducted by Maison & Partners on behalf of the Assay Group. We usually associate investing with something complex, requiring specialized knowledge, which is confirmed by the Special Investment Merit Index created by the examination group. On a scale of 0 to 100, we achieved a score of 33. This means that as a society, we are one-third of the way to fully invested readiness.

The Assay Group, a company that deals with investments in the future of Polish start-ups, decided to look at the behavior of Poles with regard to saving and investing.

As a study commissioned by the company showed, only 56 percent. Poles declare that they have no savings. Although as many as two out of three people in this group have savings of less than 30,000. zlotys, the credit goes to the richest Poles – who set aside more than 100,000. PLN – the average amount of money saved amounted to 29,688 PLN.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.