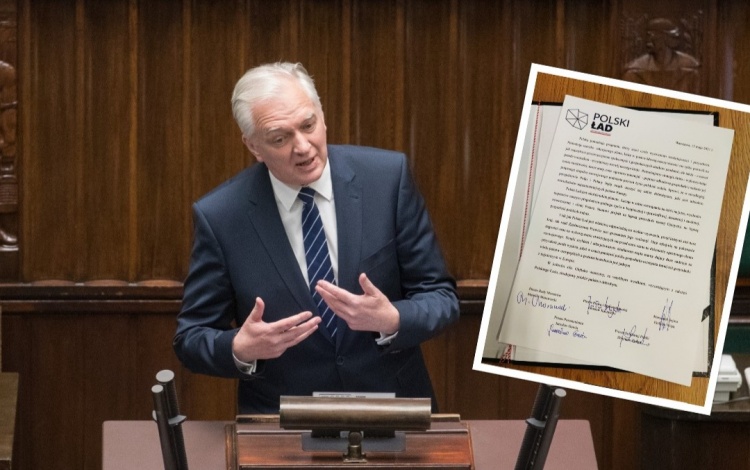

On October 1, the Sejm passed the tax laws for the Polish system. The amendment to the Tax Code provides for an increase in the tax-exempt amount to 30 thousand PLN. 90 percent of Polish pensioners and pensioners will benefit from the changes, and 65 percent will not pay tax at all. Government representatives assert that the introduced changes will be beneficial to more than 8 million Polish elderly people.

Retirement without tax – who will gain and who will lose?

From January 1, 2022, those who receive a pension amounting to a total of 2,500 PLN will not pay comprehensive income tax at all. Their wallets will increase by the amount of the tribute that will no longer be deducted.

With a pension totaling PLN 2,500, it will be an additional PLN 2,250 per year. However, it should be noted that the amendment to the tax regulations will also benefit pensioners who receive higher benefits, since they will pay tax only on the amount exceeding the total of 2500 PLN. The Ministry of the Family has prepared a simulation showing that with a total pension of PLN 3,500, the elderly will receive PLN 1,320 per year.

The change will be neutral for people earning less than PLN 1,000 net net interest. The Polish Lada All pensioners and pensioners whose benefits range from PLN 1,000 – PLN 4,500 net will benefit.. What about people who receive higher amounts? These elderly people should take into account that their advantages will be reduced. This is due to the fact that from 2022 the full health contribution of 9% will be deducted.

Standard valuation and higher “thirteen”

In 2022, retirees will also experience a benchmark benefit index. Minister Marlena Maląg announced in an interview with TVP Info that the index rate will be around 5.5 percent. Pensioners receiving minimal benefits will then receive up to a total of PLN 100 (increased from 1250 to 1350).

After increasing the minimum pension The ‘thirteen’ paid for the elderly will also increase. Next year Pensioners receiving benefits less than 2,387 PLN per month will receive “Thirteen” in the amount of 1,228.5 PLN. In case Higher benefits would be “thirteen” PLN 999.5 For the need to deduct 9% health contribution and 17% tax.

Source: gov.pl, radiozet.pl, money.pl, rp.pl

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![This is the retirement age in Poland – that’s for sure. We also have a pension index forecast for 2024 [15.05.2023] This is the retirement age in Poland – that’s for sure. We also have a pension index forecast for 2024 [15.05.2023]](https://d-art.ppstatic.pl/kadry/k/r/1/7d/fa/6449401914c5c_o_original.jpg)