Publishing

2023-01-04 13:08

Update

2023-01-04 17:46

At WSE, the strong growth of banks continues. The prices of the largest companies in the sector are clearly on the rise, which translates into higher and higher WIG20 bids. The prices of the best stocks this year have already increased by more than 15%, and this is only the third session in 2023.

The recovery of financial companies has been observed across Europe, with the Euro Stoxx Banks Index rising more than 3 percent on Wednesday, and has been around 6 percent higher since Monday. As stock market expert Łukasz Jańczak of Erste Group points out, the positive behavior of the Polish banking sector is mainly derived from the sectoral purchases observed in Europe.

“We have not had specific information on the Polish banking sector in recent days, so the behavior of bank shares in the WSE must be attributed to the general sentiment in the core markets in Europe. Rather, our sector is a reflection of what is happening in European banks, and due to the fact that our banks Also present in this basket, we benefit from these capital inflows,” the analyst comments.

As a result, WIG-Banki, which is listed on the Warsaw Stock Exchange, gained 3.67 percent on Wednesday, and since the beginning of the year, that is, in three days, it has already gained more than 9.2 percent. Most other industry standards. Thanks mainly to the position of the banks, the WIG20 saw a second session of increases in a row and is already 3.52 percent higher. higher than the beginning of the week.

The real stars in the bank’s portfolio are Millennium and Alior with mWIG40. And on Tuesday, the rise in the basket led the exchange rate of the latter, and the Millennium stock was the highest gainer on Wednesday. As a result, Alior’s share price after three incomplete sessions of the new year has already exceeded 19.78 percent. In the black, Millennium rose 22.16 percent during this time.

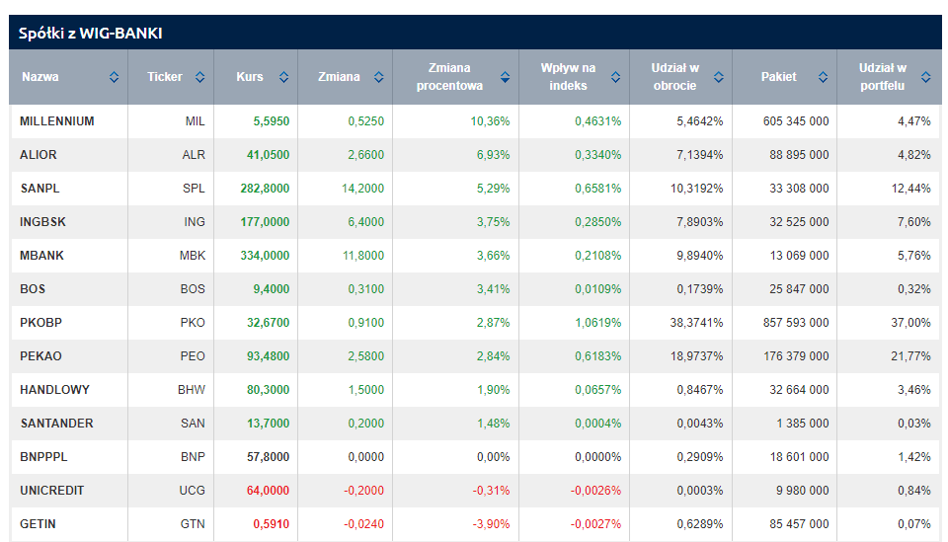

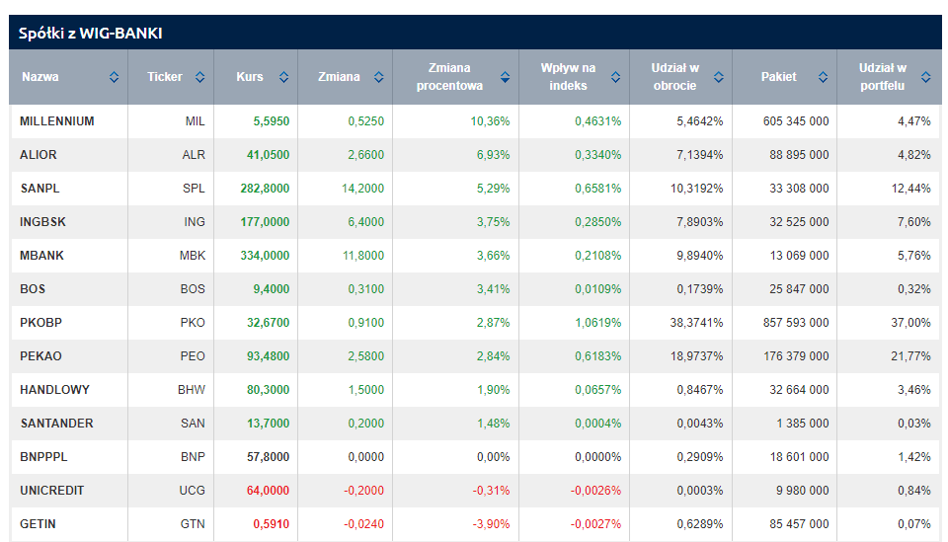

Add to this the position of mBank with the WIG20 index with an increase of approximately 12.8%, Santander, which is already more than 9%, PKO BP, the largest in terms of capitalization, which already has a numerator plus 7.8%, and Pekao has increased by 8.1 percent. Since the October low, the WIG-Banki recovery is already around 55 percent. Following are the sector’s results in Wednesday’s session.

Factors that may explain the rush to buy shares of banking companies in Europe include their lower valuations and inflation data, which could have encouraged a scenario of avoiding a recession in Europe, which seems to be a better solution for banks than the potential profits from higher interest rates.

“I can imagine investors thinking this way, and it probably makes sense, because increasing the cost of risk and write-downs of so-called ‘bad loans’ would be painful. However, it should be noted that the ECB does not have such a simple thing to overcome, Because while CPI inflation is going down, core inflation is going up,” adds the expert.