Economic effects of war in the Middle East. The merchant reported this The prices of containers he ordered from China rose as much as…sevenfold in one month. What's going on? Does it apply to all containers? Commercial ships began avoiding the Suez Canal due to the missile launches. What does this mean for consumers? Are we happy that inflation has fallen so quickly?

It seems that misfortune does not want to leave us. The world must face another challenge that will make it more difficult to overcome the ongoing economic slowdown. The coronavirus pandemic, the war in Ukraine have disrupted supply chains, and now the war between Israel and Hamas is hitting us. Container prices increased sevenfold! What does this mean for us?

The Suez Canal is closed again

Missile attacks on civilian commercial ships entering the Red Sea towards the Suez Canal are increasing. The Houthis, an armed group from Yemen, supported by Iran, bear responsibility for the attacks. Until recently, few people had heard of it, but it is quickly becoming the biggest threat to global trade.

Iran and the Arab countries (Including Yemen, but also for example Qatar, which supports Hamas financially) They want to prevent Israel from destroying the Gaza Strip and support the idea of rebuilding a Palestinian state. On the other hand, Israel does not want to hear about it. Iran has not yet taken military action against Israel (it does not want to face a counterattack from the United States, which supports Israel), but it supports the Houthis in Yemen – and they are capable of disrupting global trade and raising oil prices with their efforts. Attacks. Perhaps standing behind Iran is Putin, for whom the weakness of the West and the outbreak of the second major war in the world is considered manna from heaven.

The Houthis based in Yemen do not limit their attacks to ships sailing to Israel, but rather target all ships. Western naval forces are trying to confront missiles launched by terrorists (US Secretary of Defense Lloyd Austin announced Operation Prosperity Guardian, which aims to enhance security in the Red Sea and the Gulf of Aden), but to no avail so far.

The attacks almost completely paralyzed trade through the Suez Canal. The number of ships that have stopped their journey and are awaiting developments is increasing. last It is rerouted via the Cape of Good Hope (i.e. sailing around Africa). Tankers responsible for more than 70% of the Suez Canal's transport capacity have already changed course. This means that approximately 4 out of 5 ships sailed “around”.

It flows (or actually flows) through the Suez Canal every day More than 50 ships carry billions of dollars' worth of cargo to Europe, the Mediterranean and the east coast of North America. This is the shortest and cheapest way. “Going around” Africa would not only be more expensive, but would also take longer.

In fact, it is enough to remember the confusion caused by the container ship “Ever Given”, which ran aground in March 2021 and became stuck across the canal. A traffic jam quickly formed with dozens of other container ships. Below is a satellite image of this situation (from Wikipedia).

There are a lot of memes on the Internet, but the truth is that the crisis was serious. The week-long stalemate resulted in losses amounting to billions of dollars. The Houthi militants possess a large stockpile of missiles, and it is unlikely that today's conflict will be resolved within a week.

Read also: Savior or crazy? Javier Miley wins election in Argentina and says: We don't need our own currency or central bank. Or maybe this makes sense?

Container prices are rising rapidly

Al-Houti made sure of that The Suez Canal has once again become a crucial point on the world trade map. As a result we should expect Extended delivery times (Ships are rerouted via the Cape of Good Hope, adding about two weeks to the entire voyage) and potential Interruptions in supply chains (If the bombing continues for a longer period).

The situation must have also affected shipping prices through the Suez Canal, and this is already evident in the indicators. The global container freight index (FBX) rose 28% in one month To $1,346.20, and the index FBX13 (Reflects freight rates between China and Mediterranean ports) Increase up to 80%, To $2,524.60.

Indicators that reflect shipping prices for transportation from China only are also rising significantly. The Shanghai Container Freight Index rose by 26% last month, and the China Container Freight Index rose by less than 1% (from 876.74 to 879.75 points).

The situation is not yet as dire as it was in 2021, when we faced the complete closure of stations in China due to the Corona virus. At that time, the Shanghai Container Shipping Index was 4,000-5,000 points, and the World Container Shipping Index was $9,000-10,000 (today – let me remind you – about $1,350). However, we should not underestimate the continued growth. Especially since this is just “official” data.

“We will never get out of the crisis in Europe”

What does this mean for us, consumers? I contacted a businessman who regularly imports goods from China. It seems that The accident had a real impact on importers' transportation costs. The rise in prices is much more severe than the above indicators suggest.

“I paid $1,250 for a container in October. In November, I loaded a container for $850. At the beginning of December, the price was already $2,000, and today it is $6,000.

– Mr. Jaroslav reports. The above prices apply to one container with a capacity of 76 cubic meters or 20 tons (you can load more, but it is difficult to transport such a container across Poland by road). These are no longer simple price fluctuations, but a sudden and dynamic increase (seven hundred percent per month).

Of course, this is just one business person's relationship, and shipping rates depend, among other things, on: who: the broker we use, the number of containers ordered, the delivery date and additional fees. However, the trend is clear and clear. via the Suez Canal, Connecting the Mediterranean Sea to the Red Sea, About 12% of global trade flows, So – if the crisis lasts longer – it will significantly impact supply chains, among other things. in Europe.

“It's half the problem if someone imports expensive, small-volume products, because shipping will be less painful.”

– adds the businessman. It's worse with larger, cheaper products. If something weighs, for example, 5 kg, only 4,000 pieces can fit into a 20-ton container. An increase in the price of containers from USD 850 to USD 6,000 means higher transportation costs by PLN 5.15 per unit (PLN 6 instead of PLN 85). There is a big difference that needs to be explained to customers in some way.

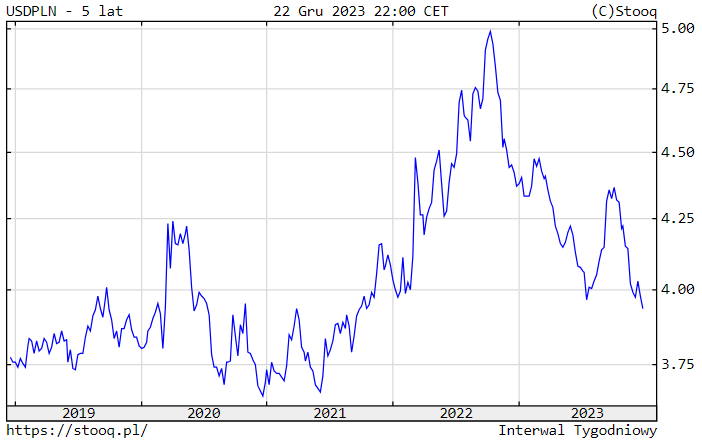

It is convenient for those who import goods from abroad The dollar exchange rate, which has currently reached its lowest level since 2021 (we wrote about it here). This would somewhat alleviate the current transportation crisis for importers.

But the costs borne by importers are not the only problem. If the crisis persists, supply chain disruptions will resurface (it will take some time before everyone gets used to longer delivery times). This means that one of the basic laws of economics will apply: Less product means higher prices.

It's also a matter of time Price increase Semi-finished products and energy raw materials (such as crude oil, petroleum products and liquefied natural gas), which were also transported, among other things, by sea via the Suez Canal.

Read also: Good news for home builders? Prices of steel and other raw materials are falling significantly. Is the unpredictability of construction costs behind us?

It seems that we cannot yet claim victory over inflation. Neither in Poland nor anywhere else. Rising transportation costs will be another factor exacerbating inflation next year. If the crisis is not resolved quickly, it will certainly translate into price increases. Either companies will pay more for transportation and pass that at least partly on to consumers, or they will not replenish inventory, which will lead to higher prices. (Less product on the market means higher prices).

The situation will not improve by including shipping in the EU CO2 emissions trading system from 1 January 2024. Shipowners will have to purchase CO2 emissions allowances for each ton of CO2 emitted, which they will of course pass on to customers. What amounts are we talking about? This depends on the price of the allowances, but is estimated at around 20 euros per container and 40 euros per refrigerated container.

———————-

Since this text was published on Christmas Eve, please accept the wishes of the entire “Subiektywnie o Finansach” team, as well as our friend Homodigital.pl and “Zielony Portfel” – Merry Christmas Wishes!

Main image: tawatchai07 /Freebec

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![Mortgage rates will rise. We know how much your loan premium will be increased [wyliczenia – 29.05.2022] Mortgage rates will rise. We know how much your loan premium will be increased [wyliczenia – 29.05.2022]](https://www.moviesonline.ca/wp-content/uploads/2022/05/Mortgage-rates-will-rise-We-know-how-much-your-loan.jpg)