publishing

2022-02-25 22:05

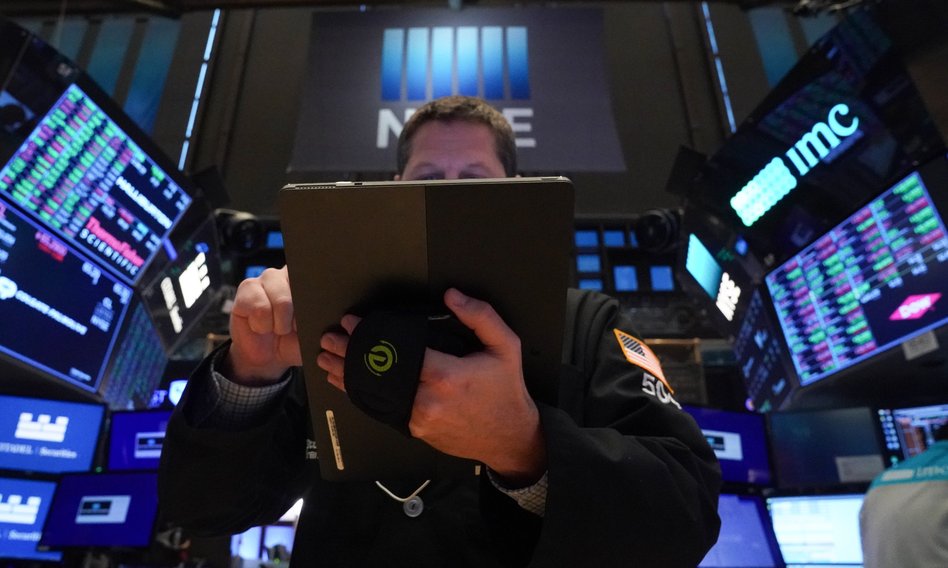

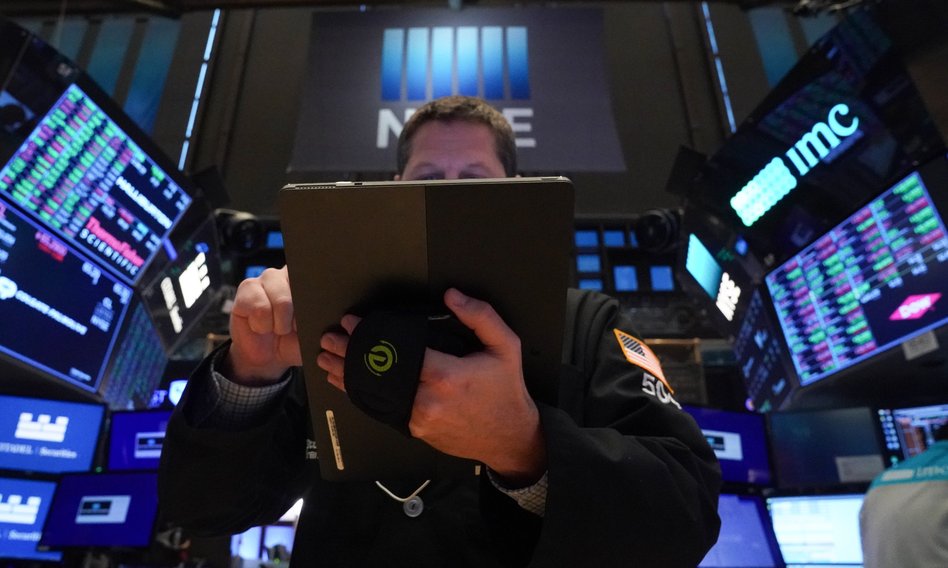

Friday’s session saw the continuation of the recovery in the New York stock exchanges. Analysts say directly: investors are not interested in the war in Ukraine, but Western sanctions against Russia.

After a crazy Thursday, events in the financial markets have not slowed down. Friday

It was a boom day in Europe And bring continued gains on Wall Street. There is still a war raging in Ukraine, and Russian forces are about to attack Kiev. However, for global investors, the outcome of this clash is of secondary importance. The main question is whether the United States and the European Union will eventually decide to impose severe economic sanctions on Russia. So far, nothing like this has happened.

Some believe that these increases reflect the fact that the full-scale Russian invasion of Ukraine has already been pushed back. We do not agree with this From the beginning, the markets were not interested in the war, but in the sanctions and the possible Russian response to them

— Elsa Lignos, Head of Currency Strategies at RBC Capital Markets, wrote in a customer report,

Russia has not been cut off from global payment systems, information technology and transportation. Russian raw materials are still in circulation without any obstacles. The latter issue was of particular concern to investors. A possible ban in this area could mean a global energy crisis and a massive economic recession, which will lead to a sharp decrease in the profitability of listed companies.

It was the decline in the risks of this scenario that decided the American stock exchanges. The S&P500 rose 2.24% on Friday, ending the week at 4,384.66 points. The Nasdaq rose 1.64% to 13,694.62 points. Stronger this time was the Dow Jones, which grew by 2.51% and reached the level of 34,0258.75 points at the end of the session.

During this historic week, US indices have fallen… pale. The Dow Jones Industrial Average remained largely unchanged, the S&P500 was up 0.8% and the Nasdaq Composite rose 1.1%.

The reaction of the crude oil market, one of the main gauges of the economic retaliation metric, was also important. Brent crude ended the week at less than $95 a barrel. Well, well below Thursday’s high (over $102) and close to levels prior to the Russian invasion of Ukraine. It was the uncontrolled increase in energy prices that could (and may be) the main economic cost of the war on the Dnieper.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.