inflation base – ie without the prices Energy and food – it has not been so high since the beginning of 2001, since the National Bank polishing publish information about it. according to Last The data released by the central bank on Wednesday, November 16th Core inflation in October reached 11 percent in Poland. every year.

This is not only the most in the history of measurements, but also Already the sixteenth consecutive reading higher than that recorded in the previous month. The last time core inflation (on an annualized basis) was lower than the previous month was in June 2021. Since July last year. Every month it gets higher and higher.

The final reading is also the second consecutive (and second in history) double-digit result. Core inflation was 10.7% in September.

Let us recall that inflation in Poland (according to the basic measure of the Central Statistical Office, without any exceptions) was 17.9 percent in October.

- Read more about the economy on the homepage Gazeta.pl

Why core inflation?

Core inflation is the rate of price growth excluding food and energy from the inflation basket (i.e. fuel, ElectricityGas, central heating, hot water and fuel). Why is this being done at all? Well, food and energy prices are most susceptible to seasonal fluctuations. They are particularly sensitive to supply shocks (as in the current energy crisis).

In other words, they can introduce disturbances into the measurements. With the exception of these two categories, the price processes that occur in the economy are better visible, for example to what extent higher costs are passed on by firms to consumers.

The Polish National Bank itself informs on its website that core inflation “produces a medium- and long-term trend of increasing prices of consumer goods and services in the economy.” The central bank states that the measure “refers to that part of inflation which is more closely related to monetary policy applied than in the case of other parts” and “is useful in (ex post) analyzes of the direction and magnitude of the effect of monetary policy applied on inflation.”

Core inflation is 11%, but there are other metrics as well

Although economists, when talking about core inflation, think of this measure as excluding food and energy prices, the NBP also calculates many other statistics for core inflation.

The so-called core inflation rate excluding managed prices in October 18.7% each year. It is a measure of inflation that does not take into account the prices of those products and services which depend on the decisions of the government, local governments or market regulators (such as the Bureau of Energy Regulation). We are talking here, among other things, about rent prices, garbage collection, water supply and sanitation services, electricity or gas prices.

Core inflation, excluding the most volatile prices, was in October 14.4 percent each year. This measure does not take into account changes in the prices of goods and services, which were characterized by the greatest fluctuations in the previous year. Usually these are for example fuel, gas, fuel, fruit or vegetable prices.

In turn, the so-called trimmed 15% average was in October 14.3 percent This core inflation measure does not take into account the price group that has experienced the greatest changes in the past year.

All measures of core inflation were at the highest level in the history of NBP research in October.

- Help Ukraine, join the group. You will pay money on the site pcpm.org.pl/ukraina

Will core inflation start to fall next year?

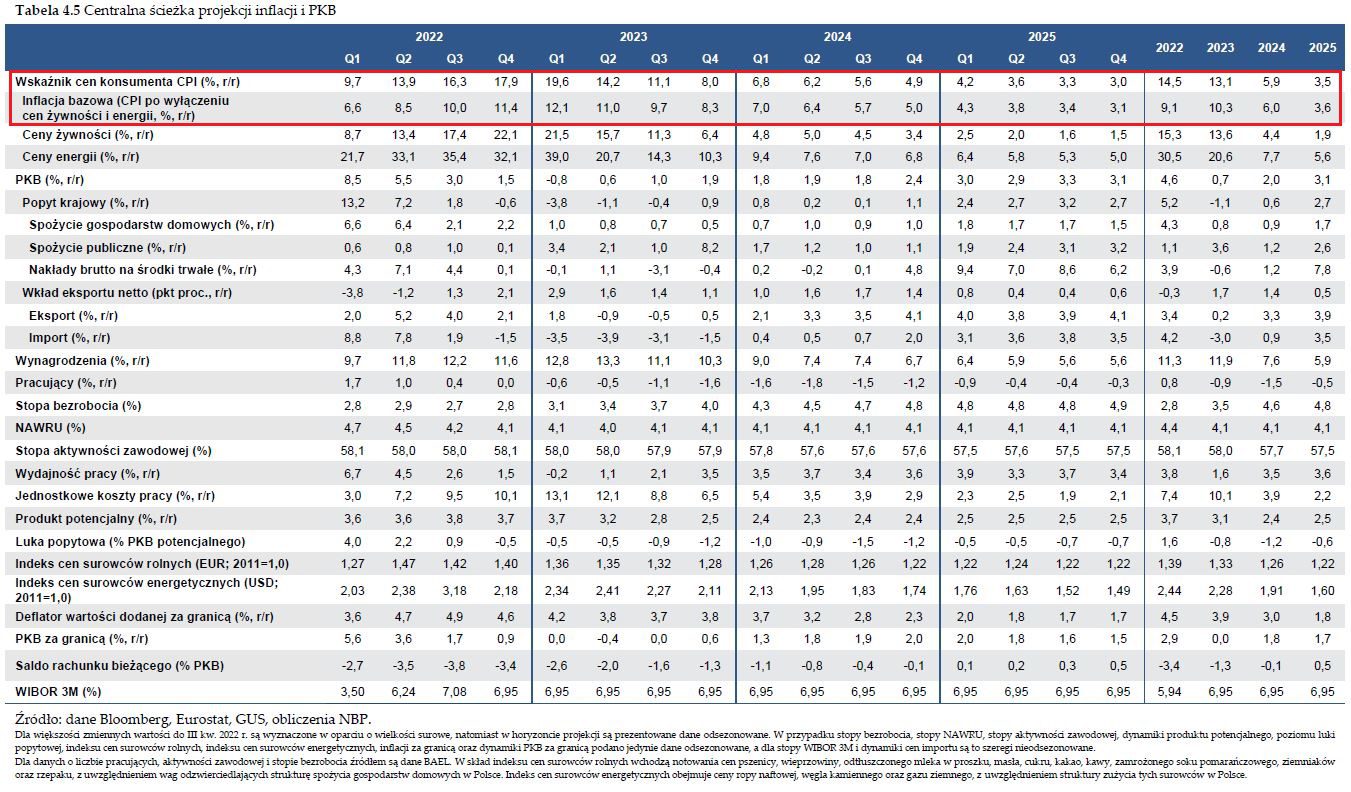

According to the latest projection of the Polish National Bank published a few days ago, core inflation – similar to the “standard” main inflation measure – will continue to grow and will peak in the first quarter of 2023 (at the level) 12.1% on average per quarter the first of 2023). Quarter – is a reading from the central track of the NBP projection).

After that, it should drop – to 8.3 percent. In the fourth quarter of 2023, 5 percent. at the end of 2024 and 3.1%. At the end of 2025

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

.jpeg)

.jpeg)

![Additional funds for the widow – two pensions. Changes in spouse benefits are planned [12.09.2022] Additional funds for the widow – two pensions. Changes in spouse benefits are planned [12.09.2022]](https://www.moviesonline.ca/wp-content/uploads/2022/09/Additional-funds-for-the-widow-two-pensions-Changes-in.jpg)