This year is different from previous years Not every borrower will benefit from the relief. The legislator has introduced restrictions to narrow the category of beneficiaries to the needy. It was mainly banks that appealed for the restrictions.

The rest of the article is below the video

See also: Once upon a time, “Made in Germany” was synonymous with poor quality – Krzysztof Domarecki in Business Class

Credit holidays 2024. Who will benefit?

About credit holidays Borrowers whose mortgage payments exceed 30% will be able to apply. Family incomeIt is calculated as the average of the previous three months. All you need is a declaration submitted under penalty of criminal liability.

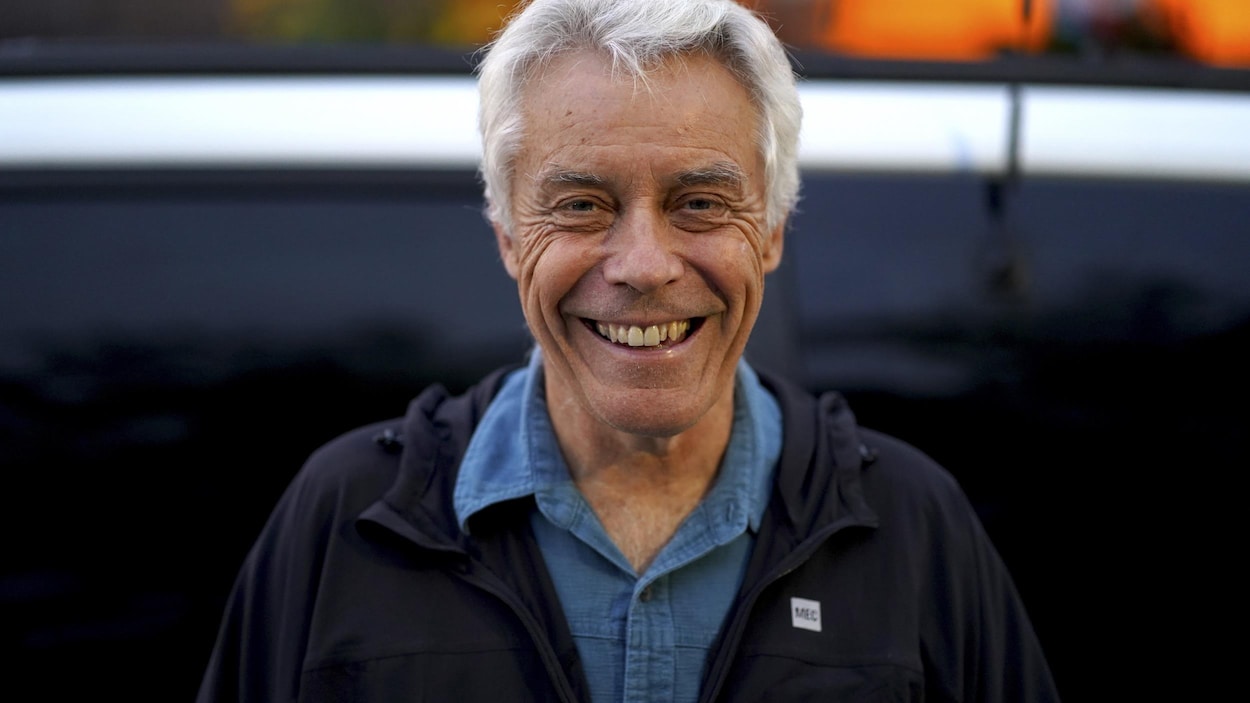

– This year, credit holidays are only available to people with high premiums or low income. Most of them will probably spend the money not spent on lifetime annuities or save them to create a financial cushion for the months in which the annuity must be paid – says Money.pl Jaroslaw Sadowski, chief analyst at Expander Advisors, a financial broker.

The income limit does not apply to families with at least three dependent children. These borrowers, as well as all other borrowers, will be subject to other restrictions: maximum loan amount. Granted loans amounting to PLN 1.2 million will be sent for “holidays”. To obtain such a loan, you must earn approximately PLN 20,000. Zloty.

According to estimates by the Ministry of Finance, a maximum of 562,000 people will benefit from loan holidays this year. Borrowers. The banks estimate that this will cost them a total of PLN 3 to 5 billion.

Is it worth overpaying for your loan?

According to Jarosław Sadowski, if possible, it is useful to allocate some funds to repay the excess loan. This will pay off because interest rates on loans are currently high.

According to March data from the National Bank of Poland (NBP), the average interest rate on loans was 7.58%. Interest constitutes a large part of the installment – especially in the case of loans granted in recent years, where the interest part is much higher than the original part.

– For example, on an installment of 2000 PLN, the interest may reach 1800 PLN. After paying this installment, the debt decreases by only PLN 200. By allocating the money saved thanks to credit holidays to repay the excess loan, you can reduce your debt by a full amount of PLN 2,000 – says the expert.

This will not only reduce the amount of remaining principal to be repaid, but also the interest amount to the bank.

If we can use all 4 months of credit holidays to repay the excess loan, with an installment of PLN 2,000 per month, we can reduce the debt by PLN 8,000. At the current interest rate on the loan, this amount generates interest of about PLN 587 per year. Over 10 years, savings can reach PLN 5,870. Of course, the amount may change because we do not know what the level of interest rates will be in the coming years – according to analyst estimates.

Benefiting from credit exemptions – as our interlocutor confirms – does not mean waiving unpaid installments. On the contrary – the loan repayment schedule will be extended by 4 months or 12 months if someone uses this solution for 3 years.. Let us remind you that 2024 is the third year in a row in which statutory credit holidays will be applied.

Borrowers should not be afraid of their creditworthiness being reduced due to taking advantage of credit holidays.

– If they wanted to get another loan and were able to afford it, the banks would certainly accept them with open arms, because the demand for bank financing has been weak for a long time – says Michal Konarski, analyst at mBank Brokerage House, in an interview with money.pl.

Banks resist “credit holiday”

The signing of the law extending credit holidays did not come as a shock to the listed banks. Monday’s session ended with a positive result for the stock market’s part of the banking sector. The WIG-banki index rose 1.72 percent, and the largest banks rose almost 2.5 percent.

– The market had previously assumed that credit relief would be maintained this year. Moreover, the sector estimated that its cost would cost banks much less than in previous years – explains our interlocutor.

Taking into account the very good profitability of the sector this year, according to our analyst from the financial brokerage house mBank, the cost of credit holidays will not be too severe for banks. The sector’s profits this year could reach PLN 30 billion. This is largely due to the cost of funds in the interbank market determined by the National Bank of Poland (5.75%).

– But let’s hope, as the government announced, that this will be the last year for credit holidays and no one will come up with the idea of preserving them in the following years – concludes the analyst.

Karolina Wisota, journalist at money.pl

Rate the quality of our article:

Your feedback helps us create better content.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.