Picture..a currency boom? Franc, Pound, Euro, Dollar – check how much you will pay for these currencies in zloty! Currency forecast

The behavior of domestic assets was determined last week by a comment from the European Commission indicating high chances of the imminent release of funds from the Reconstruction Fund. This means an increased demand for zlotys – money from the KPO will be exchanged on the market in PLN. As a result, the EUR/PLZ fell from 4.68 to 4.63.

See also: The war in Ukraine severely affected the prices of the zloty, forint, Czech and Swedish krona

The EUR/Polish zloty exchange rate basically broke the support at 4.63 on Friday evening. This opens the way for the pair to fall to 4.60-61. The zloty was still supported by expectations of further large NBP rate hikes, which only boosted the April data. Likewise, a very strong and pro-inflationary picture of the economic situation in the country was supported by the retail sales data on Monday. Investors are also hoping that the KPO ban will be unblocked soon. Eurozone PMI and expected decline in EUR/USD may not allow for further movement this week. However, the EUR/PLZ exchange rate is supposed to move below 4.60 next week.

See also: It will be on the exchange rates of dollars, euros and zlotys! Find out what will move the forex market

Further price increases by NBP and a change in the way currencies are exchanged by the Ministry of Finance (in the market, not in NBP), in our opinion, also justify further decline in EUR/PLZ in the long term. The European Central Bank may start raising interest rates earlier than assumed, but their range may be greater than assumed in the base scenario. At H222, we also assume a further normalization of the situation in the markets, including with a reduction in war tensions. This should allow €/PLN to return close to 4.50 before the end of the year.

Relative Value Models

- Relative value models evaluate the current deviation of market variables from their theoretical values calculated on the basis of other market variables.

- According to our estimates, the depreciation of the zloty against the euro remains very high. The rising expectations of an interest rate hike in Poland justify a further marked strengthening of the zloty against the single currency. The problem is geopolitical uncertainty and the long struggle over the KPO. The models also suggest scope for asset swaps to narrow, although bond yields themselves still have room to grow.

See also: Currency forecast for the pound, franc, euro and dollar – forex exchange rates

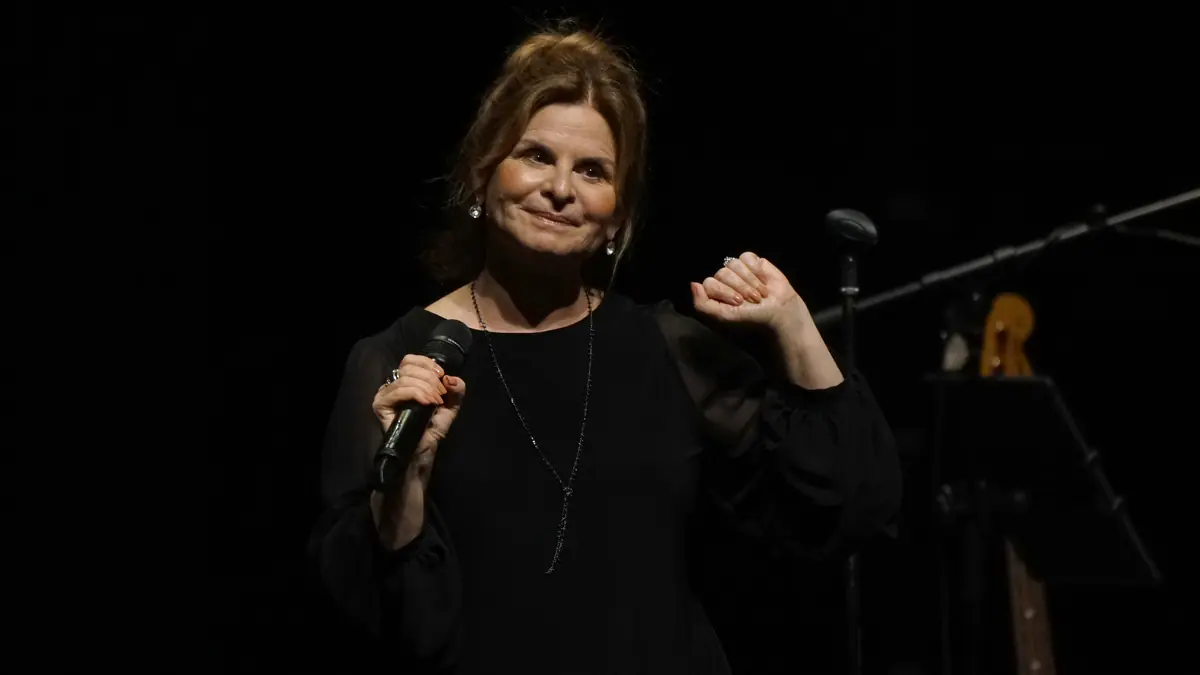

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.