An application can be made for the 2023/2024 loan holiday, among others: Online.

Applying for a loan holiday for 2023 is easy. We explain step-by-step how to put your mortgage repayments on hold with your bank. Also find out what the 2024 credit application will look like. Who will benefit from this option?

Contents

- Application for credit holidays 2023 – who can apply?

- Application for credit holidays 2023 – how to submit it in person or in writing?

- How to apply for credit holidays 2023 online in individual banks?

- Application for Alior Bank credit holidays

- Application for BNP Paribas credit holidays

- Application for credit holidays from Credit Agricole Bank

- Application for holiday loans ING Śląski Bank

- Application for mBank credit holidays

- Apply for Millennium Credit Holidays

- Application for credit holidays Pekao SA

- Application for credit holidays PKO BP

- Application for credit holidays Santander Polska Bank

- Credit holidays 2024 – for whom and on what conditions?

- Application for credit holidays 2024 – How to apply?

Application for credit holidays 2023 – who can apply?

Credit holidays 2023 allowing Suspending the payment of one installment of the housing loan in each quarter of the year (Both capital and interest parts). Anyone who has entered into a contract can use this option Mortgage loan (or mortgage loan) in PLN for your housing needs. The agreement must be concluded before July 1, 2022, and the loan term expires at least 6 months after that date. The contract must still be in force, i.e. not expired or terminated.

To take advantage of your vacation, All you have to do is submit a simple request – in person, in writing, by email or via e-banking (Different banks may offer different options.) Credit holidays go into effect when the application is delivered to the bank. For formalities, the bank will send confirmation of receipt of the application and information about the amount of any security fees within 21 days. It is worth noting that the loan period extends according to the duration of the holidays.

Check also:

If the loan agreement is concluded jointly by several persons, it is not necessary to obtain the consent of all borrowers to benefit from the loan deferral period – each of these persons can apply for the loan deferral period.

Secure loan with 2% interest – is it for everyone? Murator financing.

Application for credit holidays 2023 – how to submit it in person or in writing?

How to apply for credit holidays for 2023 in person or in writing? its very easy. if you want Submit the application in person All you have to do is go to the branch of the bank that granted us the mortgage and declare your desire to benefit from the loan holidays. After that, a bank employee will guide us through all the necessary steps.

In turn he wants Submit a request for credit holidays in writingYou just need to prepare a simple document yourself. There is no single applicable form for downloading a credit holiday application. If you would like to submit a paper application, please include the following:

- Top left: Your personal data (name, surname, address, PESEL) and contract details (number, date of conclusion of the contract, contract designation),

- Top right: City and current date,

- Bottom right: addressee of the request (lending bank),

- In the middle: the logo “Request to suspend loan repayment” and the request to suspend repayment for the period or periods indicated,

- Under the middle section: a statement that the application submitted relates to a contract concluded to meet your housing needs and that you are aware of criminal liability for making a false declaration,

- Below: The borrower’s legible handwritten signature.

The application prepared in this way must then be delivered to the lending bank (eg by post).

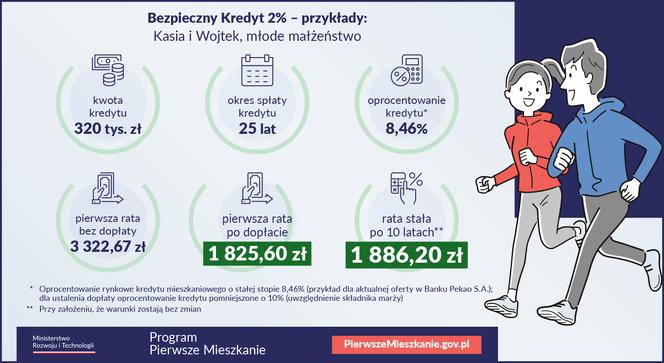

Author: Ministry of Development and Technology

Safe Credit 2% – Example 1

How to apply for credit holidays 2023 online in individual banks?

You can also apply for credit holidays 2023 online easily. Individual banks offer different possibilities in this regardFor example, submitting a request via electronic banking or email. The procedures will also be slightly different. Therefore, if you have any doubts, it is best to contact your bank and ask any questions you may have. Below we discuss step by step how to apply for loan forgiveness in the most popular Polish banks.

Application for Alior Bank credit holidays

You can submit the application by email (by sending a scan of the completed paper application to [email protected]) or in Alior Online banking. To use the second option:

- Log in to your account,

- Go to the “My Affairs” tab, then to “Actions, Opinions, and Endorsements.”

- Find, complete and submit the Mortgage Holiday application according to the on-screen instructions.

Application for BNP Paribas credit holidays

The application is submitted via Goonline Banking. To do that:

- Log in to the Go Online website,

- Go to the “My Money” tab, then “Loans”, then “Details”, then “Applications” and look for “Credit Leave Request”

- Complete the application according to the on-screen instructions,

- Click on the “Submit Request” button.

Application for credit holidays from Credit Agricole Bank

The application can be submitted via an electronic form or downloaded to disk, completed and returned. It is available after logging into your customer account as “Request to suspend mortgage payments”. When completing the form, follow the instructions that appear on the screen, and after sending the request, confirm it with the code that you will receive via SMS (to the number provided at the bank as a contact number).

Application for credit holidays ING Śląski Bank

You can apply via Moje ING. To do this, follow these steps:

- Log in to My ING,

- Select the loan to which the holiday applies from the list,

- Go to the “Requests” tab and find the “Loan Payment Suspension Request” option.

- Complete and submit the application according to the on-screen instructions.

Application for mBank credit holidays

The application is available on the bank’s transaction website. To assemble it:

- Log in to the deal website,

- Go to the Help tab,

- Select “Organize your affairs” then “Other matters”.

- In the search engine that appears, enter “Loan repayment support” and select the “Loan repayment suspension (statutory credit holidays)” option,

- follow the instructions that are on the screen.

Apply for Millennium Credit Holidays

The order is placed via Millenet (this cannot be done via the mobile application). To do this:

- login to millint,

- Go to “My Products”,

- Click on the Mortgage Loan button and select Apply for Statutory Loan Holidays from the available options,

- Complete and submit the application according to the on-screen instructions.

- It should be noted that the same application can also be found in a different way – by going to “My Money”, then “Loans and Credits”, then “Mortgage”, then “Details” and finally “Credit Leave Application”. “Option”.

Application for credit holidays Pekao SA

The application can be submitted via the PeoPay mobile application or Pekao24 e-banking. Follow the following steps:

- Log in to online banking,

- Go to “Offers & Apps,” then to “Services,” then to “Help” and finally to “Help & Certifications.”

- Select the product to which the holiday will be applied (loan agreement or loan),

- From the Instructions menu, select “Suspend loan repayment (deferral of government loans).”

- Complete the order according to the information that appears on the screen,

- Once finished, click “Next” and then “Submit Request.”

Application for credit holidays PKO BP

You can submit the application via the iPKO website. for this purpose:

- iPKO login,

- Go to the “My Affairs” page, then to “Actions and Testimonials”,

- Select the “New Instructions” option and go to the “Mortgage Loans” section,

- Go to the “Government Suspension of Loan Repayment” option,

- Select the product to which the holiday will be applied (credit or loan),

- Follow the on-screen instructions and finally confirm your order.

Application for credit holidays Santander Polska Bank

The Village is served via electronic banking. to do this. Follow next steps:

- Log in to online banking,

- Go to the “Your Issues” tab,

- Select the “Mortgage Loan” option and then “Loan Deferral – Suspension of Loan Repayment”,

- Click “Submit Application” and complete and submit it according to the on-screen instructions.

Credit holidays 2024 – for whom and on what conditions?

Credit holidays for 2024 have already been confirmed, but not all details have been revealed. However, it is known that Borrowers who entered into a mortgage agreement before July 1, 2022 will benefit from loan holidays for 2024:

- The maximum loan capital granted is PLN 400,000. zloty,

- The loan capital granted ranges between PLN 400,000 and PLN 800,000, provided that the cost of servicing the loan, i.e. principal and interest installments, exceeds 50%. Family income.

More importantly, in the latter case, income is counted from the last 3 months before the 2024 loan deferral application is submitted.

As reported by the government. In 2024, it will be possible to suspend the payment of one installment per quarter. The borrower decides how often he or she will take vacation. During holidays, both the principal and interest of the installment are suspended. After availing the holiday, the loan period is automatically extended depending on the duration of the holiday.

If you have a loan of PLN 380,000 for 25 years with an interest rate of 7.2 percent, then the principal and interest installment is PLN 2,734.44. By availing loan holidays, you can suspend one installment every three months. This means that you can spend up to PLN 10,937.75 per year on other needs – the government gives an example of this.

Application for credit holidays 2024 – How to apply?

It’s currently unknown what exactly applying for the 2024 credit holiday will look like, however Most likely, the rules will be the same as in 2023. This means you can apply for holidays in person, in writing or online.

Individual banks may offer different options in this regard, for example, submitting an application via an online form or sending it via email. Detailed information can be found on the website of the bank that granted us the mortgage or mortgage loan.

The bank confirms acceptance of the application within 21 days from the date of receipt. Failure to confirm does not affect the start of the suspension period – It’s like the government.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.