2022-02-16 21:01

publishing

2022-02-16 21:01

The pace of increases in the federal funds rate should be faster than in the previous extended cycle, according to records from the January meeting of the Federal Reserve authorities.

Since the January meeting of the Federal Open Market Committee (FOMC), market speculation has intensified The US central bank will finally begin to normalize ultra-loose monetary policy. It’s essentially a foregone conclusion that in two weeks the Fed will end its bond-buying program (QE – colloquially known as “reprint money”) and make its first rate hike at the March FOMC meeting.

It has been going on for several days The auction of the most shocking prediction of an interest rate hike in the United States. Until recently, the futures market was fully priced with a movement of 50 basis points. in March. Now the chances are half and half. In other words, just over 50% to raise 25 basis points. Not behind the movement by 50 basis points. The futures quote shows that at the end of 2022, the market expects the fed funds rate to be in the range of 1.75-2.00%.

The release of the FOMC meeting minutes on Wednesday did not lead to much new information on the subject. We learned that only “a few” of the participants wanted a quicker end to “reprint money” and that “too many” were in favor of starting to sell mortgage bonds. However, there was little about the interest rates themselves.

– compared to the conditions of 2015, when the Committee last started the process of reversing the expansionary monetary policy, Most respondents suggested a faster rate of increases in the federal funds rate range than in the post-2015 period

– We read in January “minutes”.

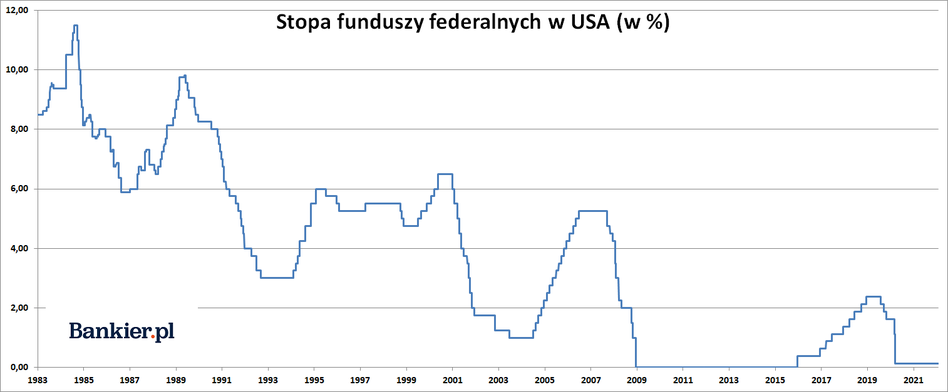

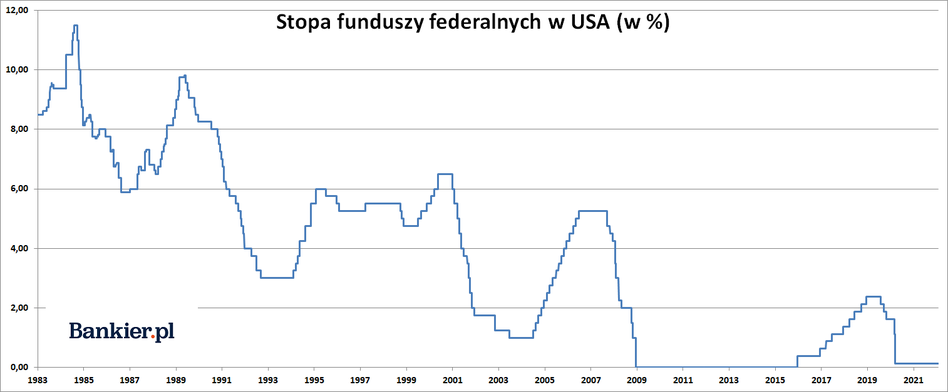

The previous cycle of monetary policy tightening (or normalization) in the US was very restrictive. The Fed has waited seven long years to break away from its zero-interest policy, absorbing every excuse to keep the money price at historically low levels. We didn’t get our first raise until December 2015. To get a second boost We waited another year. Then things went a little faster: we had two increases in 2017 and four in 2018. All of them average 25 basis points. Thus, it took the Federal Reserve three years to raise interest rates from zero to 2.25-2.50%. Then in December 2018 He gave in to the demands of the financial lobby Suddenly they started loosening monetary policy.

However, the current situation is fundamentally different from what it was seven years ago. At the time, CPI inflation was close to the Fed’s 2% inflation target, and Now it’s up to 7.5% and is the highest in 40 years.

At that time, the labor market was ruled by employers, and now America is suffering from a shortage of several million workers. A rapid rise in salaries will significantly increase high inflation in the coming years as well. Therefore, Powell & Co. faces a more difficult challenge than their predecessors, Yellen and Bernanke.

– The participants emphasized that the correct course of monetary policy will depend on the development of economic and financial events and their repercussions on risks and economic prospects – “January minutes” provide us with such classic dominance. It does not appear to be an announcement of the central bank’s intention to suppress more than 7% CPI inflation.

Also, the immediate market reaction may indicate that the January FOMC meeting minutes did not feed monetary policy hawks. The dollar weakened slightly against the euro and gold prices rose. On the other hand, sentiment improved on Wall Street, with the previously declining S&P500 index turning green, and the Nasdaq recovering most of the initial losses.

Krzysztof Colani

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.