Publishing

2022-09-16 12:00

Thursday afternoon saw the collapse of all-important technical support in the dollar futures contract. So there is a case where gold fails to hedge against inflation in the short and medium term.

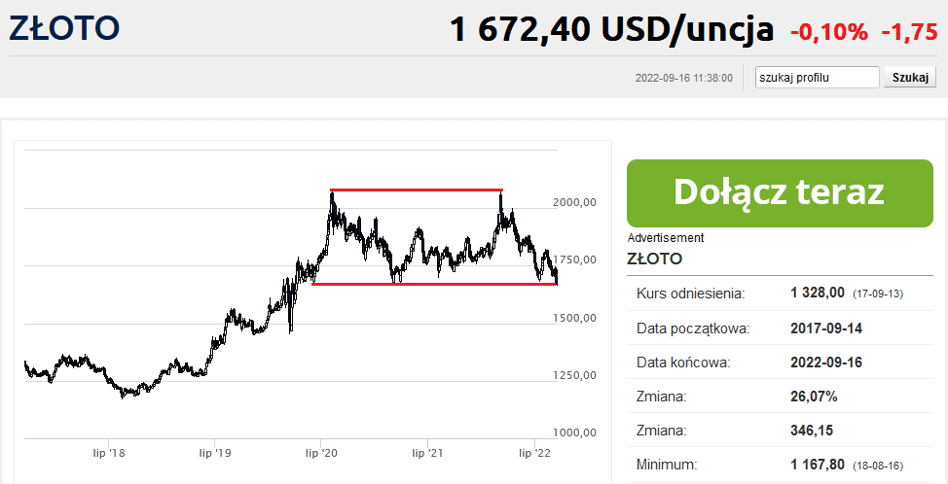

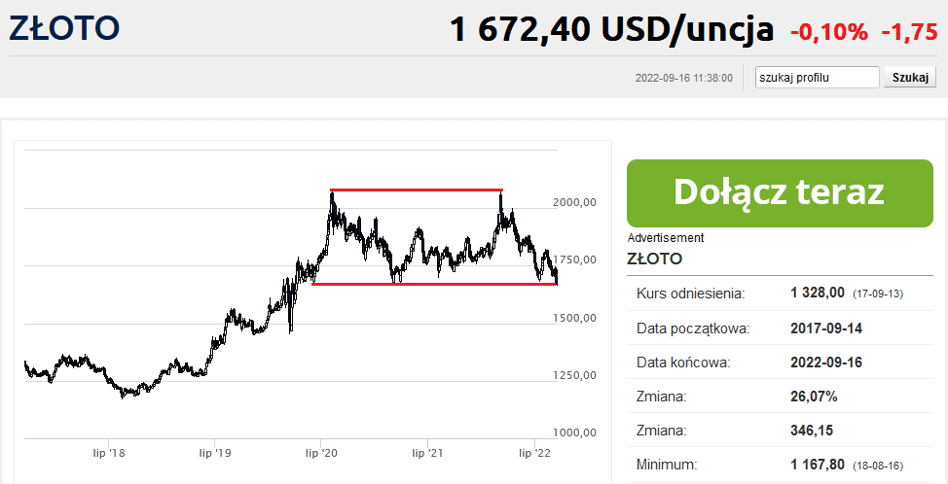

He’s been pretty quiet lately about precious metals. Gold, silver and the rest fell off the radars of the financial media. Until Thursday. After 16:00 CET, the gold futures market witnessed a strong supply attack that broke through the defenses in the region of $1675-1680/oz. These levels represent the lower bounds of a sideways trend that has been in progress for more than two years.

Usually, stop-loss orders placed by holders of long positions are located in such places. Therefore, breaking these levels leads to “liquidation” of stop losses, that is, creates a wave of new sell orders. We saw this effect on Thursday when gold fell from $1,690 to around $1,665 in less than an hour. On Friday morning, the movement deepened to $1,662 an ounce.

If gold is no longer above $1,675/oz by the end of the day (and thus also the week), the technical analysis proponents will have a strong argument for taking short positions. The AT theory says that after breaking the bottom of the consolidation one can expect dips in the width of the previous channel. In this case, a whopping $400 would likely set a goal of $1,275, which is About local minimums from Spring 2019.

In such a scenario, the entire recovery from 2019-20 would be wiped out. It would also be a serious blow to the Goldbug camp that is already facing

With allegations that gold has failed investors. In dollar terms, the case seems untenable: the royal metal has already lost more than 9% against the dollar this year, and has been valued at about 6% less than… 10 years ago. All this amid accelerating inflation, extremely negative real global interest rates and a bear market in the stock and bond markets. That is, in ideal conditions for gold appreciation.

Special offer from Finax for readers of Bankier.pl

Finax is a heist advisor that gives you the possibility of simple and automated investing. We wrote more about this in the text.Finax learn how to invest in the stock market“.

Finax together with Bankier.pl has prepared a promotion for our readers: a coupon of 20 euros that can be used to increase the investment! The offer is available to new Finax users, that is, those who have not registered on the site and do not have an account on it.

What do I need to do to get a voucher?

- Register on the promotion page www.bankier.pl/finax Select the required approvals. Confirm your registration.

- Complete the survey and create an account on Finax.

- Verify your identity And pay a minimum of PLN 100 to your account.

After Finax confirms the last step, we will ask you to fill in your details and send a code that can be used to top up your account In the amount of 20 euros. You can take advantage of the offer Only until September 18, 2022The number of coupons is limited!

Remember that only applications submitted via the website are eligible for promotion www.bankier.pl/finaxAfter registration! If you wish to withdraw funds within 3 months of creating your account, Finax may deduct the €20 voucher value from your account balance.

Details can be found on the website www.bankier.pl/finax

Assuming additional benefits child account: New minor customers who open an account with Finax by 31/12/2022 will receive a discount on the first open wallet (01) upon account opening. Thanks to this, the funds in the account up to 1,380 euros (about 6000 PLN) will be exempted from management fees for 365 days from the date of opening the account, and they will also not be paid until the age of 18 for the reservation of lower payments.

Investing comes with risks.

What sank gold?

Before we can get rid of the “barbarian remnants” once and for all, let’s explain the reason for such poor results. Or notIn my opinion, it is worth stopping to look at gold only from the perspective of the dollar. The US currency is currently trading near its strongest level in 20 years. The strength of the US dollar is stifling the price of gold, which has so far defended itself well against the dollar’s rally. But counted in euros, the yellow metal is still gaining more than 3.5% this year and has been rising for four consecutive years. For Japanese investors, gold has gained more than 13% since the start of the year, which is partly protecting against the yen’s depreciation.

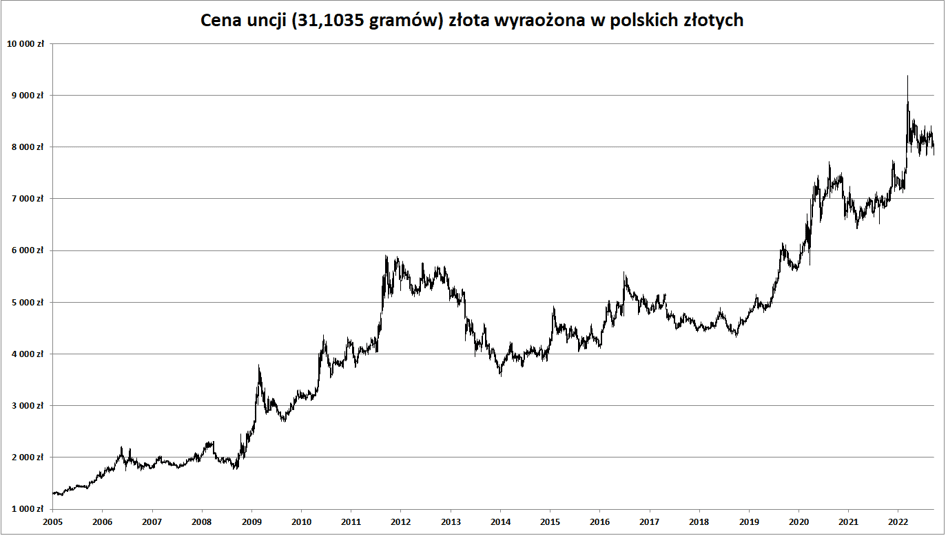

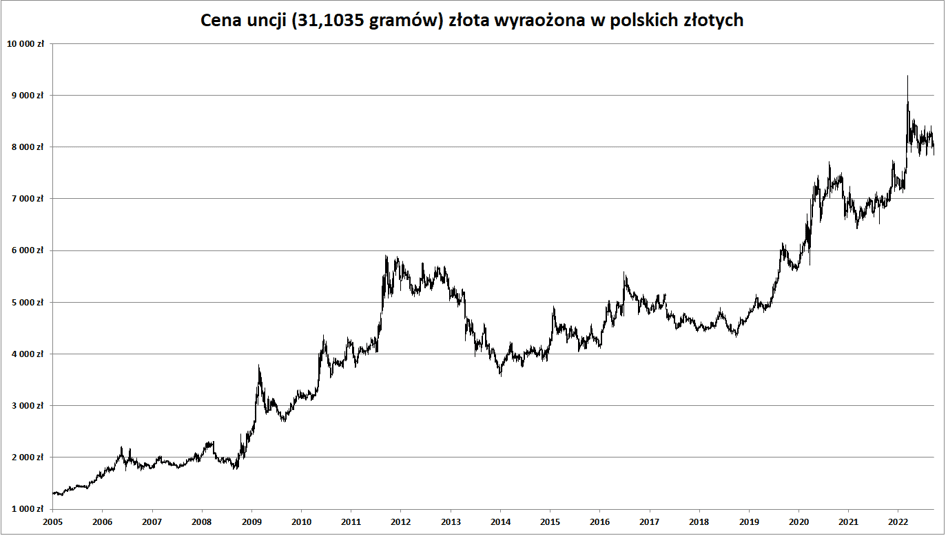

The situation is similar in Poland, where the zloty fell against the dollar by about 15%. As a result, an ounce of gold in the Vistula and Oder costs 6.5% more than at the beginning of the year. Looking at the price chart of the yellow metal expressed in PLN, we can see that we have just reached the bottom line of the consolidation that continues from the spring.

secondlyThe immediate catalyst for the massive sell-off in gold contracts on Thursday was an increase in market interest rates in the US. The yield on US 2-year Treasuries has exceeded 3.9%, the highest since 2007. 10-Year Treasuries are already paying around 3.5%. This is just as much during the peak of CPI in June in America.

We trust the Federal Reserve.

The rise in bond yields reflects expectations of a significant increase in interest rates at the Federal Reserve. The market is convinced that the Federal Reserve will raise the federal funds rate on Wednesday by as much as 75 basis points for the third time in a row, and some are even betting on a 100 basis point increase. By the end of the year, the US central bank’s money rate is expected to clearly exceed 4%. Yes, it is still below historical CPI inflation (ie for the past 12 months), but it will probably be more than inflation in the next few months.

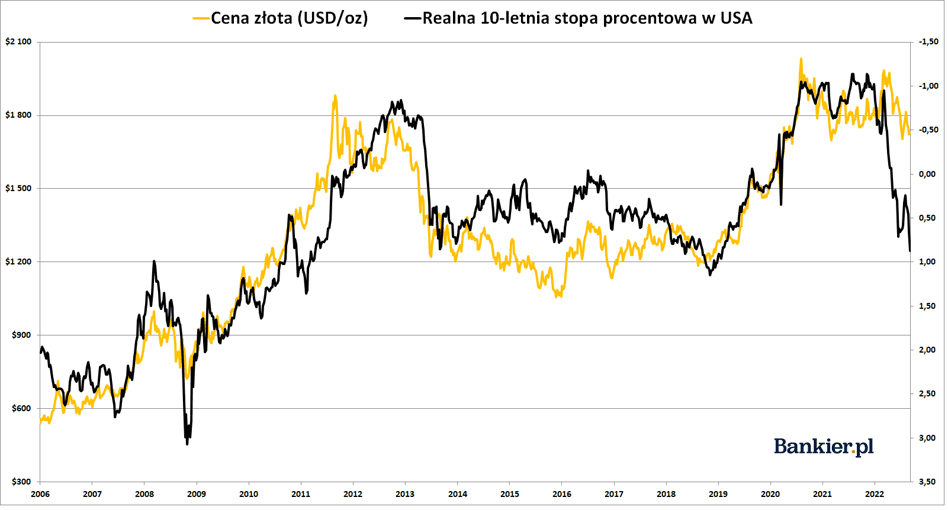

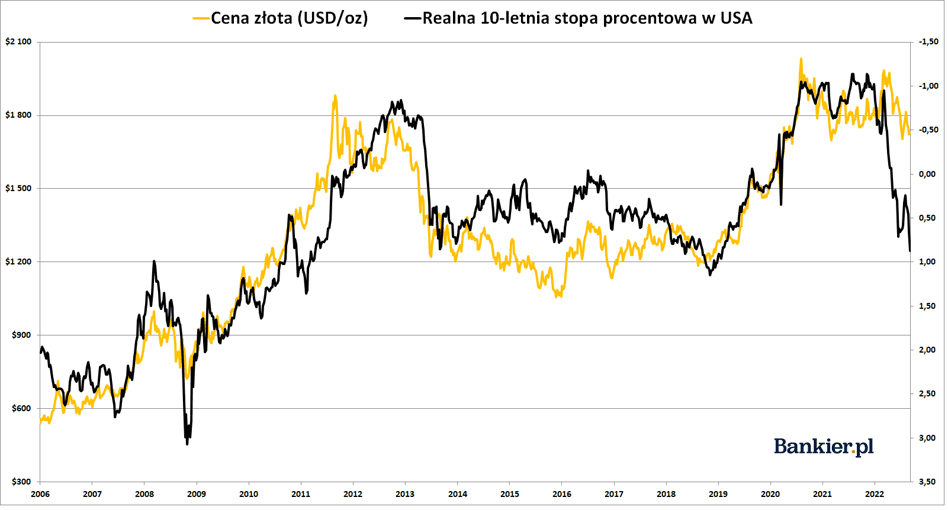

US investors still believe the Fed will stifle inflation. A reflection of these expectations is the fact that since May we have been noticing positive 10-year real returns trich. You can clearly see in the chart above that dollar gold prices are moving in the same direction as real long-term interest rates in the US. If the latter is not reversed, it may be difficult for gold in US dollars to rise.

In fact, investing in gold is an act of apostasy from the fiat money system. Any currency based solely on trust (but also on compulsion to use it) towards the central bank. The vast majority of investors still believe in the Federal Reserve and its determination to reduce dollar inflation. If someone shares this belief, then gold is not of much value to him. However, if one remains skeptical about seeing a return to the 2% inflation target, it is likely that he is holding a long position in gold as part of a diversified, long-term investment portfolio. Time will tell who “wins”.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.