2021-12-14 14:13

publishing

2021-12-14 14:13

The Hungarian National Bank raised interest rates for the seventh time in a row to fight inflation. But this time, the increase is largely symbolic.

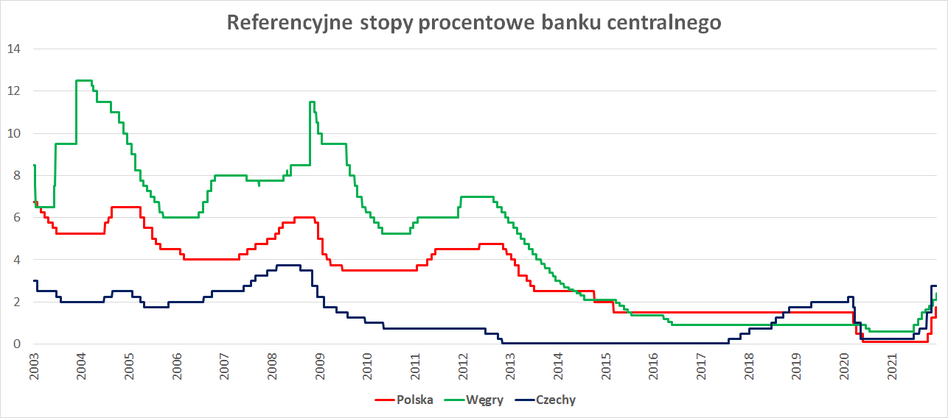

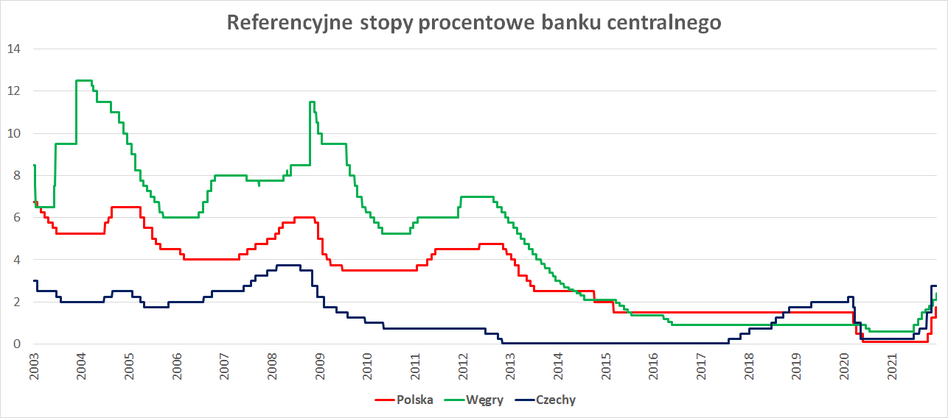

Under the decision of the Hungarian National Bank (MNB), the reference interest rate was increased from 2.1%. Up to 2.4 percent, the move was in line with the expectations of most analysts and market commentators.

More importantly, in recent weeks, it has not been the reference rate, but the deposit rate, which is the primary instrument of MNB influence. The price raised in Thursday’s auctions is now 3.3%. 1.6 percentage points more than a month ago. By raising the reference rate, the MNB somehow narrows the business corridor, because the bank’s plans are to bring the two rates closer together – when the goal of curbing inflation is achieved.

It should be noted, however, that this is the seventh consecutive increase in price hikes at Lake Balaton. In June, MNB achieved its first increase in nearly a decade (from 0.6% to 0.9%), and this movement was repeated in July (from 0.9% to 1.2% – then) We were dealing with an increase that exceeded expectations), August

(from 1.2% to 1.5%), In September (from 1.50% to 1.65%)And In October (from 1.65% to 1.8%) And In November (from 1.8% to 2.1%).

Hungary’s interest rates are currently the highest since June 2014. In the following quarters, “nephews” continued the cycle of cuts, cutting interest rates to 0.9 percent, and in the face of the pandemic, they lowered this rate to 0.6 percent.

The number one reason for Hungary’s first cycle of rate hikes in nearly a decade is inflation, which in November reached 7.4%. This result is lower than the Polish result (7.7%), where the MPC raised interest rates to 1.75%. in December. The Czech Republic is taking similar steps (rates of 2.75%), where inflation is the lowest (6% in November).

Among the countries in our region, interest rates will be set this year by the Czech Central Bank (December 22). Earlier, because tomorrow the decisions will be made by the US Federal Reserve, and on Thursday we will have a day, among other things, with the European Central Bank, the Swiss National Bank or the Bank of England.

Michał Żuławiński

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.