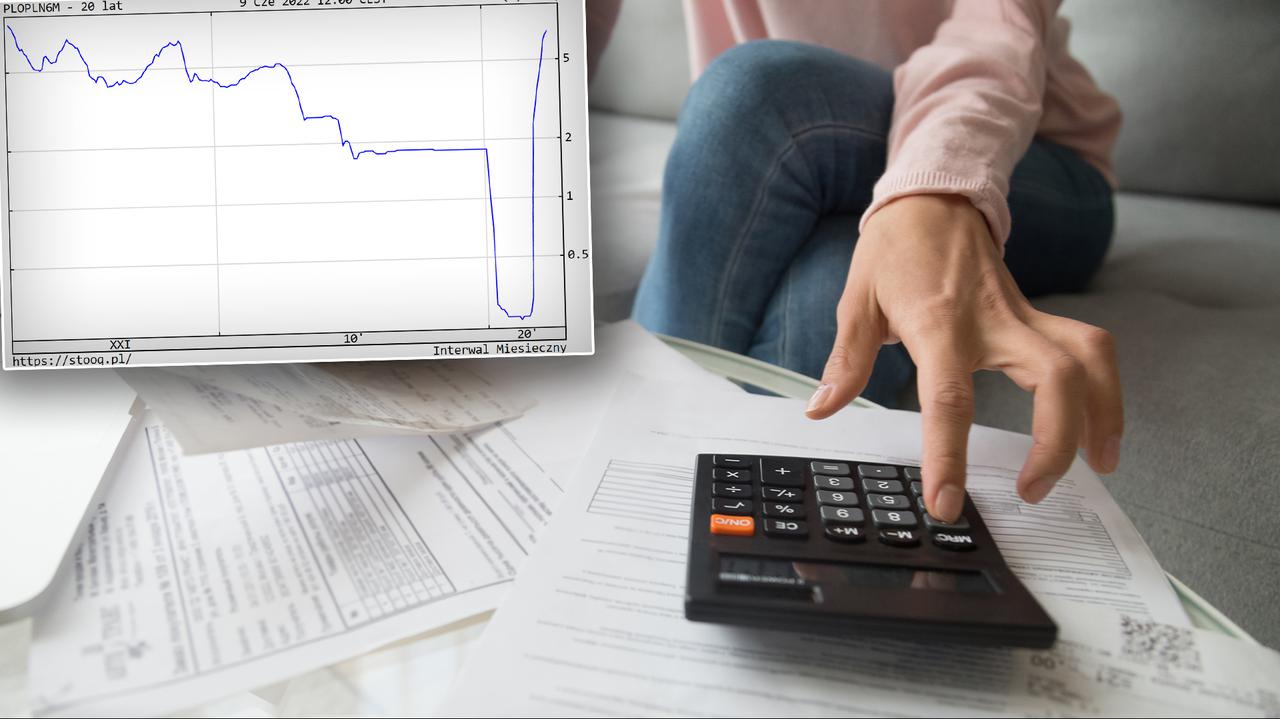

The average margin on housing loans was 1.94%. The last time it was very low was in January 2020. The decline in margins is one result of higher interest rates, according to an analysis by HRE Investments.

As noted by Oskar Sękowski and Bartosz Turek of HRE Investments, 8 out of 11 banks surveyed offer their clients a margin of less than 2 percent. They noted, “This is the best evidence that banks are making mortgage offers more attractive.” They added that the most prominent offers are loans with fixed interest.

Margins on Mortgage Loans

Experts pointed out that the decline in margins is one of the results of higher interest rates. “In this way, at least in part, the banks consume the increased interest rates and compete for the interests of customers” – they emphasized.

As experts admitted, higher interest rates lead to a higher cost of loans. “Today it can be estimated that the premium of the average debt is or will be about 70 per cent higher than it was in September of last year” – he emphasized. It is noteworthy that the interest rate hike cycle began in October 2021.

Creditworthiness is declining

Experts at the same time noted that the creditworthiness began to decline, that is, the maximum amount for which we can borrow.

“Since April, banks have been asked to include a higher reserve for interest rate hikes when checking creditworthiness. So far, it was at 2.5 percent, now it’s 5 percent.” mentioned in the analysis.

As a result, a family of three, whose income is at the level of the national average, can still receive a loan proposal from the bank in the amount of PLN 700 thousand in September 2021. PLN. At the moment, taking into account the increasing interest rates on mortgages or the changing level of wages, the same family should be able to borrow about 460,000. Analysts indicated – PLN.

creditworthinessHuman rights education investments

“It should come as no surprise that there is a growing interest in fixed-rate loans”

“With interest rates rising, and therefore loan installments increasing, the increased interest on fixed-rate loans should not come as a surprise,” he said. It is noteworthy that the offer currently includes real estate loans with fixed interest for a period of 5, 7 or even 10 years.

As a rule – as noted by analysts – if interest rates are higher than currently expected, the owner of the loan at a fixed rate of interest will save. On the other hand, if the cost of money is less than what is expected today, the holder of the offer at a variable rate of interest will spend less on servicing the loan.

“When choosing a fixed-rate loan, we buy some peace of mind that our premium will not suddenly increase for at least a few years” – he emphasized. Analysts admitted that you will have to pay extra for this guarantee – the premium, at least in the first months of repayment, is higher. According to them, this solution is “highly recommended” for people who take out a credit-worthy loan or whose loan installments make up a large part of the home budget.

Human rights education investments

She added that from the point of view of interest in mortgages, customers will experience an interesting change at the end of May. “Then the Loan Guarantee Program – also known as a ‘no down payment’ loan – will be launched,” it was reported.

According to analysts, the number of new housing loan agreements in 2022 will be much lower than in the previous year. “At least part of this space will be developed by individual investors and investment funds” – evaluated.

“The first driver may be the rapid rise in rent rates and the search for inflation protection. For big money building portfolios of rental apartments, the key may be the expected effects of immigration, which today increases rent rates, which in a longer term may translate into an increase In housing prices ”- Briefly.

Main image source: stock struggle

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![This is the latest pension since January – accounts. Check your net hand scores [17.01.2022] This is the latest pension since January – accounts. Check your net hand scores [17.01.2022]](https://www.moviesonline.ca/wp-content/uploads/2022/01/This-is-the-latest-pension-since-January-accounts-Check.jpg)