Interest rates rose for the ninth time in a row. WIBOR ratios are also rising, on which the amount of the loan installment depends. For six months, WIBOR broke the 7 percent level, for the first time since October 2004.

The Monetary Policy Council (MPC) raised interest rates by 75 basis points during its June meeting. The first of the current series of increases occurred in October 2021. Since then, the MPC has raised interest rates every month. The benchmark interest rate rose to 6.0 percent. This is the highest level since June 2008.

– inflation It is growing, and so are the rates, as we have announced. It’s a cycle interest rate increases – He said During Thursday’s press conference, Adam GlapinskiChairman of the National Bank of Poland and Chairman of the Monetary Policy Committee. At the same time, the head of the central bank indicated that we are approaching the end of the cycle. – We’re closer to the end than the beginning, because it was another walk. We’re at a fairly high level, Glapiński said.

The next MPC decision meeting is scheduled for July 7.

Weibor interest rates

As a rule, MPC decisions have an impact on WIBOR, which at the same time translates into the amount of loan installments. The loan interest rate consists of two components: the bank’s margin and the WIBOR ratio. If a housing loan has a variable interest rate, changes in WIBOR affect the amount of the installment.

Some banks use a 3M (three-month) WIBOR rate, which means that the mortgage interest rate is updated every three months, starting from the moment the loan is disbursed. In the case of WIBOR 6M (six months), the interest rate is updated every six months. The above rates include potential interest rate increases or reductions that may occur during this period.

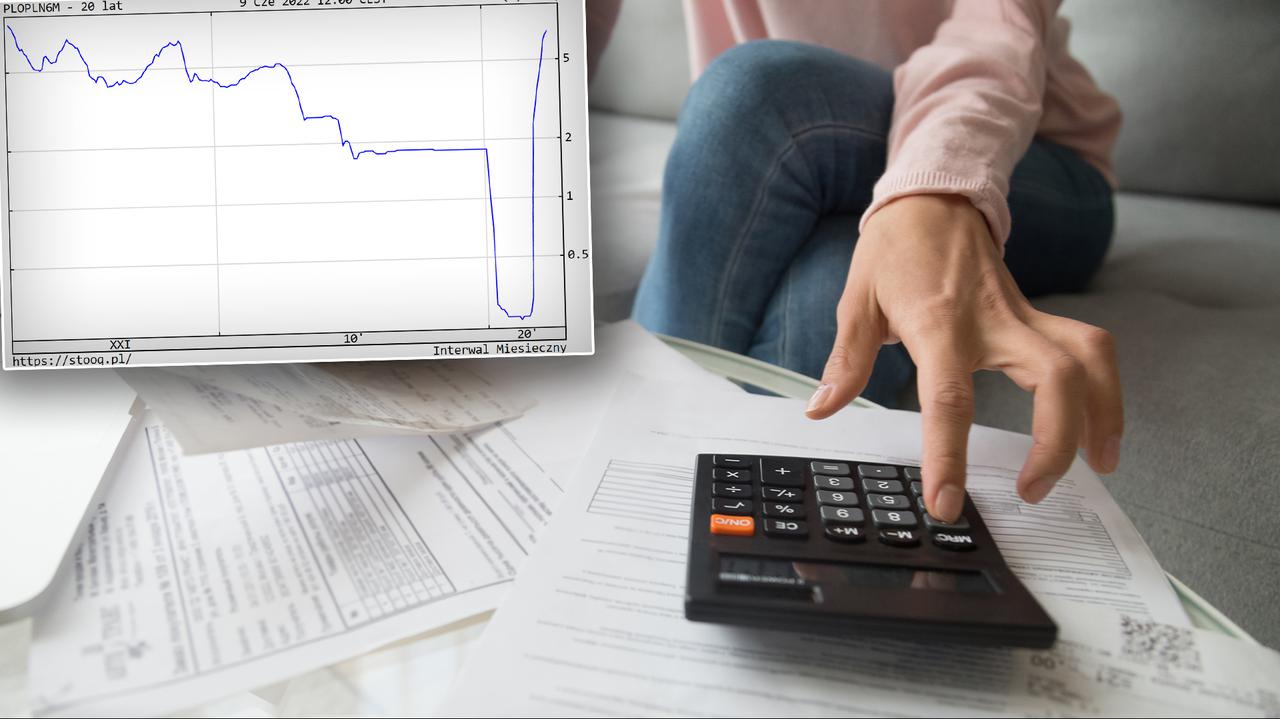

Both indices rose on Thursday. WIBOR 6M broke the 7 percent level, for the first time since October 2004.

WIBOR 6M in the last 20 yearsstooq.pl

“If anyone gets an interest rate update in the near future, they can expect a boost in the region of just over 2,500 PLN,” economic analyst Ravi Mundri wrote on Twitter. It is a loan for 25 years, pay back 300,000. PLN of the capital. “Creditworthiness is declining rapidly,” Mundry noted.

WIBOR 3M is currently at the level of 6.76%, and WIBOR 6M is at the level of 7.02%.

This means that if we’ve updated the premiums in recent days, the rate hike in June – and possibly July – has already been included.

How much will WIBOR grow?

Jaroslav Sadovsky, chief analyst at Expander Advisors, indicated at the beginning of the week that futures quotations indicated that 3M WIBOR could rise to about 8 percent in the next six months. Therefore, in practice, we can expect 3M WIBOR to continue to gradually grow up to this level in the coming months.

“In normal times, the difference between 3 million WIBOR and the reference rate (…) should be about 0.25 percent. If we start to approach the end of the rate-raising cycle, the aforementioned disproportion should start to decrease towards 0.25 points. Aforementioned Celsius” – told TVN24 Biznes Bartosz Turek, Senior Analyst at HRE Investments.

Main image source: stock struggle

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.