Nvidia found itself in the center of an investment mania associated with the development of the so-called. artificial intelligence. This is because the company, which until recently was primarily associated with the production of graphics cards, has specialized in providing computing power to data-hungry AI algorithms. And this is the segment that has been driving Nvidia’s results for several quarters.

In the fiscal quarter ended July 30, the California-based company reported revenue of $13.51 billion. This is more than double what it was a year ago and more than the market assumes ($11.2 billion according to FactSet). This impressive result was driven by the Data Center division, which generated sales of $10.32 billion, which is 141% more than in the previous quarter and 171% more than in the same quarter last year. Market consensus assumes that revenue in this segment is just over $8 billion. So the difference is very significant.

Earnings expectations were also clearly exceeded. EPS diluted earnings per share was $2.48, 854% higher sequentially and 202% higher sequentially. Non-GAAP earnings per share was $2.70. Wall Street analysts had expected earnings per share of $2.08, on average. Obviously less than stated in reality.

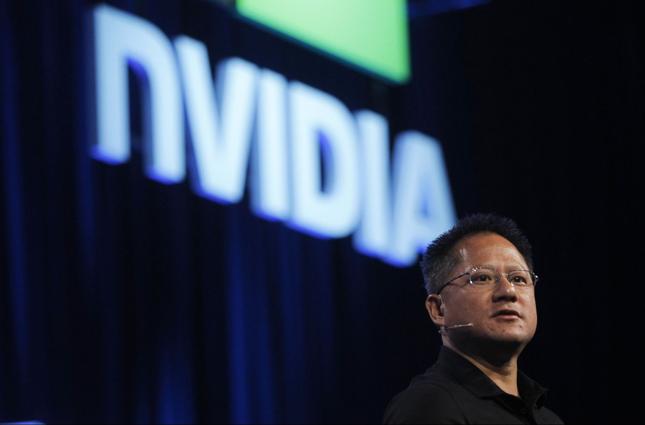

– A new era of data processing has begun. “Companies around the world are shifting from general purpose to accelerated computing and production AI,” Jensen Huang, founder and president of NVIDIA Corporation, wrote in a commentary on quarterly results.

Star investment in artificial intelligence

Reacting to the publication of quarterly results, Nvidia shares rose nearly 9%, to $513.76 at 22:45 CET. Only since the beginning of the year, the company’s capitalization has increased by 222%. Compared to the bottom of the bear market last fall, Nvidia stock has become nearly 5 times more expensive.

And it is this company that is currently igniting the greatest investor passions as part of the mania over the use of AI algorithms in business, which began at the end of 2022. Enthusiasts of this technology do not care about the direct warning of termination films and see here an opportunity for huge profits and “something big new”. Another that would revolutionize the global economy. There are some similarities to the internet bubble of nearly a quarter of a century ago or the cryptocurrency craze from a few years ago.

NVIDIA is currently valued at more than $1.2 trillion, while its profits over the last four quarters were less than $11.5 billion. Therefore, the P/E ratio (price to earnings per share) based on historical results is currently around 105. This is an astronomically high level, although it can be justified by maintaining such high earnings dynamics in the years to come.

Besides the quarterly report, Nvidia also provided a financial forecast for the current fiscal quarter. Management expects revenue of $16 billion (+/- 2%) and gross margin in the range of 71.5-72.5%. Analysts had assumed sales revenues of $12.6 billion.

K

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![You can even deduct it from your tax in 2023. Here are the latest tax breaks for the new year [7.01.2023] You can even deduct it from your tax in 2023. Here are the latest tax breaks for the new year [7.01.2023]](https://d-art.ppstatic.pl/kadry/k/r/1/1e/c4/63b15e35e5066_o_original.jpg)