Even if pensions are not formally excluded from income subject to personal income tax, from 2024 the tax may in practice cover a narrow margin of financially better-off seniors.

Retirees should not pay PIT, i.e. income tax – these opinions have been expressed by both interested parties and experts for years. Nearly two years ago, there were major changes to the taxation of pensions, and more changes are now being announced ahead of the election. Will pensions be exempt from tax and when?

Contents

- Pensions tax 2023: who doesn’t pay tax now?

- Pension tax 2024: will there be income tax relief?

- Pensions 2024: who will benefit from PIT exemption?

Officially, there is no project to exempt pensions as a specific category of income from personal income tax. However, there is an announcement to increase the tax-free amount to PLN 60,000. Polish zloty per year. In practice, this means an exemption of more than 90%. Pensioners, which in turn means an increase in household pensions from January by up to PLN 300 per month, without any official increase.

Pensions tax 2023: who doesn’t pay tax now?

The changes known as the Polish System mean that more than half of pensioners will retire from 2021 However, you do not pay PIT income tax Formally, pensions remain income from which the ZUS counts and may collect a tax advance when the benefit is paid.

This is an effect Increase the amount of tax exemption to PLN 30,000. This means that the ZUS determines the PIT advance only when the pension is higher than PLN 2,500 – and the lower benefits are tax-free.

Unfortunately, this does not mean that the pensioner receives the full pension amount up to PLN 2,500. No matter the height, it is reduced Q9 Proc. For health insurance contributions.

This method of collecting this contribution has largely eliminated the effect of tax relief – through the higher tax relief for personal income tax – for the lowest pensions. Before the changes, the tax-free amount was much smaller, but 7.75%. Health insurance contributions were tax-exempt, which practically meant that the total pension was charged with a 1.25% health insurance contribution.

It is true that the basic tax rate has been reduced from 17 to 12%, but the gross and net pension benefits still differ significantly.

Pension tax 2024: will there be income tax relief?

Unfortunately, this is unlikely to happen – pensions are still supposed to be income, which in principle is subject to personal income tax. However, several groups have announced this The tax-free amount will be increased from January 1, 2024 to PLN 60,000..

If this happens, in practice Without tax -And only with health insurance contributions – There will be pensions of up to PLN 5,000.

This means the same benefits regarding the tax-free amount as they were during the first two years of the reform (only benefits for pensioners up to PLN 2,500). With the higher tax-free amount, pensions will also be tax-free for retirees whose pensions are currently within limits. 2,501 PLN – 5,000 PLN.

Read also:

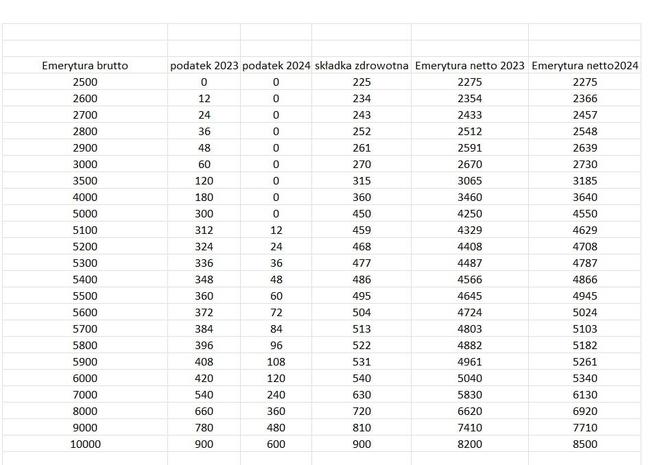

Pensions currently and after a possible increase in the free bonus from 2024 – sample calculations

connection: Click and zoom

Pensions 2024: who will benefit from PIT exemption?

If there is an increase in the amount exempt from personal income tax – PIT, From January 1, 2024 from 30,000 PLN to 60,000 PLN, Even before pensions are indexed in March, the pensions of people from whom ZUS now deducts advance tax payments will automatically increase.

These pensions range from PLN 2,501 per month to PLN 5,000 per month. Pensioners who now receive benefits in this amount will automatically from January 2024 receive a greater amount from PLN 1 to PLN 300.

Those with higher pensions will also benefit from the change – because the higher tax-free amount applies to everyone who pays the PIT calculated from the table.

People receiving pensions from PLN 5,001 and above will receive a “top-up” (higher pension) of up to PLN 300 per month.

How much exactly? We have calculated on selected examples in the table above.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![These pensions will be paid in November 2022. Below are the gross and net interest rates [31.10.2022] These pensions will be paid in November 2022. Below are the gross and net interest rates [31.10.2022]](https://www.moviesonline.ca/wp-content/uploads/2022/10/These-pensions-will-be-paid-in-November-2022-Below-are.jpg)