He is the owner of a popular app for trading cryptocurrencies, stocks, and other products. However, the fate of the repurchased shares is as complex as the history of the stock exchange itself and its founder. The Ministry of Justice confiscated the securities in January this year. They have been considered part of the declining block on the FTX exchange.

The original shareholder was Emergent Fidelity Technologies, a holding company whose majority shareholder was Bankman-Fried. The company went bankrupt shortly after the FTX crash.

Robinhood’s fate is also complicated. Four entities wanted to acquire shares in the company. The first was the FTX exchange, the second – and how so – Bankman Fried, and the third was the cryptocurrency loan company BlockFi. The shares were to be security for the loan to Emergent. FTX’s individual creditors also claimed the shares.

The rest of the article is under the video

See also: “Today there is no talk of good change.” Inflation is not PiS’ only problem

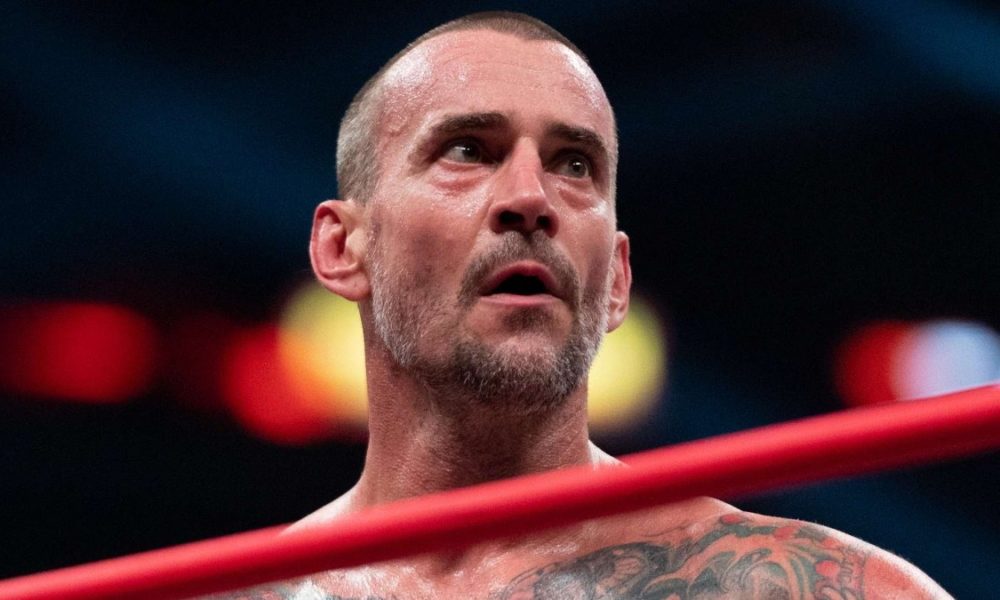

Sam Bankman-Fried has already tried to recover lost shares on its stock exchange many times before. He even explained that being denied access to them effectively prevented him from effectively defending himself in the lawsuit. Lawyers cost a lot. Especially when you are accused of organizing a multi-billion dollar scam and stealing money belonging to FTX clients.

The crash shook bitcoin stocks. For a short period

And the stock market crashed in November 2022. It turns out that the company that many small investors trust is in serious trouble. First, there were reports of attempts to attract investors who would be able to offer up to $20 billion. However, this information did not prompt investors to withdraw funds from FTX.

The real race only started when Changpeng Zhao, the head of Binance, one of the largest cryptocurrency exchanges in the world, announced the sale of his FTX assets. Others followed – in just a few days, the stock exchange recorded an outflow of $6 billion. Those who are more conscious have saved their money, for others it is too late.

Clients of other exchanges were afraid of the FTX disaster – Bitcoin fell from 21 to 15.6 thousand in one day. dollar. Concerns have been raised that investors will start treating virtual currencies less favourably. However, it has not been fully confirmed, as evidenced by Bitcoin prices. And today they reach the level of approximately 26,000. slots. In mid-July, cryptocurrency prices were higher (around 31,000 USD), but there is no trace of the drop recorded at the end of last year (which was achieved after the bankruptcy of FTX). As happened after the pessimism of investors.

Rate the quality of our article:

Your feedback helps us create better content.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.