2022-02-22 09:14, Law 2022-02-22 12:48

publishing

2022-02-22 09:14

Update

2022-02-22 12:48

Reports of Russian troops entering the Donbass caused declines in global stock markets. At the beginning of the Tuesday session on the Warsaw Stock Exchange, the WIG20 index fell more than 2 percent, but then began to almost recover. 10.00 am to go out in plus.

Monday news from Russia where President Putin He issued a decree confirming the independence of the separatist people’s republicsThen he instructed the troops entering the eastern regions of Ukraine, They were caused by morning declines in stock exchanges across Europe and in Poland. The embodiment of risk, and thus its partial removal from the financial markets, made it possible to catch a breath while waiting for further developments.

Investors are now trying to assess the scale of the West’s reaction and the severity of possible economic sanctions against Russia. The German chancellor announced that he would suspend the certification of the Nord Stream 2 gas pipeline, The European Commission is proposing to ban the circulation of Russian government bonds and impose sanctions on several hundred people and companies.

“The question is whether the entry of the Russian army into the separatist regions will be considered an invasion. As the first media reports show, this is not so, and the sanctions will focus on reducing relations with the breakaway republics. In such a negative impact on the Russian economy will be limited, which could be There is room for a partial recovery from the recent sell-off. Some countries still fear negative economic consequences in the event of stronger sanctions against Russia, especially in the context of gas supplies and the energy crisis.” – Rafai Sadoch wrote in the morning a comment on BM mBank.

Immediately after the opening, WIG20 fell by as much as 2.7 percent, but then started to recover. After 12.30, WIG20 is already up 0.3 percent. About 2075 points earlier approached the level of 2000 points, the lowest value since May last year. This is Monday’s sell-off deepening, as part of WSE’s key indicators They broke through key support levels in the form of the November lows. WIG increased 0.25 percent, and the trading volume in the afternoon amounted to more than 655 million PLN.

The fuel sector was the most affected (3%) due to the good behavior of PGNiG. The automotive sector (1.7%) and mining (1.5%) did well. In the afternoon, 9 sectoral indicators were positive. The five companies that fell include information technology, construction, banking, chemicals and clothing (-3.6%). In addition to apparel, other industries declined by less than 1 percent.

The first hit from the show on WIG20 pushed the company’s ratings down more than 2%. However, after a while, the demand started to rise higher than it was during yesterday’s close. PGNiG stock made the largest gain (8.4%), Which showed significant historical results, but still estimates for the fourth quarter. By more than 2 percent, shares of Orange, JSW and Allegro followed, with shares of 13 companies exceeding the line including. Mercator or Cyfrowy Polsat. Fuel and energy companies joined. After the temporary increases, the banks were again below the line. PKO lost 1.4%, Picao 1.2% and Santander 1.9%. The largest trade takes place on Peako, the turnover exceeds 83 million PLN. Also, Allegro’s increase (3.3%) is accompanied by one of the highest turnovers in WSE, which amounted to PLN 60 million. Allegro has announced that it will launch the English version of its platform, and the dedicated domainlegro.com will be launched soon.

The largest decline was recorded in oil and gas prices (-3.7%), which derive some of its revenue from the eastern markets (more than 20%). Prices for PZU, Dino and Asseco were lower.

Promoting Bankier.pl . readers

Refinax Promoting Bankier.pl . readers. Each reader who meets the conditions of the offer will receive:

- Exemption from charging commission on low deposits (ie those less than 1,000 euros) forever on all accounts (you can open several in one) that will be opened on Finax during the promotion period.

- A voucher for a free month of subscription on the Legimi portal for e-books and audiobooks available on the offer, to be used within one year (Voucher will be sent out in the first week of March 2022)

To take advantage of the promotion, from February 14 to 28, 2022 (the promotion period), you must follow these steps:

- Click Bankier.pl link to Finax website.

- Go to Finax’s website this way and open an account.

- Make your first deposit into a Finax account ( enough PLN 150).

The promotion is only applicable to new customers, i.e. people who did not have a Finax account before.

mWIG40 was also 0.1% above the mark.. sWIG80 also rose by 0.1%, although a few minutes after 9.00 am, the losses of both indicators clearly exceeded 2%. Among medium-sized companies, more than half of the shares were in black. Famur (3.9%) and Asbis (3.2%) shares saw the highest growth, which reported that its consolidated revenue in January 2022 increased by 5% year on year. About 2 percent in turn, mBank shares grew and were the banking sector’s strongest. BM mBank estimates, as part of the March review of WSE indicators, mBank will join the WIG20 formation. Nearly half of the components are down, with Kroc shares losing (-3.4%), the lowest value appraised since July 2021.

Nearly half of the companies in sWIG80 are growing, while MCI, Rafako, Bumech and ZEPAK are the most up – about 4-6 percent each. Rfco, whose price has grown by six percent. At 6 million turnovers and traded around recent annual highs. Obonyo (-4.9%) and Astarta (-4.62%) were the biggest losers,

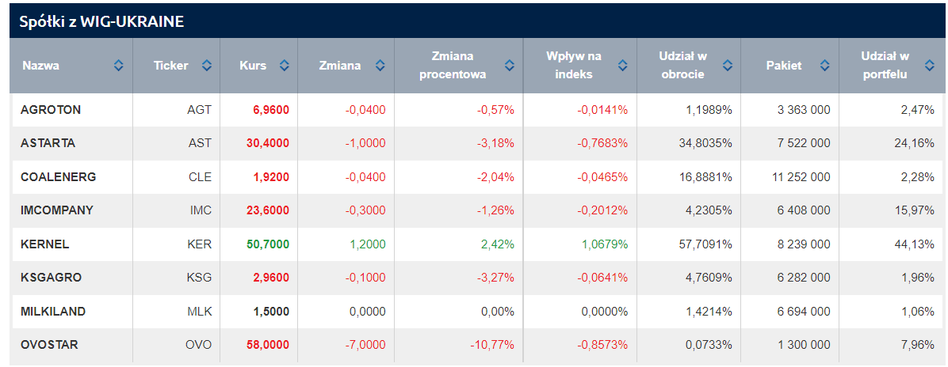

Ukrainian companies are also improving, mostly losing about 5 percent in the first hour of trading. After 12.30, Kernel, the largest of the WIG-Ukraine basket (-0.93%), was up 2.4%. Smaller entities were still below the line, but declines were at the 2-3 percent level.

The scenario was similar on European stock exchanges. The bearish opening turned out to be offsetting the losses. In the afternoon, the DAX index approached the reference point, and the CAC40 index was gaining about 0.2 percent. Russia’s RTS and MOEX indices lost 5 percent, respectively. and 4.9 percent The contracts for US indices, the stock exchange returned after the break day, were in the positive range of 1-1.2 percent.

We plan to continue the topic.

KK / MKu

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.