In the draft budget law, the government asks the House of Representatives to adopt another indexation of pensions and annuities at a rate of 112.3%.

This is the second indexation of pensions by the government. The first pension indexation decision was implemented in March 2023, during which pensions and annuities were increased by an indexation index of 114.8%. Now the government has decided that the next indexation will be 112.3%.

Contents

- Second retirement indexation 2023: What did the government decide?

- Indexing of pensions and annuities 2024: how much will the lowest pension be?

- Another indexation of benefits: How much will the 13th and 14th pensions be in 2024?

- New pensions after second indexation: why they are less favorable

Such a government decision is included in the draft budget law for 2024. This means that the government has allocated money for further indexation and the benefits will certainly increase by this amount.

Second retirement indexation 2023: What did the government decide?

In the draft budget law, the government asks the House of Representatives to adopt another indexation of pensions and annuities at a rate of 112.3%.

this means Increase the value of total benefits by 12.3%.. This is slightly lower than in March 2023, but inflation has also fallen since then. In August, it reached only 10.1%, and economists agree that it will be in single digits in September 2023 and will continue to decline.

Pensions and pensions will be indexed in accordance with the Law on Pensions and Pensions from the Social Insurance Fund on March 1. This means that retirees and disability pensioners will again start receiving increased benefits from March 1, 2024.

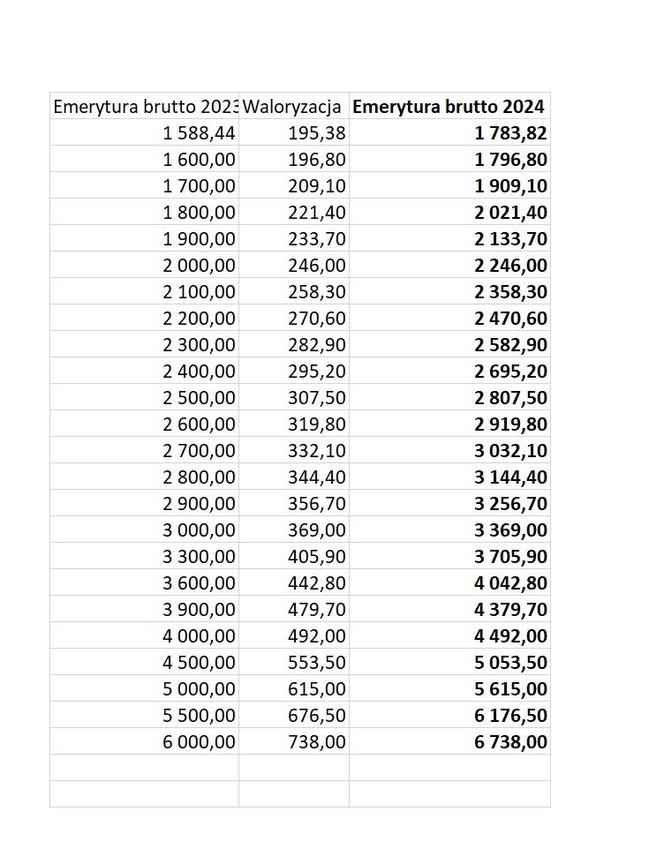

How much will pensions be indexed from March 2024. What will be the new lump sum

connection: Enlarge the table

Indexing of pensions and annuities 2024: how much will the lowest pension be?

After the second decision this year regarding linking pensions and annuities as of March 1, 2024 The lowest pension will be PLN 1,783.82, and the take-home pension will be PLN 1,623.28.

This year, from March 1 to February 2024, the gross amount amounts to PLN 1,588.42 and net PLN 1,445.48. This means that from March 2024, and over the next 12 months, everyone receiving the lowest pension will receive an increase of approximately 180 zlotys.

The minimum increase in the lowest pensions and pensions could be even higher if the government – which cannot be confirmed at the moment, but cannot be ruled out – decides to adjust the amount and percentage, for example instead of the total PLN 195.38 – as shown In indexation of the index – it will increase the minimum pension, for example by PLN 250.

This has happened in recent years.

Another indexation of benefits: How much will the 13th and 14th pensions be in 2024?

The minimum pension amount is also important because of the 13th pension, which is the same pension for all retirees – exactly the 13th pension amount.

So in 2024 it will be so A minimum of PLN 1,783.82 and PLN 1,623.28 on hand.. It may also be more if the smallest benefits are indexed in terms of amounts.

The fourteenth pension, as is evident from this year’s pension, should not be the minimum amount of pension, but rather the highest. However, the amount of the lowest pension in a given year is a guarantee that this second additional benefit in the year will amount to at least this amount for retirees and pensioners who receive the lowest amounts from the ZUS (up to a total of PLN 2,900; it is then reduced on a zloty by zloty basis). ).

New pensions after second indexation: why they are less favorable

How much will the new pensions be? We show the calculation models in the table above. There are the current lump sum pension amounts, the indexation amount – that is, how much the lump sum will increase from 1 March 2024 and how much the new lump sum will be from March 2024 to February 2025.

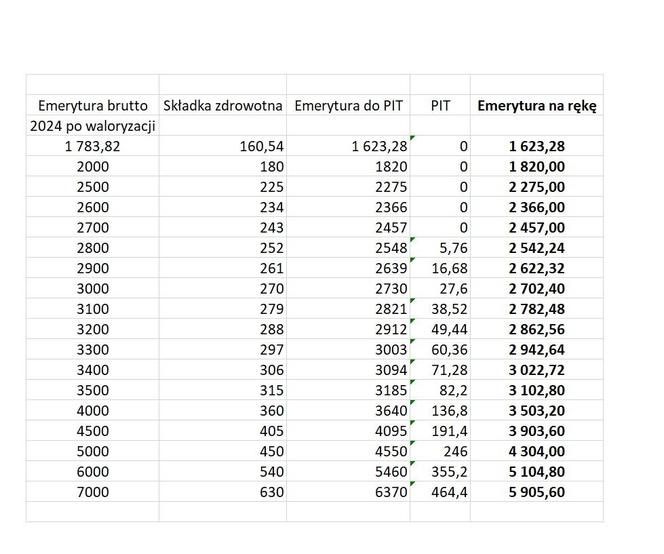

Here we present the second table – the total of the new pensions and subsequent reductions, which ultimately results in what the retiree receives.

Why is there a difference between the gross amount of the new pension after the indexation and the net amount, that is, the amount that the pensioner will receive in his bank account or that the postman will bring to him?

All retirees pay 9% of their pension. Health insurance premiums. This is the first reduction.

Then there is an advance payment for personal income tax – PIT. However, the tax itself is only due after the annual taxable income exceeds PLN 30,000.

Therefore, pensioners receive lump sums of less than 2.8 thousand PLN per month. There is a second reduction – advance payment of taxes. In our table of sample calculations, it is averaged for the month – in practice, in most cases, the deductions will be slightly lower or higher, because the algorithm calculating the transfer from ZUS will take into account the reduction of the corresponding advance of the tax-free amount for the whole year. But everything will be balanced down to a penny in settlement throughout the year.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.