BUSINESS INTERIA is on Facebook and you are up to date with the latest happenings

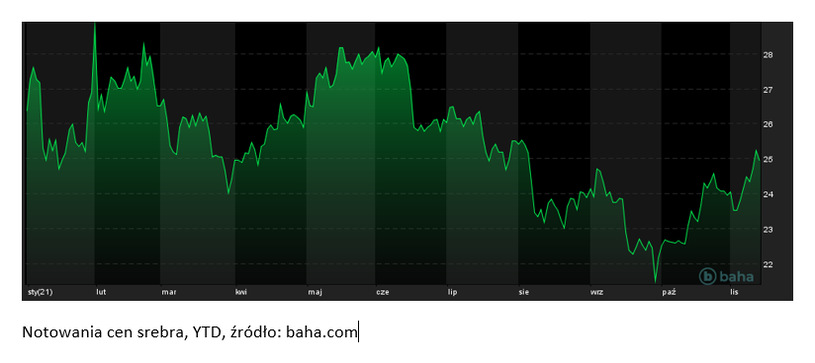

Currently, the price of silver has already exceeded 25 US dollars per ounce, which is the highest trading level in about three months, that is, as of the first half of August of this year. The recovery in the silver market is largely due to the gains in gold prices. The prices of both ores are closely related to each other, and gold prices have a period of increasingly dynamic increases behind them.

This week, the biggest driver of growth in the gold and silver markets was certainly the US inflation data. The US inflation reading of 6.2% y/y in October surprised even conservative market participants and indicated that inflation in this country is not only high, but may also last longer.

A higher CPI reading is favorable for gold and silver prices, which (especially gold) are treated by many investors as a hedge against inflation. However, it should be noted that in the context of this data, speculation about the possibility of a faster rate hike in the US by the Federal Reserve is likely to emerge, which in itself negatively affects precious metal prices due to a potentially stronger dollar. Federal Reserve representatives have repeatedly stressed that they will carefully scrutinize aggregate data in the United States and adjust their procedures accordingly.

/Superfund.pl

However, in the context of gold and silver, it is worth remembering an additional price factor, that is, the attitude of investors to risk. Global investors are slowly becoming more cautious, fearing whether monetary tightening will have a negative impact on the state of the global economy. The greater the risk aversion, the better for gold as well as the silver associated with it.

Bowie Grobiak, Chairman, Superfund TFI Investment Adviser, 11/12/2021

On Wednesday, we saw data on US consumer inflation (CPI), which rose from 5.4% to 6.2%, hitting record levels in more than 20 years. This was met with reaction from investors in both the bond and stock markets. The yield on the 10-year government bond rose to 1.56%, with the Nasdaq down 1.66%. Given the reaction of the markets, it may be assumed that investors are beginning to doubt the Fed’s narrative about temporary inflation and no need to raise interest rates.

The Producer Price Index (PPI) data, which showed a price increase of 8.6% year over year, also fits well with the thesis of additional increases in inflation and declining confidence in the Federal Reserve. Producer inflation higher than consumer inflation indicates that this is not the end of the decline in the purchasing power of money. However, the main objective of companies is to make profits while striving to increase stock valuation and pay dividends. Therefore, if firms incur ever higher costs of production, which will consist of higher costs of semi-finished products and wages, then firms will be doomed to raise prices – which in turn should contribute to further consumer inflation.

The decrease in purchasing power is also a driver in itself to weaken the currency further. Buyers’ perception of persistent or even rising inflation (although the Federal Reserve thinks it is temporary) should influence their decision to spend some of their savings now, not later. This, in turn, affects the rate of currency circulation, which is a component of inflation. Adding to the increase in money supply resulting from the stimulus packages in response to the COVID-19 pandemic and its effects, we get a potentially strong pro-inflation driver.

The decline in investor confidence in the stability of inflation is reflected in the price of gold. After breaking the strong resistance at $1800 an ounce, the metal’s price continued to climb towards $1,855. The lack of a decisive response from the Federal Reserve to the latest data may give impetus to further increases.

Today, data from the Michigan Institute on Consumer Confidence will be released. A possible lower reading compared to the previous month may indicate a change in buyers’ expectations regarding market prices and the country’s general economic situation.

Mateusz Szymansky, Superfund TFI,

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.