2022-05-24 22:15

publishing

2022-05-24 22:15

Investors were too frightened by the Snap chief’s warnings. The market is concerned that the US economy will face a “hard landing” – the severe recession caused by the Fed’s rate hike.

Snap CEO Evan Spiegel has warned that the economic situation in the United States is rapidly deteriorating. In addition, Spiegel noted that Snap’s second-quarter earnings will be lower than previous estimates, and that the company itself is limiting its hiring rate and looking at ways to cut costs. Snap shares were also down 43%, spoiling the trend for the entire IT sector. Meta Platoforms (i.e. Facebook) were down 7.6%, and Alphabet and about 5%.

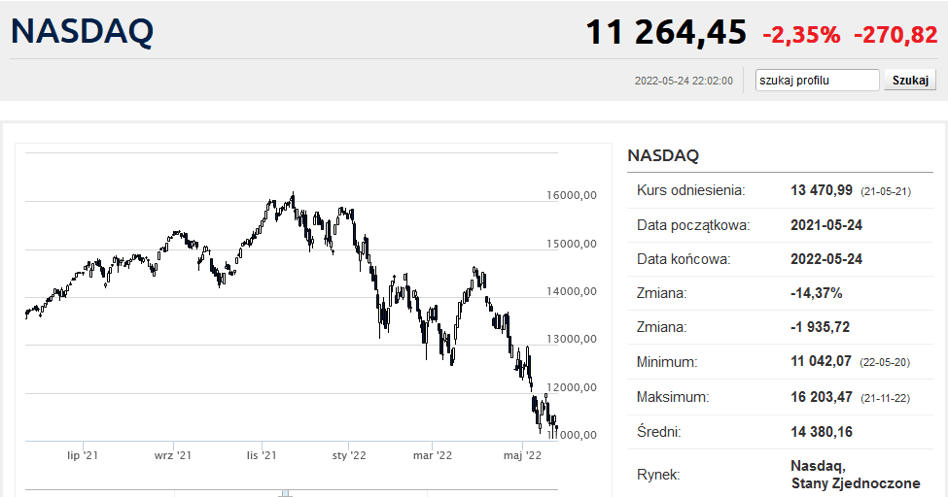

As a result, the Nasdaq fell 2.35% on Tuesday, dropping to 11,264.45 points. Hence back to the current bearish lower bound area on Friday. Outside of the tech sector, the situation hasn’t been so dire. The S&P500 index fell 0.81% and ended at 3,941.48 points. But the Dow Jones Industrial Average rose 0.15%, ending the day at 31,928.62 points.

All because of a hard landing, the Fed rushed into a corner with only the tools to influence the demand side at its disposal. InspereX’s David Petrosinil commented, citing Reuters, that they really need to throttle demand.

Unique investment competition

Are you an investor? Take part in a unique competition organized by Dom Maklerski Banku BPS SA, which will take place May 30 – July 8. Participants will have the opportunity to invest an amount from 2 to 20 thousand. PLN on a real brokerage account. The winners will receive cash prizes in the form of a multiplier of the profits earned – up to PLN 30,000. PLN, plus preferential rates for brokerage commissions in DM BPS. Find out more about the competition and Dom Maklerski Banku BPS SA, One of the pioneers in the online commission market. Bankier.pl is the media sponsor of the competition.

PMI readings in May confirmed the hypothesis of rapid progress in the economic slowdown. In the euro area, they clearly indicated a slowdown in economic growthIn the US, it was lower than most economists’ expectations and obviously lower than it was in April. New home sales statistics in the US were disastrous. In April, on an annual basis, only 591 thousand. Homes for 709 thousand. In March, 750 thousand are expected. This is the first sign that the sharp rise in market interest rates has hurt the demand for real estate.

China is also in economic trouble, as the authorities continue to push the crazy zero-Covid policy, ruthlessly closing entire gatherings over single positive tests, thus paralyzing economic life. Economists at JPMorgan lowered their forecast for Chinese GDP dynamics in the second quarter from -1.5% to -5.4% (yes, minus five and four-tenths of a percent).

The market continues to anticipate strong interest rate hikes in the US. Futures quotes show the probability of a 50 basis point hike in the Fed funds rate. In June, it was nearly 90%, in July more than 88% and in September 37%, according to FedWatch Tool calculations. By the end of the year, the Fed will raise the money rate to about 3%, the largest monetary tightening in 28 years.

K

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.