2022-09-29 22:05

Publishing

2022-09-29 22:05

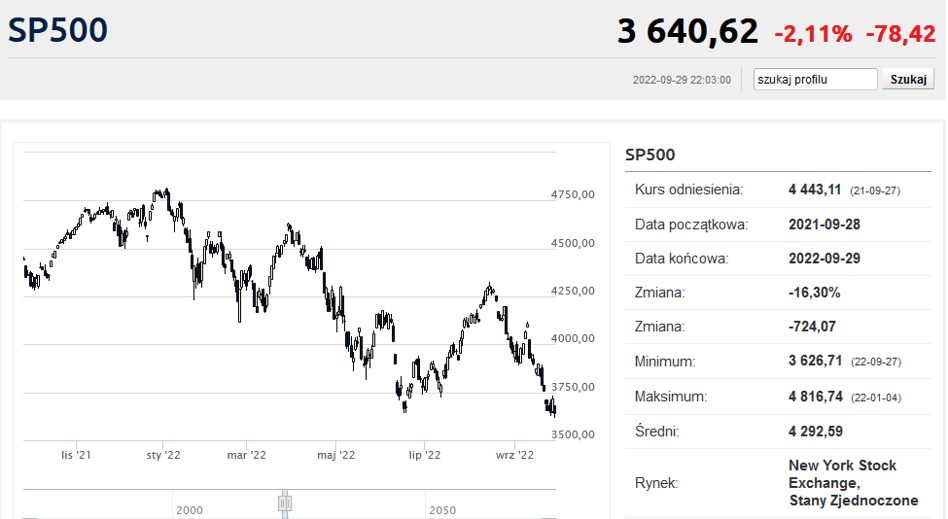

The S&P500 saw its strongest drop in more than two weeks and ended the day at its lowest level this year. Investors are beginning to panic about the policies of the West’s largest central banks.

One day after the breakout, the US indices are back lower. The S&P500 fell 2.11% and ended Thursday’s session at 3,640.47 points. This is the lowest closing price since November 2020. Intraday, this indicator identified the new mid-session low of the bear market at 3610.40 points. Since the beginning of September, the S&P500 has lost more than 7.8%.

Interestingly, the Nasdaq did not set a new low as it lost the most, i.e. 2.84%. The Dow Jones Industrial Average did not break the recent lows during the session either, dropping 1.54% on Thursday to end the day at 29,225.61 points.

This does not change the fact that the trend on Wall Street has been bearish since the beginning of the year. The market is reacting more and more with concern to the plans of central bankers who intend to continue the policy of increasing interest rates. The Fed, the European Central Bank, and the Bank of England don’t have much choice here: they are too late in their pursuit of accelerating inflation and must “catch up” with rapid rate hikes.

On Thursday, we found out German CPI inflation exceeded 10% for the first time in seven decades. The US GDP deflator in the second quarter was also higher than originally reported. On the other hand, the weekly number of jobless claims in the US fell unexpectedly, indicating the continued strength of the labor market. Under these circumstances, the Fed has an open path for rates at 4.5-5.0% from the current 3.00-3.25%.

Higher interest rates not only make bonds more attractive to stocks, but also reduce the present value of future cash flows, reducing the typical value of listed companies. This is especially true of so-called growth companies, for which investors expect much higher returns in the distant future. Not surprisingly, then, Tesla shares are discounted at about 7%, Amazon at about 3%, Apple at about 5% and nVidia at more than 4%.

In addition, analysts for several weeks began to cut the expected earnings of US companies in the coming year. The fear of this benchmark deteriorating can be seen on Wall Street almost every day. CarMax shares fell about 25% Thursday after a used-car dealer disappointed quarterly results. It’s also a sign that US consumers, overwhelmed by the massive increase in the cost of living (food, fuel and energy) and actually declining wages, are beginning to spend less on other goods. Ford’s shares fell 5.8% and General Motors’ shares fell 5.6%.

K

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.