Europe is now telling Moscow “I’m checking” and is almost becoming independent of oil from this trend. However, the breakthrough is happening quietly – the market has calmly accepted the embargo on Russian gas, which has come into force since Monday. Brent crude was around $86 on Monday. per barrel. That’s about $25. less than june.

It is not surprising – the decision has been known since May, so the market has managed to get used to it. Stability is also supported by the planned transition – tankers loaded by December 4 must be unloaded by January 19. Until then, there is no ban or price limit.

However, the lack of a reaction does not mean that nothing has changed. On the contrary, the decision represents a major shift. – If we add to the cessation of the import of Russian oil by sea the announced departure from its import through oil pipelines through Germany and Poland, it turns out that oil from Russia will only be sent. The southern thread of friendship runs through Ukraine to Hungary, Slovakia and the Czech Republic. This means that in In Europe there will be only about 10 per cent left. of Russian oil compared to what it was before the war – says Raffai Ziewert, fuel market analyst at Reflex.

After the implementation of the declarations of Poland and Germany, the Druzhba oil pipeline will only transport raw materials through the southern branch.

|

US Department of Energy/Wiki Commons (Stock: dd786598)

Siege is the beginning. The price limit comes into effect

The EU does not intend to stop at bans alone. At the end of the week, it was announced that a compromise had been reached on the Russian oil price cap. Crucially, it transcends the continent itself.

“You have to explain it.” Limit means price ($60 per barrel)that European oil traders have to adjust to. In other words, if, for example, Turkey, Paraguay and Indonesia want to buy Russian oil, but transfer European companies, financing or insurance to a European bank, the purchase price cannot be higher than 60 US dollars. – explains Raffai Zyurt.

However, this news has not yet fueled the market. why? – It is difficult to predict today what the already presented limitation will achieve. It must be made clear that this means the rate at which European oil trading companies must adjust. In other words, if, for example, Turkey, Paraguay and Indonesia want to buy Russian oil, but with the transfer of European companies, financing or insurance to a European bank, the purchase price It can’t be higher than $60. And the analyst notes that he does not take into account freight and insurance costs, which have now risen significantly.

The silence before the hurricane?

However, the current peace is not to last long. Much depends on how far Russia can manage without practically supporting European entities. And what revenge will he choose? For now, the reaction is ambiguous. Until recently, 60 percent of the crude oil flowed from the ports of Primorsk and Novorossiysk It has been ported to EU and G7 companies. Now maybe Russia should cut production a bit. The market is waiting for Moscow’s response, and the local energy minister indicated that he would not accept this mechanism and would prepare an appropriate response. Raphael Zwert says that OPEC has refrained from its decisions.

The rest of the article is below the video:

What could be Moscow’s response? It’s all about cutting off Russian production. In the absence of an OPEC + reaction (which has so far decided to cut production due to lower prices), it may soon lead to higher prices in global markets.

– If the largest importers of Russian oil like China or India will not be able to handle the import of raw materials without using them Of European assets, Russia will cut production, and they will have to look for supplies from the Middle East, for example. This would lead to an inevitable increase in prices, he says.

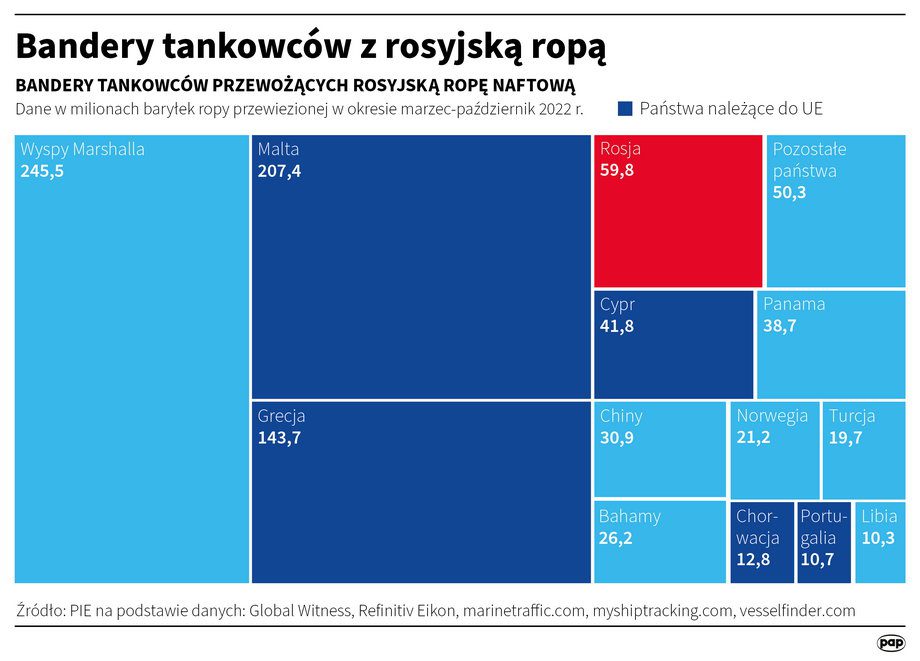

Russian oil is often transported by tankers flying European flags.

|

Maciej Zieliński/PAP/Images

Diesel under pressure

While it is expected that customers are already accustomed to the lack of Russian fuel on the European market, access to ready-made fuel, especially diesel, may be problematic.

The European ban on its imports from the east came into force in February. And the continent, unlike what is happening in the oil market, is still dependent on diesel from the east. According to Bloomberg, from November 1-24, the European Union and the United Kingdom received about 600,000 daily. diesel fuel drums from russia, It is 45 percent. All deliveries. In October it was 34 percent.

Analysts point out that this means fuel will be more expensive. – In the following months, especially after the February ban on imports of finished fuel from Russia imposed by the European Union entered into force. We can expect a significant increase in prices. Quite obviously, given that for years the European Union has benefited from the profitability of imports from a relatively cheap source, which is the Russian Federation, while moving away from diesel production at home for environmental reasons – says Jakub Boguslavsky, e-petrol.pl expert.

– Approximately. 10-12 percent of European diesel consumption came from Russia. In fact, Europe lacks the refining capacity to fully meet demand. It is likely that consumption will decrease slightly in the face of the ban, and new refining capacity will soon be added in the Middle East. So the market has to sort itself out, but let’s remember that the Middle East is also an area of frequent political turmoil. Prices may go up however Today it is difficult to predict whether diesel oil may run out in Europe – notes Rafae Zyurt.

There is already a sharp jump in prices. According to a recent report from the International Energy Agency (IEA), they rose to record levels in October and are now on the verge of 70 percent higher than last yearWhile benchmark Brent crude prices rose only 11% over the same period. Distillate inventories are at their lowest levels in several decades.

And last month’s strikes at French refineries and a looming embargo meant that diesel prices in Rotterdam, Europe’s main trading hub, at some point overtook $80 per barrelThen it decreased slightly.

Orlen calms down

As PKN Orlen assures, there will be a lot of diesel oil at Polish stations, and the announced ban will not come as a shock – deliveries from this direction have already been abandoned. “PKN Orlen does not import diesel oil from Russia, balancing the domestic market with purchases from alternative directions. Therefore, the concern is already the implementation of restrictions that will officially enter into force from February 2023. From this perspective, supply problems should not be expected. In The state of fuel shortages at stations and in the wholesale market, ”we read in response to our questions.

Płock admits, however, that the situation on the European market is difficult. “The demand for diesel has exceeded the available supply for a year. The source of this situation must be sought already in the COVID-19 pandemic, which has affected the operation of refineries all over the world. In 2022, the energy sector demand in many areas has shifted from gas to diesel However, the war deepened this deficit, “according to the company’s estimates.

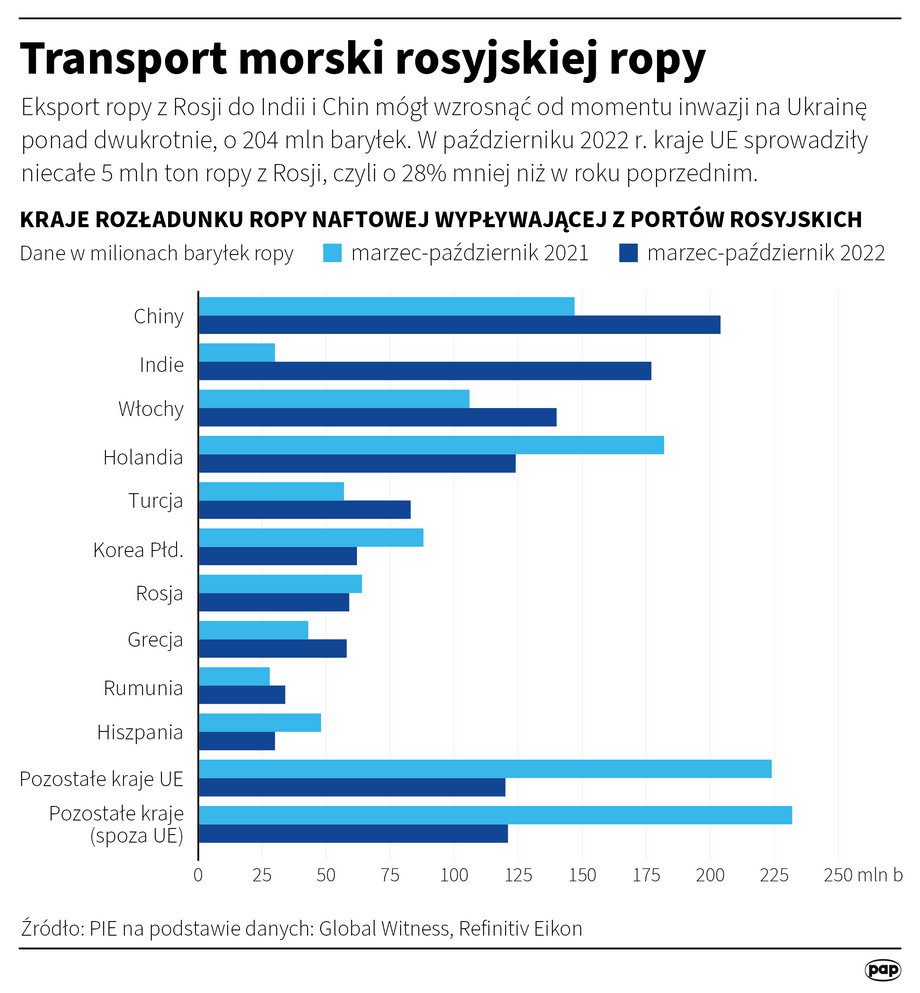

China and India are the largest recipients of oil from Russia.

|

Maciej Zieliński/PAP/Images

According to Rafael Zyurt, although Poland is in a fairly good position compared to the rest of Europe, we are also facing a serious test that will test the reliability of the new supply directions.

Poland today receives much less diesel from Russia, although the ban does not take effect until February 5 of next year. Last year, Russian diesel accounted for more than 20 percent. Domestic consumption is now less than 8 percent. We now import them from Germany, Norway, Great Britain, Sweden, Holland and the United States. Imports from the Middle East are likely to increase. Apparently for this reason We are safer than most of the continent, but the question is how stable our sources of supply will be. The expert points out that after the ban enters into force on February 5, 2023, it will be tested.

Grzegorz Kowalczyk is a journalist for Business Insider Poland

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.