New York stock exchanges on Monday saw a strong decline in indices, led by the Nasdaq, which fell more than 2 percent, and technology companies lost more in value due to the global failure of Facebook and increased Treasury yields.

The Dow Jones Industrial Average closed 0.94 percent at the close. As of 3,4002.92 points, the S&P 500 index was down 1.30 percent at the end of the day. Reaching 4,300.46 points in the meantime, the Nasdaq Composite Index lost 2.14 percent. And closed the session at 14255.49 points.

Strained monetary policy, disruptions in supply chains, the possibility of higher taxes, and rising inflation kept market enthusiasm in check. Interestingly, in recent times, investor concerns about Covid-19 and its variants seem to play a smaller role day by day in the markets than they did over the summer.

said John Stoltzfuss, chief investment strategist at Oppenheimer Asset Management.

This week, markets are likely to look for hints about the strength of the US economy in Friday’s US employment report for September

– added.

Facebook, Instagram and WhatsApp not working

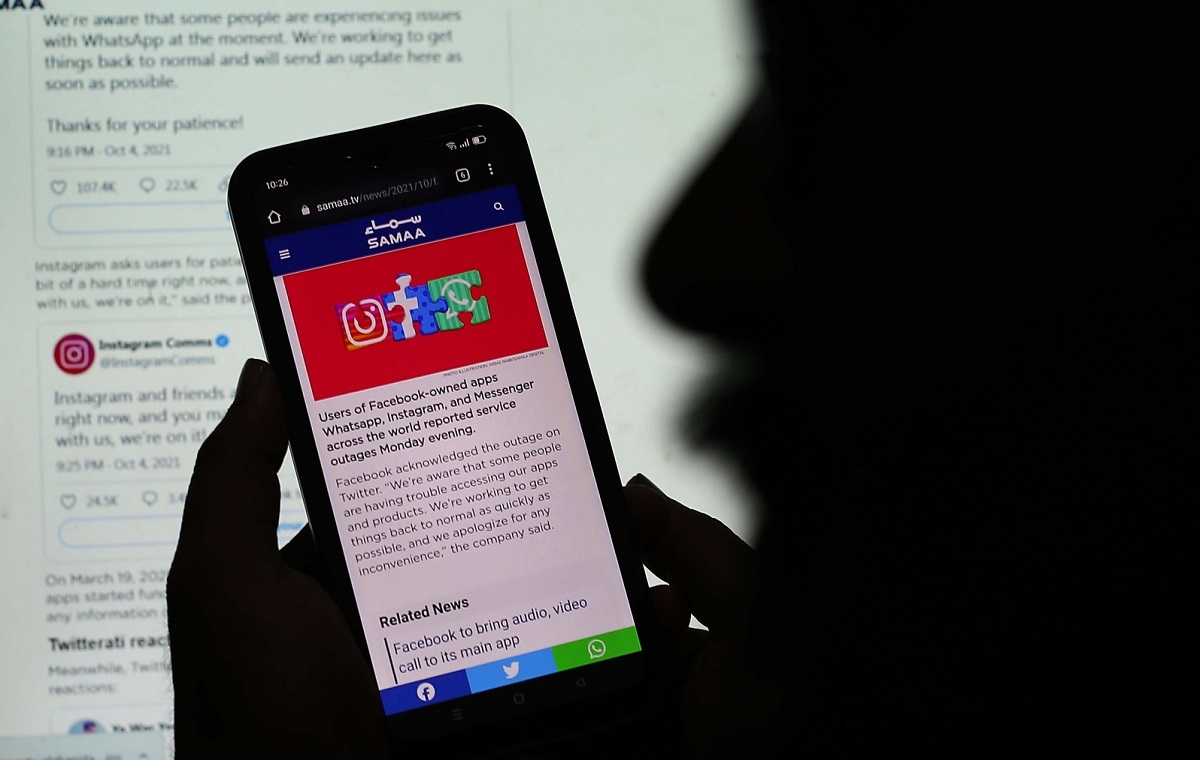

On Monday, a serious failure occurred in Facebook, Instagram, WhatsApp and Messenger, affecting millions of users of these sites around the world – according to Agence France-Presse, citing the specialized portal Down Detector. Gateway has seen failures in densely populated cities like Washington and Paris, among others.

Read also:

Shortly thereafter, Facebook’s management announced on Twitter that some users of the company’s social networking sites, products, and applications were having difficulty accessing them.

unknown reasons

So far, there is no information about the cause of the accident. According to the EFE, difficulties in accessing services were noted in the USA, Mexico, France, Romania, Norway, Georgia, Greece and other countries.

The social media giant was already backing down after being accused of “betraying democracy” by a whistleblower who released documents suggesting that the company’s executives were aware of the negative impact its platforms had on some young users.

Big tech stocks also fell due to higher US bond yields. They dropped, among others, Apple, Nvidia, Amazon, and Microsoft. 10-year floor tank profitability grew 4 basis points to 1.51 percent. The yield on the 30-year bond rose 4 basis points to 2.08%. The spread between US 2-month and 10-year bonds is 122 basis points, while the spread between 3-month and 10-year US bonds is 147 basis points. Last week, US bond yields rose to their highest level since June at 1.56%.

Exxon Mobil and Chevron grew 1% each. against the rise in oil prices. West Texas Intermediate crude is the most expensive in seven years.

During Monday’s meeting of OPEC + countries, it was not possible to obtain approval to increase oil production. This was to reduce pressure on the rapidly increasing prices of this commodity around the world. Increased production was expected, among other things, before the US, economists believe, that higher oil prices could disrupt economic growth both in the US and around the world.

After the OPEC+ meeting, oil prices rose to levels not seen in years. US WTI crude oil is currently the most expensive in seven years at $78 a barrel. On the other hand, Brent crude hit a three-year high ($82 per barrel).

JAH / PAP

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.