The government has announced a new housing program for 2023 – Flat One

First Apartment is a new housing program that will be launched on July 1, 2023. The First Apartment program is for young people under the age of 45 who are faced with buying their first apartment. What is the subsidy in buying your first home? It comes, among other things, to get a cheap and safe home loan.

table of contents

- Who is the First Apartment program for?

- Who wouldn’t be able to use the first apartment?

- The first apartment program with a safe and cheaper loan

- More than 200,000 PLN support for the loan in the first apartment

- Housing account in the first apartment program

- The “first apartment” program must be airtight

- The first apartment program will solve several problems

new The housing program is the first apartment she has To support young people in buying their first apartment next year, but also in the next few years.

– Regardless of whether we are talking about a twenty-year-old man or a forty-year-old, we strive to have our own apartment. Exceptionally in Poland, we have the feeling that stability and security mean having your own apartment,” said Waldemar Buda, Minister of Development and Technology.

The first apartment program is based on two solutions:

- safe credit 2%

- housing account.

Who is the First Apartment program for?

First Apartment is a program aimed at people up to the age of 45 yearsthat bother my first purchase apartments. The first apartment can be purchased on both the primary and secondary markets. There is also no limit when it comes to the size of the apartment.

Who wouldn’t be able to use the first apartment?

If a person has an apartment (including a single-family home or a cooperative right relating to a single-family apartment or home), they will not be able to benefit from this program.

The program will not be available to the person who received a property in the form of a donation, which is then withdrawn, because it means that he owned the property in the past – Waldemar Buda noted.

Buda also noted that marriages in which one person owned property would not qualify for the program, even if there was a property separation. “If one of the spouses owns real estate, it means that he can live in this apartment. If he does not use it, then this is their decision,” – explained Boda. He stressed that if one of the spouses sells his apartment, he will also not be able to benefit from the program.

The first apartment program with a safe and cheaper loan

This is one of the housing program solutions – safe credit 2%. will depend on Guaranteed loan interest rate of 2%. The state will pay the remaining part of the housing loan. This pillar of the program is intended for people who are thinking of buying an apartment in the near future, for example in a year.

“For 10 years, the state budget will pay the difference between the fixed rate determined on the basis of the average interest rate on fixed-rate loans in lending banks (valid on the date of fixing the interest rate together with the fixed credit rate on the date of granting the loan and after 5 years) and the interest rate On the loan at 2%, ”- explains the Ministry of Agriculture and Tourism on its website.

The maximum loan amount should be:

- 500 thousand PLN in the case of a single-person family,

- 600 thousand PLN with at least two people.

Private contribution is not required. The interest rate on the loan will be 2% fixed, and the installment amount will be variable. Initially, the principal must be repaid.

More than 200,000 PLN support for the loan in the first apartment

HRE Investments analyzes estimated that, assuming unchanged market conditions, one loan was obtained for a period of 30 years and an amount of PLN 500,000. PLN will be required More than 235 thousand PLN from budget support.

With this money, a person who takes a cheap loan will not be able to pay an installment of approximately PLN 3850 per month. instead of this For 10 years, we will return the installment in the amount of approximately PLN 2.6 thousand In the first month that It will gradually drop below 2.2 thousand. PLN per month 120 of payment. Then the subsidy will stop and the remaining amount (in this case PLN 333,000) will have to be paid back on standard terms. If we spread this debt over 20 years of repayment in equal installments, that would mean a monthly cost of less than PLN 2.9 thousand. PLN and all this on the assumption that the current interest rate on loans (about 8.5%) will remain unchanged throughout the 30-year period.

The possibility of obtaining a loan at 2% per annum is very tempting. Currently it will be approx 4 times the interest rateWhat the market offers today. Due to the fact that the program will consist of subsidies for the interest rate on the loan, it is inevitably necessary to take out a housing loan in order to benefit from the subsidy. So you must also be creditworthy. However, the main problem today is that many Poles have lost the ability to actively apply for “mortgages” in the eyes of banks – notes Bartosz Turek, senior analyst at HRE Investments.

It also indicates that the government program will be supported by the Polish Financial Supervisory Authority, which promises to facilitate access to loans at fixed interest rates periodically. In such loans, creditworthiness should be calculated more freely than it is today. It is said that the reserve for increasing interest rates will be reduced by half (to 2.5 percentage points from 5 percentage points) or more if the fixed interest rate period lasts longer than 5 years. This may mean Increase in current creditworthiness by 20-30% account slightly.

Housing account in the first apartment program

This is the second option in the First Apartment programme, which is intended for those who are considering their first apartment in a few years.

A private housing account can be opened by the person who lives in one small apartment with at least two children or by adoption (apartment of up to 50 square meters for 2 children, 75 square meters for 3 children and 90 square meters for 4 children, no square meter limit for 5 children Or more).

The savings period in the account should be from 3 to 10 years. Regular payments (at least 11 payments per year in a certain amount) guarantee additional housing bonus from the state budget. The accumulated money, together with the bonus, can be spent on the purchase of the first apartment, house or financial contribution for investment, for example within a housing cooperative. If the savings is terminated, there will be 5 years to spend the money.

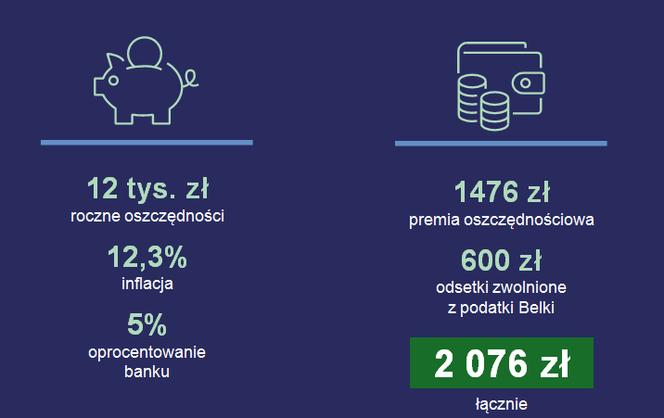

Housing account benefits – sample calculations

The “first apartment” program must be airtight

We need to shut down the system for selecting people who don’t qualify for loans on attractive terms. We will eliminate fraudsters and conspirators from this program. This should be a program for people who really deserve it,” Boda stressed on Polish Radio 24. And as Boda said, the system must be airtight so that no one illusoryly creates a legal situation to fulfill the terms of the program. The minister pointed out that the program does not provide for a preferential loan to replace an apartment with a larger one, because “the entry threshold for purchasing the first apartment is very high.”

The first apartment program will solve several problems

If the assumptions made by the Ministry are actually transformed into a housing program, it will affect many aspects of our lives. After all, when buying an apartment under the state program, you will be able to pay an installment much less than today’s rent (even less than half). This will reduce pressure on this market. This is very good news, because the local rental market is now massively overcrowded. According to Unirepo data, vacant buildings for rent account for less than 5% of the total inventory. This means a serious shortage of vacant premises, so it is not surprising that rental rates have been clearly going up lately – says Bartosz Turek of HRE Investments.

The government program should have a positive impact on Living – notes the analyst. This year, for 10 months, developers started new construction almost 30% less often than in the same period last year. This will be reflected in fewer apartments being handed over for use in the coming years. The First Apartment Program is a reason for developers to build more and leave the negotiating table with investment money. Homebuilders would rather sell an apartment to the average Smith than to a wholesale client who would require a fixed price guarantee and a discount.

MaB, source: MRiT, PAP

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.