2022-01-11 22:08

publishing

2022-01-11 22:08

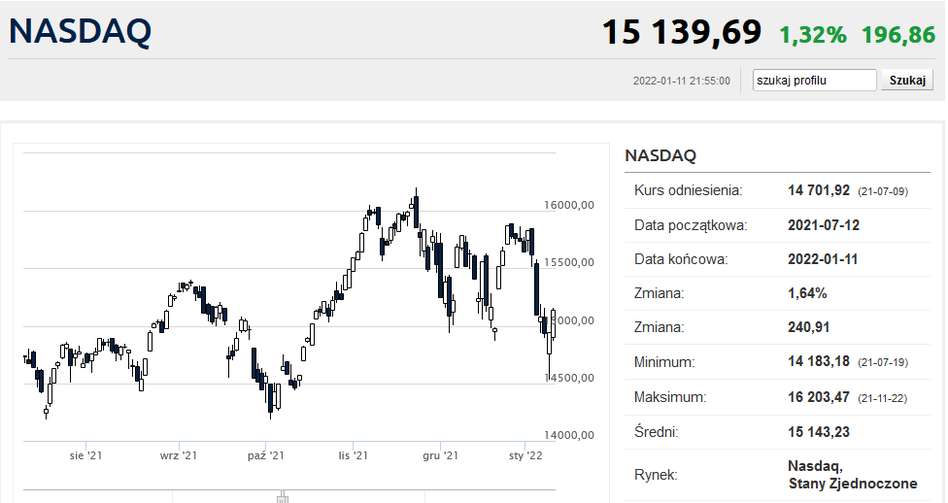

After a successful counterattack on Monday, the stock market bulls on Tuesday continued their attack, ahead of the main indexes in the “North”. Investors were not alarmed by the comments of the Federal Reserve Chairman, who talked about abandoning the very loose monetary policy.

Perhaps you can risk the assumption that the fate of Tuesday’s session is largely decided on Monday when The US stock market has recovered deeply (Especially the Nasdaq which rose from -2% to +0.05%). Such a session improved the mood and increased the desire to “buy the hole”. The famous American BTFD worked again. At least for now.

The S&P500 closed Tuesday’s session at 4,713.07 points, 0.92% higher than the day before. The Nasdaq rose 1.41% and was again above 15,000 points. On Monday, the index was on the border of an agreed correction, roughly 10% off the record set in November. The Dow Jones index rose 0.51% to reach the level of 36,252.02 points.

The highlight of Tuesday’s program in financial markets was the Federal Reserve Chairman’s statement. Jerome Powell told US lawmakers that the Fed intends to end its asset purchase (QE, colloquially known as “printing money”) program this year and raise interest rates. Investors have been speculating about these two things for several months now, so it hasn’t been much of a fanfare. According to market consensus, the US central bank will put an end to quantitative easing by the end of March and will raise interest rates from 3 to 4 on the fed funds by 25 basis points in total. Two years after exiting the zero interest rate policy.

Inflation is much higher than the target. Jerome Powell said the economy no longer needs the expansionary policies that we currently have. Economists have been telling Powell the same thing for months, but the Fed chief recently argued that inflation was “temporary.” It is also known that the Fed will not suddenly raise interest rates to 6-8%, a level that would have been evident two decades ago with such high inflation and a hot labor market.

If the situation calls for further rate increases over time, we will. “We will use our tools to stop inflation,” Powell said in response to questions from senators. – We will probably allow a balance sheet reduction next time, and it is likely that it will happen later this year – the Fed Chairman added.

The behavior of the US debt market is the best evidence of the lack of confidence in the decisive actions of the Federal Reserve. The yield on Uncle Sam’s 10-year bond is close to 1.8%, so it’s even below the Fed’s inflation target. The two-year yield is only 0.9%. This means that holding these securities to maturity roughly guarantees a loss in real terms (ie adjusted for future inflation).

Krzysztof Colani

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.