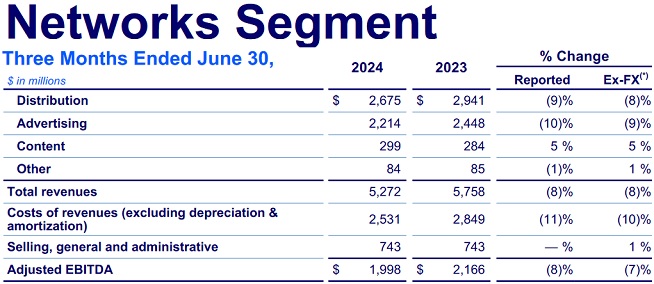

Linear TV still accounts for more than half of the business. Warner Bros. Discoveryrecords higher declines than the entire anxiety. In the second quarter of 2024 Revenue for this segment fell 8% year-over-year to $5.27 billion.

Distribution revenue fell 9% to $2.67 billion. A decline in viewers paying for TV packages with the company’s channels in the U.S. and Canada and the impact of the sale of AT&T SportsNet regional channels (reportedly down 3 percentage points on revenue growth) were not offset by an average 5% increase in prices in contracts with operators.

>>> Praca.Wirtualnemedia.pl – Thousands of advertising and marketing materials

TV ad sales brought in $2.21 billion in the fourth quarter, up 10 percent from less than a year ago. Warner Bros.’ Discovery viewership in the U.S. and Canada fell 13% year-over-year. However, content sales revenue increased by 5% to $299 million.

The company was able to reduce revenue acquisition costs by 11%. To $2.53 billion, including thanks to lower spending on content (sports content costs in the US were transferred to the live streaming division). However, with sales, general and administrative expenses similar to last year ($743 million) Adjusted earnings before interest, taxes, depreciation and amortization decreased from $2.17 to $2 billion.

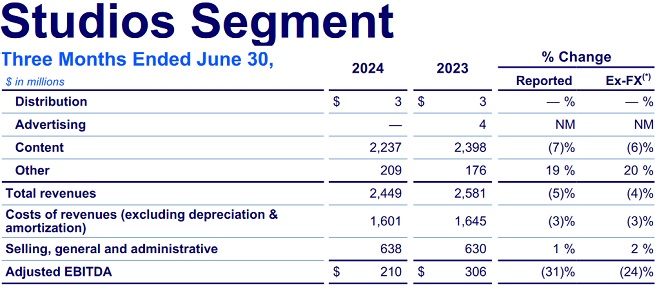

Dune helped, but TV and games were worse.

Vertically, Warner Bros. Discovery Coverage Quarterly revenue for film, TV and game studios fell 5% year-over-year to $2.45 billion, including content sales down 7% to $2.24 billion.

despite of Cinema revenues up 19% This is mainly due to the successful premieres of the second part of “Dune” and “Godzilla and Kong: A New Empire”, but TV broadcasters’ revenues fell by 27%. (The schedule of premieres in this region is arranged differently than last year), a From video games – 41 percent (Suicide Squad: Death to the Justice League’s sales were significantly lower than last year’s Hogwarts Legacy.) Still, its other-categorized revenue rose from $176 million to $209 million, largely due to the opening of a Tokyo theme park in 2018. The Harry Potter universe opened midway through last year.

The segment generated $210 million in adjusted earnings before interest, taxes, depreciation and amortization, compared to $306 million in the prior year.

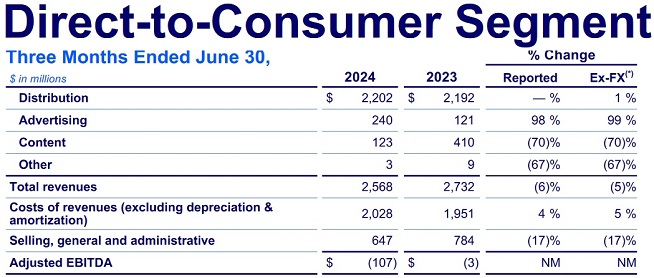

Broadcasting at a greater loss, has more than 100 million customers.

Also broadcast section Warner Bros. Discovery revenue fell 6% to $2.57 billion. This was due to content revenue shrinking from $410 million to $123 million (the company had significantly less to sell than it did a year ago).

while Distribution revenue increased slightly to $2.2 billion thanks to the launch of the Max platform in South America in the first quarter of this year and to Europe in the second quarter. (It has been operating in Poland since mid-June), despite a further decline in linear TV package sales in the USA and Canada.

Read also: Max Strategy Unclear? HBO Assets Arrival Changes Status Quo

After shifting sports spending to the streaming segment, quarterly revenue-generating expenses increased 3% to $2.03 billion, and selling, general and administrative expenses decreased 17% to $647 million (a year earlier, the company spent more on marketing related to the Max’s U.S. debut).

Max’s expansion into other countries has led to: The number of subscribers to the company’s platforms outside the United States and Canada increased from 42.6 million subscribers in the middle of last year to 46.9 million at the end of March this year. And 50.8 million at the end of June. Average revenue per customer in the fourth quarter, as it was a year ago, was $3.85.

However, in The United States and Canada (which the company classifies as domestic markets) saw subscriber numbers decline year-over-year from 54 million to 52.5 million, but average revenue from each rose from $11.09 to $12.08. This increase is also due to advertising revenue, which in the live streaming division rose from $121 million to $240 million.

Total number of streaming customers exceeds 100 milliongrew over the past quarter from $99.6 million to $103.3 million. However, the profitability of this segment deteriorated significantly – the adjusted EBITDA loss increased from $3 to $103 million.

Warner Bros. Television Discovery is worth a lot less.

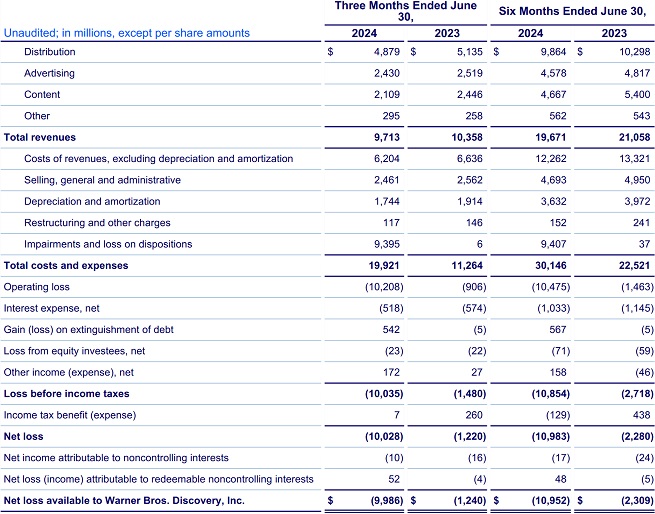

Warner Bros.’ total earnings Discovery’s adjusted EBITDA fell from $2.15 billion to $1.79 billion. Other indicators of the concern’s profitability This resulted in a write-off of assets and losses of USD 9.39 billion (only USD 6 million in the previous year). PLN 9.1 billion of this amount represents a reduction in the valuation of the TV segment.

Subsequently The company’s quarterly loss widened year-on-year from $906 million to $10.21 billion, and net loss – from $1.22 to $10.03 billion.During the first half of the year, the company’s revenues decreased by 6.6%. To $19.67 billion,

Max’s priority will be the next “bold steps.”

In the report, David Zaslav, president of Warner Bros., said the discovery confirmed that The company’s top priority is its global broadcasting business, That’s why they’re “very pleased” with its growth in the last quarter.

The goal is Achieving sustainable profitability for this division in the second half of next year. To achieve this goal, Max seeks to acquire new customers faster, while incurring fractions of the costs.

Read also: TVN for Sale Again? Warner Bros. Discovery Struggles with Debt

What about the rest of the company’s activities? Amidst industry headwinds, we have and will continue to take bold steps, such as reimagining our existing linear TV partnerships and pursuing new aggregation opportunities – Zaslav.

Warner Bros. stock price Discoveries have dropped significantly.

Warner Bros.’ results were negatively assessed by stock market investors. After the release of the fourth quarter report The company’s shares fell about 8.5% in after-hours trading.

At the close of trading on Thursday, the price reached $7.71. Since the beginning of January this year. It has decreased by 32 percent, and in the past 12 months by 47 percent.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.