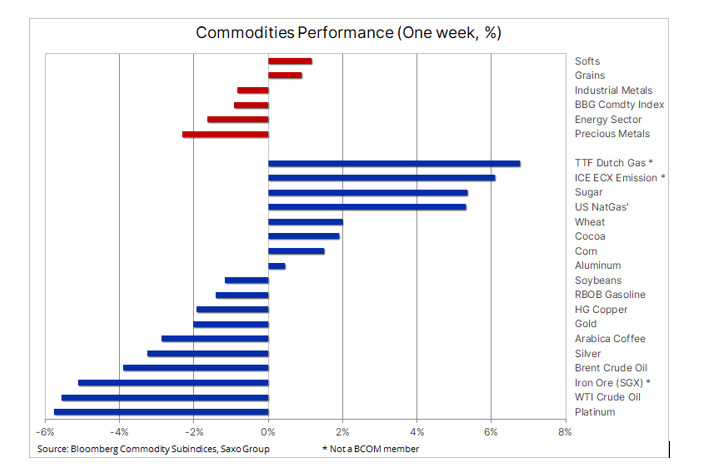

Some of the raw materials increased: Agricultural products such as sugar and wheat have benefited from the highly volatile weather conditions so far in the selected major global farming areas. Gas prices in the United States hit their highest levels in two and a half years and set record highs in Europe on the back of tight supply amid rising demand, which raised concerns about insufficient stock levels ahead of winter, the period of peak demand.

Despite the back-to-back problems with Covid-19, the macroeconomic outlook remains favorable and expects strong growth in Europe and the United States, somewhat balancing concerns about the situation in Asia, where the virus has penetrated even to fortress-like China, leading to lockdowns New and expected corrections. descending growth.

copper marketHe’s become more cautious, though averaging sideways in the past few months. In recent weeks, the price of this commodity has been affected by a number of opposing forces, raising some concerns about the direction in the short term. Overall, however, we see more potential growth, and the price of HG copper may eventually reach $5/lb, but that may not be until 2022, when market supply is insufficient due to increased demand for this metal in the context of the transition. Green and infrastructure projects. Despite the risk of a slowdown in China, rising demand elsewhere has highlighted the risk that demand – at least in the medium term – will not be met by increased supply, which appears relatively inelastic.

The risk of simultaneous strikes at the three major mines in Chile, including Escondida, the largest, currently favors the copper price. On the other hand, there is also uncertainty about the signs of a slowdown in China and the general impact of the now circulating Corona delta variant on economic growth. Demand for refined copper also fell slightly after China deviated from its planned scrap ban, and strong comments from Fed Vice Chairman Clarida on normalization could dampen investors’ appetite for the metal as a way to diversify and hedge against inflation.

CME wheat futures approached their May highs and then eased slightly on profit-taking. Increasingly, adverse weather conditions indicate the possibility of a global supply limitation due to the expected reduction in production by major exporters – Russia and the United States.

Rain negatively affected grain quality in parts of Europe and China, and temperatures and drought translated into poor prospects for production in Russia and North America. Speculative investors have just shifted their positions from wheat to net long, and continued positive price momentum supported by favorable fundamentals may force them to pursue growth in the market, according to a recent COT report.

However, in the short term, the increasing number of infections with the delta variable could raise concerns about demand, and some of the world’s largest wheat consumers, incl. Egypt, Pakistan and Turkey have resigned from purchasing this raw material in recent weeks. Even the Egyptian president, under the pressure of rising prices, is considering raising the price of state-subsidized bread. The last such attempt was in 1977, when President Anwar Sadat was forced to withdraw from the price increase as a result of the riots.

Across the world, natural gas prices continue to rise as a result of the heat wave which has increased demand for air conditioners and increased industrial demand as the global economy recovers from the pandemic.

In the US, the Henry Hub gas price exceeded $4/MMBtu, the highest level recorded for this period of the year in at least ten years, due to increased household demand and increased LNG exports. This happened at a time when it was becoming difficult to increase production, in particular due to the slow recovery of shale oil production, of which natural gas is a by-product.

The situation is much worse in Europe, where prices have reached record levels. Unjustified supply restriction from Russia, combined with growing competition from Asia for LNG supplies, has made it difficult to replenish hard-hit reserves before the next winter.

This has increased demand for coal, forcing industrial users and utility suppliers to buy more pollution permits, the price of which is already at record levels. This has led to a sharp rise in electricity prices, which will eventually be paid by consumers across Europe, which will be a major problem for governments and may undermine political efforts to decarbonize the economy at the agreed-upon fast pace.

Crude oil prices fell, and after months of focus on OPEC + and the organization’s ability to support prices by maintaining relatively limited supplies, the market refocused on the uncertain outlook for demand as a result of the rapid spread of the delta variable, especially in China – a country that is a major importer of this substance raw.

This has lowered expectations for economic growth and called into question the short-term outlook for demand for crude oil and fuel products from the world’s largest buyer.

Recent events justify OPEC+’s cautious approach to increasing production too quickly and too soon. They also highlighted why Saudi Arabia and the rest of the group are ready to extend the current quota system beyond next April.

Last year’s OPEC+ resilience is likely to prevent a deeper correction if the increase in demand suffers more than expected from the current surge in infections. With that in mind, and taking into account the lack of reaction from US producers despite the price hike, we maintain a constructive outlook for oil prices.

valuable minerals: As soon as I got back from vacation, the first question I had to ask myself was: Why isn’t the price of gold so much higher? US Treasury yields fell sharply in the past month, and due to broadly unchanged levels of inflation expectations, inflation-adjusted yields, or real yields, fell to a record low of -1.22%. Given the historically strong inverse relationship between real yields and gold, last month’s failed attempt to solidify market participants last month, which could lead to long positions being liquidated out of fear that the rise in yields may not be matched by the same level of inactivity.

This concern was confirmed on Wednesday when the first signs of a yield rally emerged in response to strong comments from Fed Vice President Clarida discussing the path of interest rate tightening. These comments, which boosted the dollar and yields, were supported by a very strong US employment report for July.

At the same time, silver recorded the largest displacement: The value of the metal against gold fell to its lowest level in six months after the gold-to-silver ratio returned above 72 ounces of silver to one ounce of gold. Hedge funds recently reduced their net long positions to just 21,000 in response to this disappointing performance. flights, the lowest level in 14 months. The gold-to-silver ratio would have to go back below 70 against silver to solidify again, but to do that, gold must first face the potential short-term challenge of higher returns.

In the context of the decline in gold and silver prices, platinum recorded the largest losses of all semi-industrial metals, whose discount on gold rose to $ 800 from the April low of 300. This is due to the current shortage of semiconductors, which negatively affected the production of cars in addition to Increased sales of electric vehicles and the current spread of the delta variant.

Ole Hansen, Head of Commodity Strategy, Saxo Bank

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![Melissa Klug admitted to giving $ 1 million to “Gado” to have a baby [VIDEO] | Fordula NNTC | BOCONVIP Melissa Klug admitted to giving $ 1 million to “Gado” to have a baby [VIDEO] | Fordula NNTC | BOCONVIP](https://www.moviesonline.ca/wp-content/uploads/2021/08/1628588221_Melissa-Klug-admitted-to-giving-1-million-to-Gado.jpg)