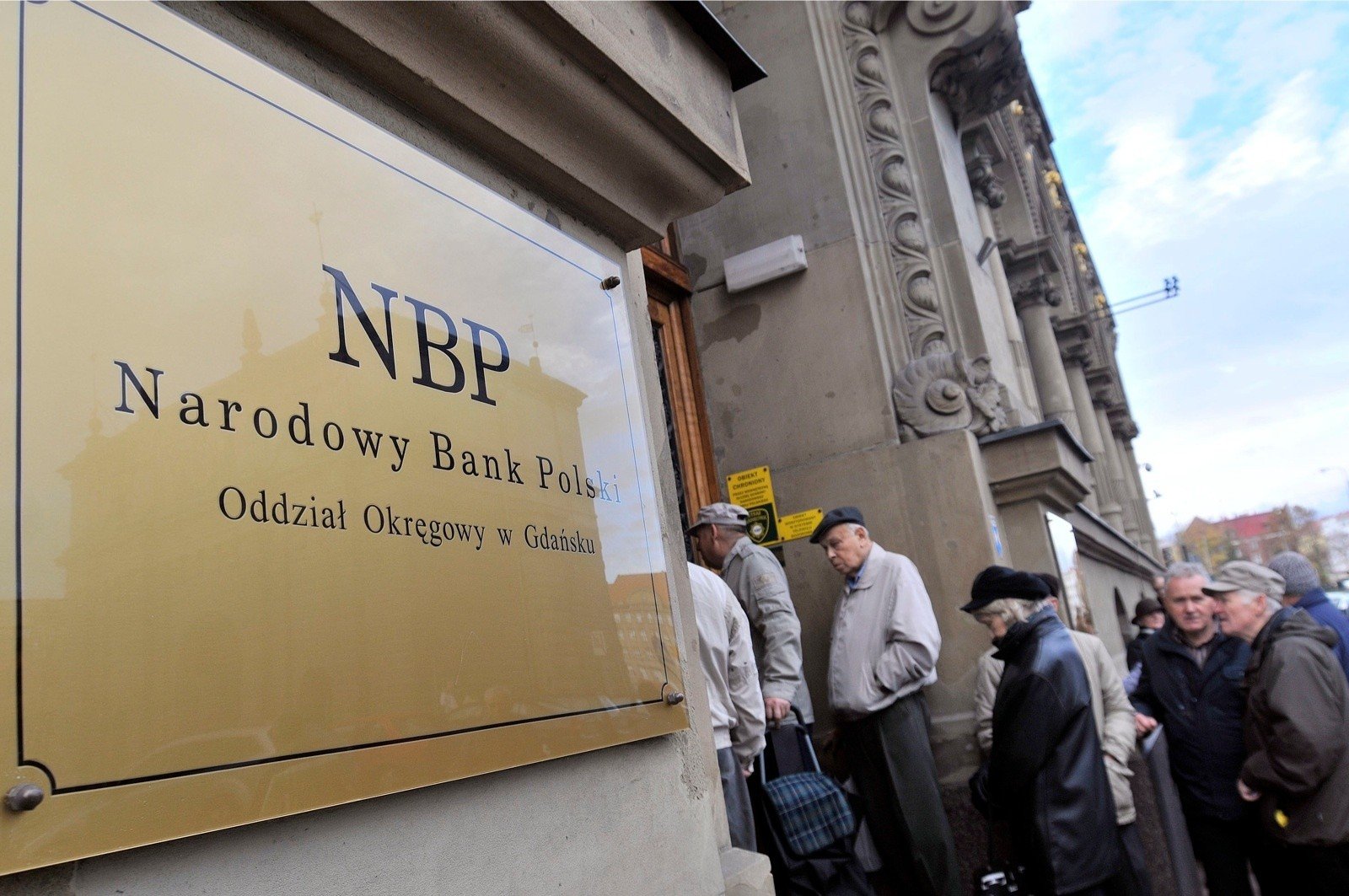

First meeting of the Monetary Policy Committee in 2024

Monetary Policy Council, after a year of keeping the national central bank's reference rate at the highest level in more than 20 years, 6.75%. Discounts started in September. The first adjustment was shockingly sharp, lowering the cost of money by as much as 75 basis points. A month later, the size of the adjustment was only 25 basis points, which calmed investors and the then unstable market, which was rapidly losing zlotys. This was the last step so far, as the series has been suspended for at least several months.

In November, the Monetary Policy Board cited regulatory uncertainties and post-election changes as a reason to suspend cuts. It was pointed out that cuts are practically unlikely until at least March, when the monetary authorities will know the government's intentions and will also have new inflation expectations. Even the latest inflation reading, which was much lower than expected, will not change the situation. CPI dynamics slowed in December from 6.5 to 6.1 percent. On an annual basis, meaning price growth was the weakest until September 2021. Core inflation was below 7% for the first time since March 2022. p/p.

In the coming months, as the MPC waits for updated forecasts, price growth will continue to slow. Consumer inflation is expected to bottom out in March, and CPI growth is likely to fall below 3.5%. r/r. Subsequently, the increase in consumer prices will accelerate, primarily due to the withdrawal of protective measures, but also due to the improvement of the economic situation and the recovery of consumption.

As a result, inflation temporarily entered the permissible volatility range of 2.5%. The inflation target set by the Bank of Japan at the beginning of this year will not translate into interest rate cuts. The market estimates that it will be reduced by a full one percentage point over the next 12 months. The absence of cuts or on a much smaller scale will have a positive impact on the zloty, especially when other central banks in the region, but above all the Fed and the European Central Bank, significantly ease their monetary policy. We expect the Polish currency to see a slight correction in the near future, but at the end of the year the EUR/PLN rate will be around 4.25.

Will the MPC change interest rates in January? This is what awaits us

Money isn't everything Slavomir Dodik

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.