Everything indicates that entrepreneurs will have to pay higher ZUS in 2024 than originally calculated. The draft 2024 budget law adopted by the government assumes higher average wages than planned. This will have natural consequences in the form of an even greater increase in ZUS 2024.

»ZUS contributions for 2024. Entrepreneurs will pay more than PLN 2,000

In 2024, as in previous years, entrepreneurs must be willing to pay the indexed amount of ZUS contributions. Although it seems that we know the amounts of social security contributions for next year, it turns out that they will not be as previously expected. The draft 2024 budget approved in September included the average salary at a different and higher amount than previously announced. This will have consequences in the form of higher contributions to ZUS in 2024.

» ZUS contributions for entrepreneurs are valid from January 1 to December 31, 2023.

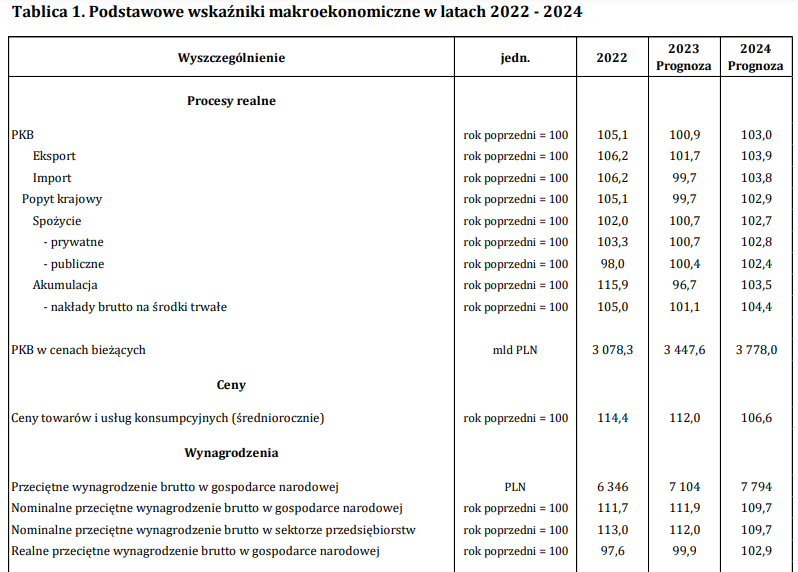

Average new salaries forecast for 2024

The government once again increased the expected amount of average wages for 2024. Let us remind you that in June the amount in the project was PLN 7,783.07, then it was changed to a total of PLN 7,794.

Source: gov.pl

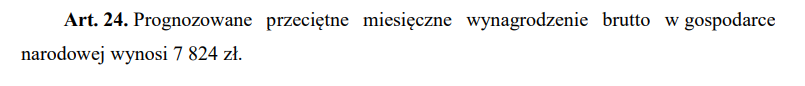

But this is not the end. In approved by Cabinet on September 26, 2023 and submitting the final draft of the 2024 budget to the House of Representatives of the Republic of Poland Located A higher amount of PLN 7,824.

Source: Draft Budget Law 2024

This means that Entrepreneurs will have to pay higher ZUS in 2024 than announced.

Which ZUS 2024?

Assuming that the amount of average wage used to determine the basis of ZUS contributions eventually amounts to PLN 7,824, then This base will amount to PLN 4,694.40 (60% of average salary).

This means that Contributions for Pension, Disability, Sickness, Accident and Work Fund will be calculated from the expected amount of PLN 4,694.40 (7,824 PLN x 60%).

Everything indicates that the amount of individual ZUS contributions in 2024 will be:

- Pension contribution 916.35 Polish zloty,

- Disability contribution 375.55 Polish zloty,

- Disease contribution 115.01 Polish zloty,

- Accident premium 78.40 Polish zloty,

- Contribution to the labor fund 115.01 Polish zloty.

Increase of PLN 2,200 in ZUS contributions for entrepreneurs in 2024

The above calculations indicate that entrepreneurs will pay higher contributions to ZUS from January. Their total amount will amount to PLN 1,600.27 per month. Let us remind you that the current amount of social security contributions is PLN 1,418.48, including sickness insurance, Which gives an increase of PLN 181.79 per month. This means that Throughout 2024, entrepreneurs will pay an additional PLN 2,181.48 in ZUS social security contributions compared to 2023.

Zeus

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![Changes in the indexation of pensions 2023 – calculation table. Some will get guaranteed raises [30.11.2022 r.] Changes in the indexation of pensions 2023 – calculation table. Some will get guaranteed raises [30.11.2022 r.]](https://www.moviesonline.ca/wp-content/uploads/2022/11/Changes-in-the-indexation-of-pensions-2023-calculation-table.jpg)